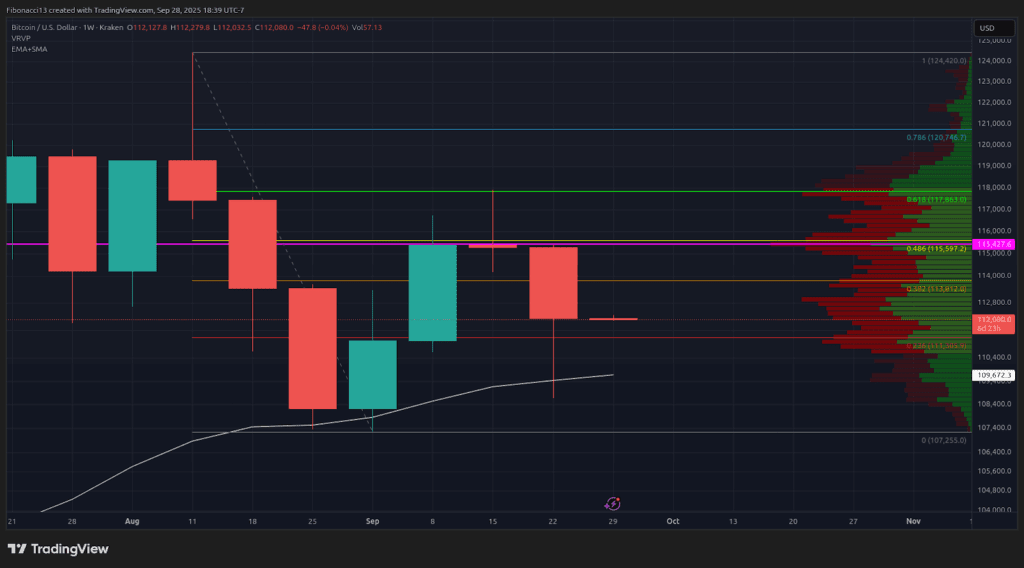

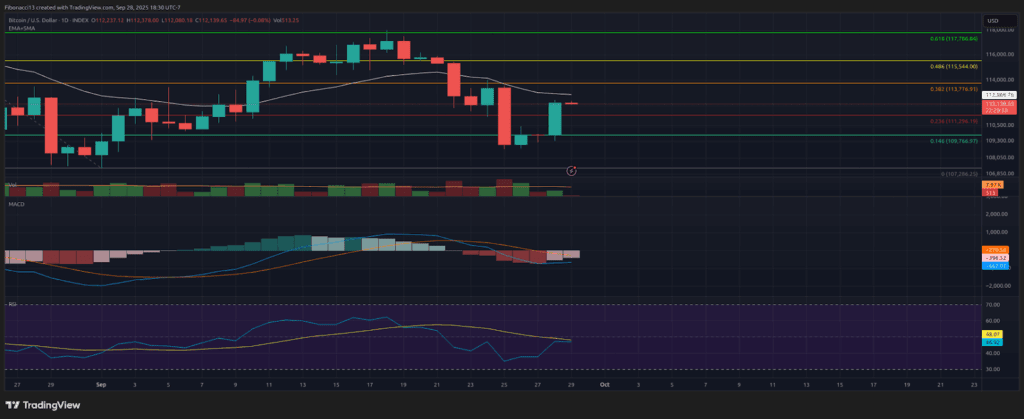

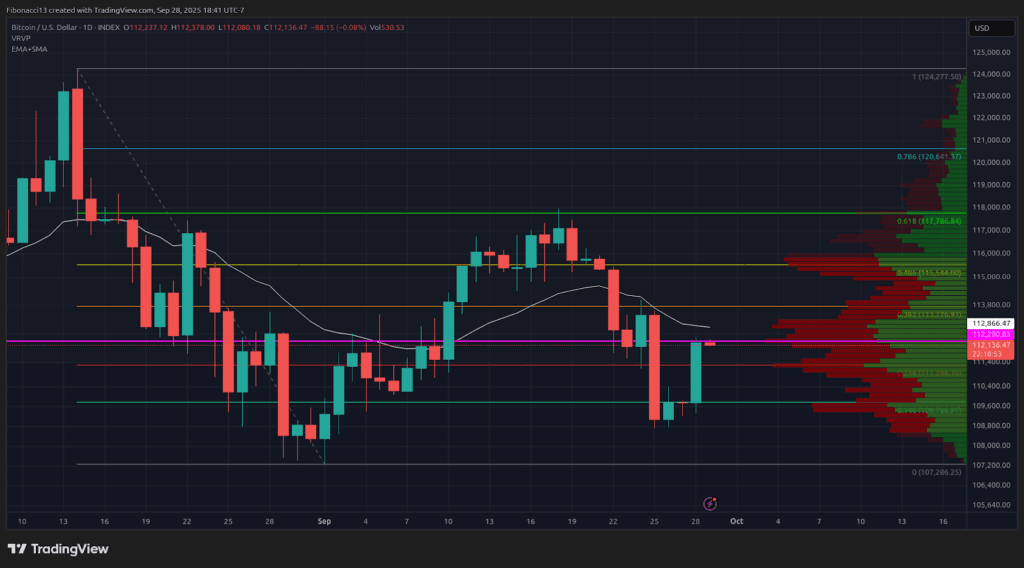

As highlighted in last week’s analysis, Bitcoin fell sharply last Sunday night to $111,800. The price then bounced back, retesting a resistance level of $113,800 and a 21-day EMA at $114,000, where it was rejected and returned to a support level of $111,300. This level returned another bounce to the 21-day EMA for the Bulls, but was denied access above the $113,800 resistance level again and dumped right under weekly support on Thursday. From that Thursday’s low, prices ended the week at $112,225.

Currently, major support and resistance levels

The Bulls will look for this support in the future as prices end the week at $109,500, past the 21-week EMA. If the Bulls make things better by generating higher prices than they each week, then $109,500 should be the floor heading into this week. $105,000 is the next level of support, and there is a big potential for a reversal from there to around $102,000. Losing $102,000 opens the door to a major long-term support of $96,000.

The advantage is that the Bulls look for prices above the $115,500 resistance level to reestablish the upward trend. This will likely give the Bulls confidence to tackle the $118,000 resistance again and move on top of it. Here we have $121,000 as a gateway to the new high, but if you go above $118,000 each week it may not last for long.

This week’s outlook

Look for a price to retest the $109,500 low early in the week. It’s likely that there will be a very strong purchase pressure to surpass the $115,500 resistance level this week, so if you can conquer $113,800, expect this level to put a lid on things. The Bulls aim to put in green candles this week and check last week to see it’s higher and lower.

However, the bias remains bearish on the weekly chart. So, in the short term, we need to predict a resistance level of $113,800. Losing $109,500 on the daily chart will result in an even bigger price cut this week, testing the $105,000-$102,000 support zone.

Market mood: Bears – There is a big red candle to close the week, so the bear is well controlled. The Bulls need to come out strong this week to protect their 21 weeks of EMA support.

Next few weeks

The weekly charts are still bearish until proven otherwise. The Bulls must favorably lean bias in order to promote more aggressive price action in the future. This week, they can do it. With interest rate cuts in September, the market will continue to flow capital in pursuit of more interest rate cuts through the October and December FOMC meetings. Investors will be closely watching US financial reports over the coming weeks for data supporting further cuts. The obstacles to further reduce data could lead to bearish price actions and further sales.

Terminology Guide:

Bulls/Bully: A buyer or investor expects prices to rise.

Bear/Bear: Sellers or investors who expect prices to drop.

Support or Support Level: At least at the beginning, the level at which the asset’s price is retained. The more touches you have in support, the more likely it will be to be weaker and will not be able to hold the price.

Resistance or Resistance Level: Opposition to support. At least at the beginning, there is a high probability of rejecting the price. The more resistance touches and the weaker the more likely it is to be unable to keep the price down.

EMA: Exponential moving average. Moving averages that apply more weight to recent prices than previous prices reduce the lag on moving averages.