The Bomb Crypto X account has announced that its community has created a documentary video documenting the game’s four-year journey. The film aims to “capture the bomb story in the most objective way,” suggesting that the game’s supporters want to maintain its legacy.

This move shows the transition from normal promotional posts to reflection and storytelling. Rather than teasing new game features, the team is having fans frame the story of the evolution of the bomb.

The documentary could be the reference point for future retrospectives in the GameFi space, especially projects that span deep development cycles.

Activity Peak in Q2 shows use in healthy markets

GATE’s feature on the 2025 bomb Crypto highlights that over 15,000 hero NFTs were traded in the game’s internal market in the second quarter. Some “legendary” heroes were on sale for up to three times the base price.

Such a volume highlights that even as key new announcements fade, users, who are core of the ecosystem, are still active in purchasing, selling and upgrading characters. In-depth trading and NFT turnover rates indicate sustained engagement.

It also suggests that value and liquidity lie in the in-game economy, but not necessarily external hype or token speculation.

No fresh roadmap milestones – focus changes inward

The current public content of Bomb Crypto is focused on existing gameplay, token mechanics, and community artifacts rather than breakthroughs in the new roadmap.

Rather than pushing out flashy updates, the project appears to integrate what exists. It leaned towards the fixation of the system, the preservation of culture, and the direction of the community. The interaction between documentary initiative and powerful NFTs suggests that narrative and architecture are just as important as new features.

In that context, today’s movements are subtle. Bomb code works through the base rather than chasing outside spotlights.

Bcoin Daily – September 30, 2025

Bcoin is trading nearly $0.00854 today after a two-week pullback from the late September spike to $0.011. The chart has shown a steady string of highs since mid-July, then a breakout in early September, and finally a quick setback from last week. Today’s candle extends rebound from the $0.007-0.0075 area that serves as support in multiple tests.

However, the momentum is completely mixed. After the breakout, Wick was repeatedly rejected from $0.0095 to $0.0105, and volume cooled from peak days. Still, buyers defended their previous breakout zone at around $0.008, turning it into short-term support. Therefore, the market is currently pivoting between its regeneration level and the supply band between $0.0092-$0.0098.

Passes are conditional from now on. If the price is above $0.008, you can revisit $0.0092 at the location where the seller rounds out their final advance, then $0.0105-$0.011. Conversely, if it falls below $0.008 and loses $0.007 to $0.007, then the downside is $0.006, then $0.005. In short, the Bulls will need to come back every day through $0.0095, where volume rises, to reestablish momentum. Otherwise, the range can last.

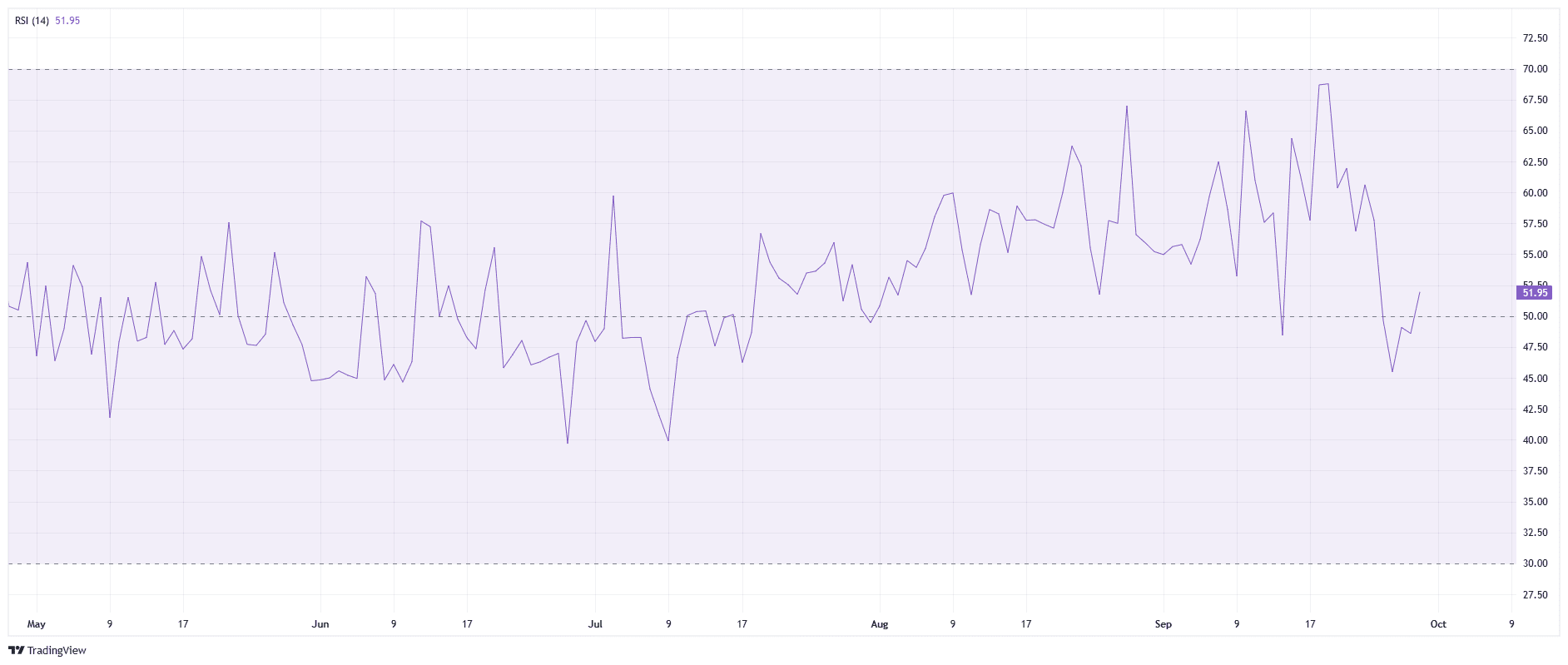

BCOIN RSI – September 30, 2025

The 14-day RSI is near 52, slightly outperforming the neutral momentum. After descending towards the mid-40s last week, the oscillator recovered and retrieved 50 lines. That movement signal fades downside pressure and a modest shift to buyers.

Recently, RSI has printed multiple swings between the 45 and 60s. These turnovers indicate a range-bound market rather than a trending market. However, the latest height of the latest RSI, where Trough has tilted its short-term momentum up last week. The oscillator is now above 50, so the Bulls control the next incremental push.

From here, the signal is binary. If the RSI moves forward towards 60-62, Momentum should support retesting the overhead price range that it identified as around $0.0092-0.0098 and later as $0.0105-0.011. Conversely, if you reconsider the 45 with RSI below 50, the seller could push the price back into the support area between $0.008 and $0.0075. So what’s closer to today compared to the 50 line sets the tone of the next move.

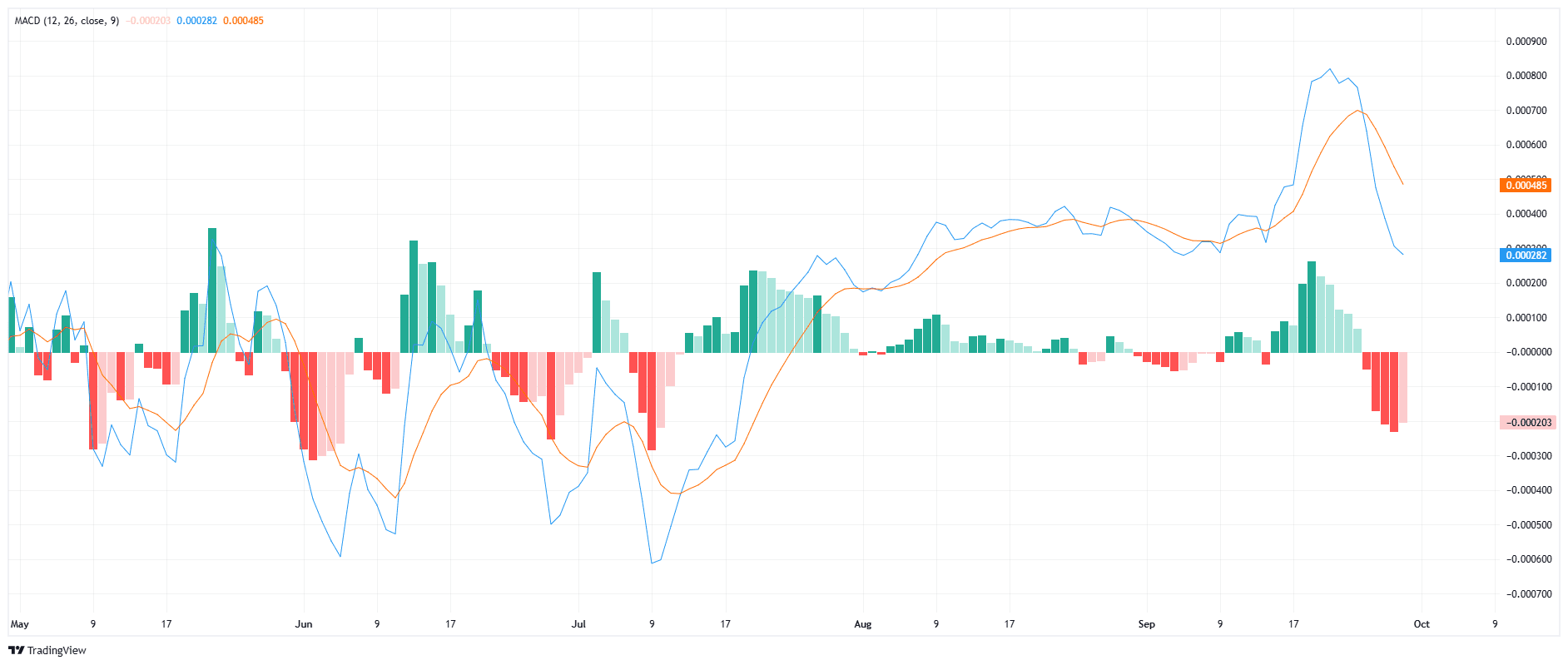

BCOIN MACD – September 30, 2025

Daily MACD shows a fresh bearish. The MACD line is near 0.00028, the signal line is held around 0.00049, and the histogram is about -0.00020. After peaking in late September, the MACD crossed below the signal, and over the past few sessions the histogram turned deep and red, suppressing the momentum of the rise.

However, the setup is traded near the Zero Line. Both lines remained rising compared to early August, so the momentum is cooled without breaking completely. If the MACD flattens and curls towards the signal while the histogram is contracting towards zero, the buyer can regain short-term control and try another push.

So look at the zero line and slope. Continuous decline by expanding the negative histogram supports drifting into the support area between $0.008-0.0075. Conversely, it quickly regains signal, with travel beyond zero supporting a retest of $0.0092-0.0098, and increases momentum from $0.0105-0.011.