Please participate telegram A channel that stays up to date to break news coverage

XRP prices have increased 2.5% over the last 24 hours, at 3:50am on EST, trading volumes of 24% have reached $5.53 billion, trading at $2.88.

This is because Bloomberg ETF analyst Eric Bulknath says approval for Spot Crypto ETFs, including the XRP ETF, is essentially guaranteed.

He explained that the new “generic listing standards” eliminates the need for traditional 19B-4 filing, leaving only final clearance from the SEC’s corporate finance division.

Honestly, the odds are really 100%. General list standards make 19B-4 and “clock” meaningless. This makes the S-1 await an official green light from Corp Finance. And they submitted Solana’s amendment #4. The baby could come anytime. i am ready.

– Eric Balchunas (@ericbalchunas) September 29, 2025

Issuers that include funds linked to Solana have already updated their S-1 filings, indicating that the process is nearing completion. My colleague James Seifert noted that the possibility of a US government shutdown could affect timing, but agreed that structural changes would likely result in approval.

The SEC is asking issuers to withdraw their 19B-4 filing and withdraw delay notifications for XRP, Solana and other Crypto ETFs, indicating that momentum is firmly on the side of approval.

Attention will be directed to October when SEC is configured to review six XRP ETF applications that start with Grayscale on October 18th and end with WisdomTree on October 24th.

The odds for the polymer for approval are already above 99%, suggesting that approval is a “when” issue rather than an “if”.

Analysts are increasingly bullish, with EGRAG Crypto predicting the possibility of XRP surges to $33 in the next cycle, supported by reports of XRPL upgrades and XRP purchases for the $48 million institution.

With ETF approval approaching, October is becoming a pivotal month for XRP.

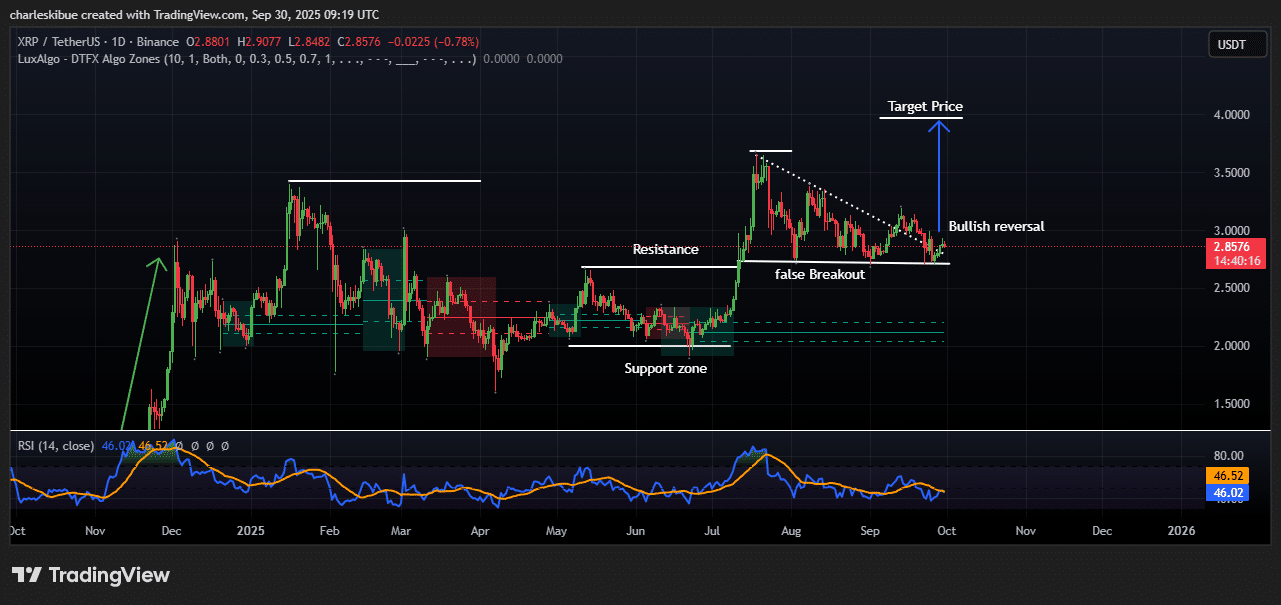

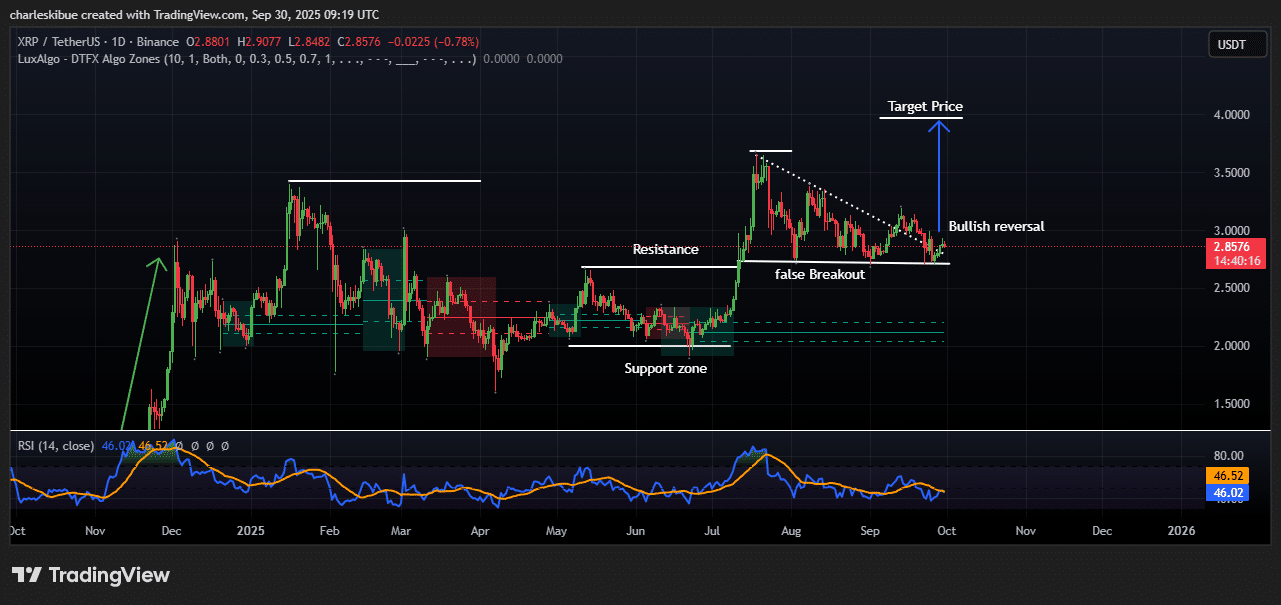

XRP shows signs of a bullish reversal as it targets the price at $4

XRP shows early signs of a bullish reversal after holding the company in its support zone. The token is currently trading at around $2.85, a bit down that day, but the chart suggests that buyers are beginning to gain control again.

Over the past few weeks, XRP has been stuck between nearly $3.00 in resistance and $2.60 to $2.70 in support. At the beginning of September, the token attempted a breakout but failed, leading to a pullback. Still, the support zone was held strong and stopped further losses. This created a base for possible upward movement.

The chart also shows a downward trend line that has been lowering prices since August. XRP is currently testing this trendline again. If buyers outweigh that, the market can see a bullish reversal. The next goal is around $4.00, which is a level that traders are looking closely at.

The relative strength index (RSI) that measures momentum is currently close to 46. This means that XRP will not be over-acquired or over-sold, and there is plenty of room to climb if demand increases. Analysts say collecting the $3.00 mark is a critical signal for more profits.

XRPUSDT Analysis Source: TradingView

XRP market sentiment is also improving thanks to optimism about the US Spot Crypto ETF. But the risk remains.

If XRP does not exceed $2.60-$2.70 support, bullish outlook could weaken and prices could drop even further. However, for now, the level of support is on track and the market appears to be leaning towards buyers.

XRP price action will be important in the coming weeks. A confirmed breakout of over $3.00 could trigger strong momentum at $4.00, especially if ETF approvals bring new capital to the crypto market. If the Bulls are successful, XRP can enter the final quarter of 2025 with a positive note.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage