Bitcoin enters the final day of the quarter with a tight coil of technical and macrocatalysts, with traders sticking to a small number of levels that could set the tone for October. Ostium Research’s weekly outlook frames the setup as a “window” that will decay the potential Q4 Tailwind, but only if the market navigates an event-heavy calendar without losing key support. As author Nick Patel said, “Weekly momentum is still in favor of higher prices, and I think we are now emerging from the window of weakness I’ve marked since Friday, September 20th.”

Major Bitcoin Levels Signal Explosive October

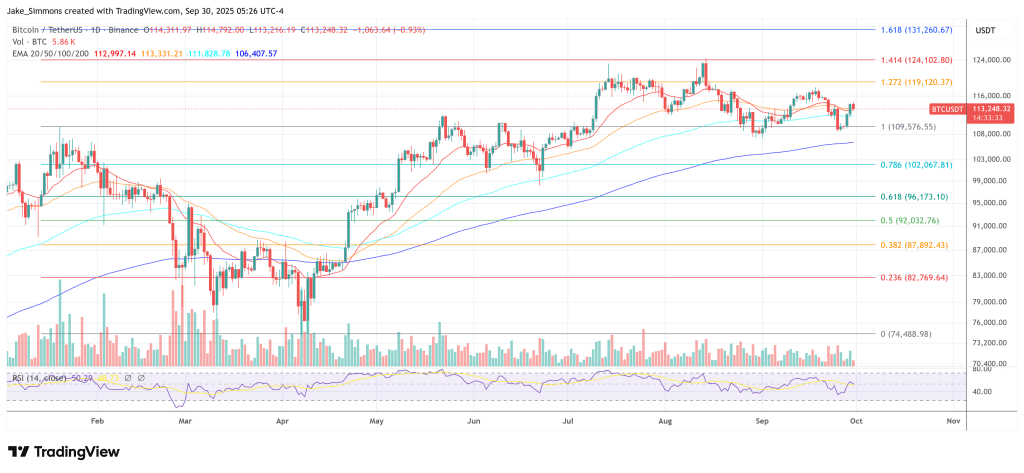

Spot price action is defined by sliding its refusal at last August’s opening to nearly $112,000, down to a lower amount of $108,000 before rebounding at the end of Sunday. While momentum is still leaning high in the weekly time frame, Patel warns that quarter end, October turns and dense data could increase volatility.

His base case is not clear. “I think this week’s dip is something I would like to consider as an opportunity for the remaining length of the fourth quarter,” he wrote, and concerns about the October cycle top are misguided given the “spreading of the tail.” The cycle risk marker is around $99,000, and the long-term nullification is tied to nearly $97,900 to the 360-day moving average. “Unless I lose $99,000 at the end of each week, there’s nothing here that looks bearish to me in the medium term,” Patel said.

Related readings

On the daily charts, the market has ticked lows above about $107,000 after a $112,000 rejection, keeping the short-term structure constructive. Patel’s upside trigger is accurate. “If we pushed this low through the rest of this week and the August opening and trendline resistance approached 115.7k, I think it would be very low that $107K-108K was retested in October.” Conversely, he highlighted the negative sidewaypoints in the volatility burst.

The tactical map he sketches gives bulls and sometimes does something within the same session. On the long side, he supports fading stop hunts at last week’s lowest or September opening.

If the market is narrowed down first, he outlines the switch hitter approach. Following a sharp rally to the quarterly ending “winning $114K until October 1st,” he aims to be ready to fry for longer again, “at least $110K, if not $108.5,000 over the weekend.”

Related readings

Macros complicate otherwise ordered technical photography. Patel expects the dollar to grow excessively before it rolls over. This is a sequence that supports risk later in the fourth quarter. Last week’s Form Post Dollar bid was “short-lived” and there’s a big move towards 93 if it collapsed in September towards 93 in Q4. In stocks, he expects an October “a little choppia” than the code, but he still lowers the slot as an opportunity for the end of the year.

A backstop view of positioning and derivative context. Patel highlights the Velo and Coinglass snapshots, a three-month annual basis, and open interest in Bitcoin vs AltCoin, highlighting weekly and month-long liquidation clusters to explain where forced flows can accelerate either path. The throughline leaves us with the possibility that this week’s volatility is likely to be a prelude rather than a postscript. “The opportunity for these lows to be cleaned should take place over the next five to seven days,” he points out. “If you run at the lowest stage last week and then retrieve it in a lower time frame, it could be a low formation in October.”

In short, the short-term mystery of Bitcoin is less about trend breaking down than the shakeout choreography. Over $112,000, buyers can quickly shove towards the ~$115,700 pivot. Beyond that, the greatest story ever returns to Center Stage. If you clean up the lows first and hold shelves between $104,600 and $107,000, the market could build an October floor. This week, Bullcase Patel will map out its quarterly maps for readers, down just under 99,000 for a week that is under $99,000. “Bears should not drill holes,” he writes. “Soaking up between now and the weekends is where I expect to see an October low.

At the time of pressing, BTC traded for $113,248.

Featured images created with dall.e, charts on tradingview.com