Bitcoin (BTC) showed resilience last weekend as it defended its $108,000 support level amid growing sales of whales at major crypto exchanges around the world, including Binance.

Bitcoin survives whale sales pressure in September

September was characterized by clear fluctuations between Bitcoin attempts to sell to sales pressure by whales and long-term holders, according to a cryptographic quick take post by Arab chains. The Binance Trading volume data checks this.

Related readings

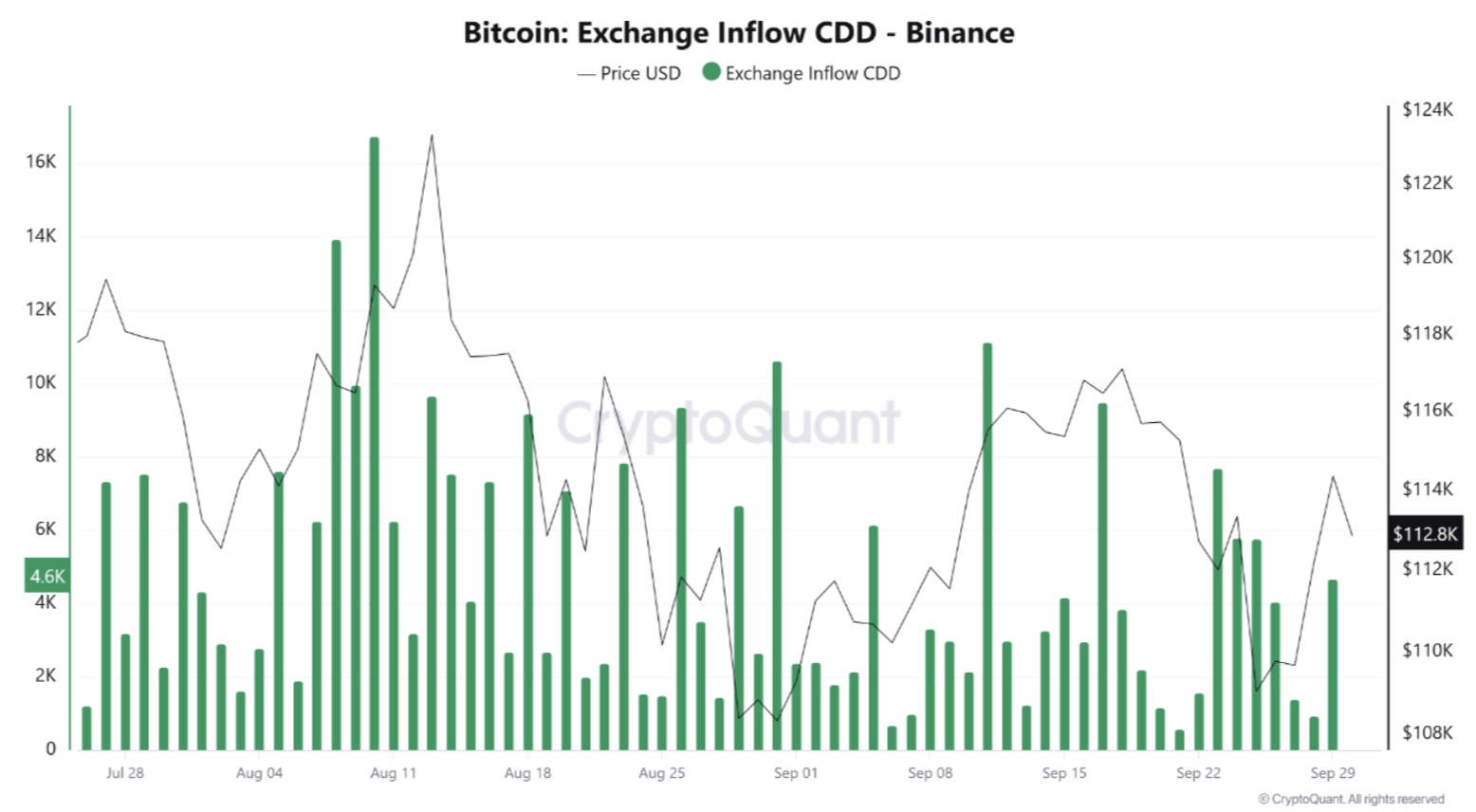

The Arab chain highlighted the Binance Exchange Inflow Coin Day Destruction (CDD) indicator. This indicator recorded multiple peaks at various points in the month, especially in mid-September.

For beginners, the Exchange CDD indicator tracks old, long, long Bitcoin movements as it flows into exchanges, adding trades by the age of coins where coins are used. The spikes in this indicator indicate that a long-term holder or whale is moving a coin intended for sale, creating sales pressure.

It is worth noting that despite the high peak hits in September, the Exchange CDD indicator did not reach the extreme level it had done the previous month. However, the recurring spikes seen in September indicate inflows from old wallets.

Cryptoquant analysts said multiple spikes in the Exchange CDD indicator reflect the status of attention among long-term investors. Some of these investors have tried to test the market by moving BTC to exchanges without turning it into a massive sale event.

Another point to highlight is that the exchange CDD spikes often matched Price pullback BTC reinforces the hypothesis that these flows are likely to represent short-term sales pressures. Analysts added:

However, these pressures did not lead to breakdowns of key support levels around $100,000. This indicates the existence of corresponding purchasing liquidity that absorbed these movements.

In conclusion, while some long-term investors have shown an eagerness to make a profit, the lack of a wave of massive sales indicates that they have not yet lost total confidence in the market.

Similarly, despite repeated sales pressures, Bitcoin prices are over $108,000. This shows that the market still has the ability to absorb BTC inflows, confirming the robust underlying demand for top digital assets.

What do you keep for BTC in October?

In another Cryptoquant post, analyst Crypto Sunmoon said historical data suggests that a surge in taker buy orders often precedes the major Bitcoin Bull run. However, there are currently no indications of an increase in taker buy orders.

Related readings

Analysts added that even if BTC witnessed a price rise, it is unlikely to record profits of the same magnitude as before. That said, there is hope for the Bulls by improving the fundamentals of the Bitcoin network.

For example, Bitcoin Network Transactions are again I’m approaching A critical 600,000 transaction threshold can be caused Bullish momentum For digital assets. At the time of pressing, BTC will trade at $113,200, a 0.6% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts