Permanently distributed exchanges have quietly become one of the hottest corners of cryptography. Traders flock to them for leverage, transparency and opportunities to move quickly, without relying on a centralized platform. In 2025, some daily volumes of these protocols have hit numbers comparable to the largest CEXS, but not all growth is created equal. Behind the eye-catching person, each project tells a different story when looking at how the total value of locked open interest and fees are handled.

In this article, we take a closer look at the top five permanent DEXs (lighter, higher lipids, Jupiter, and Avantis) that are currently shaping the market.

Aster

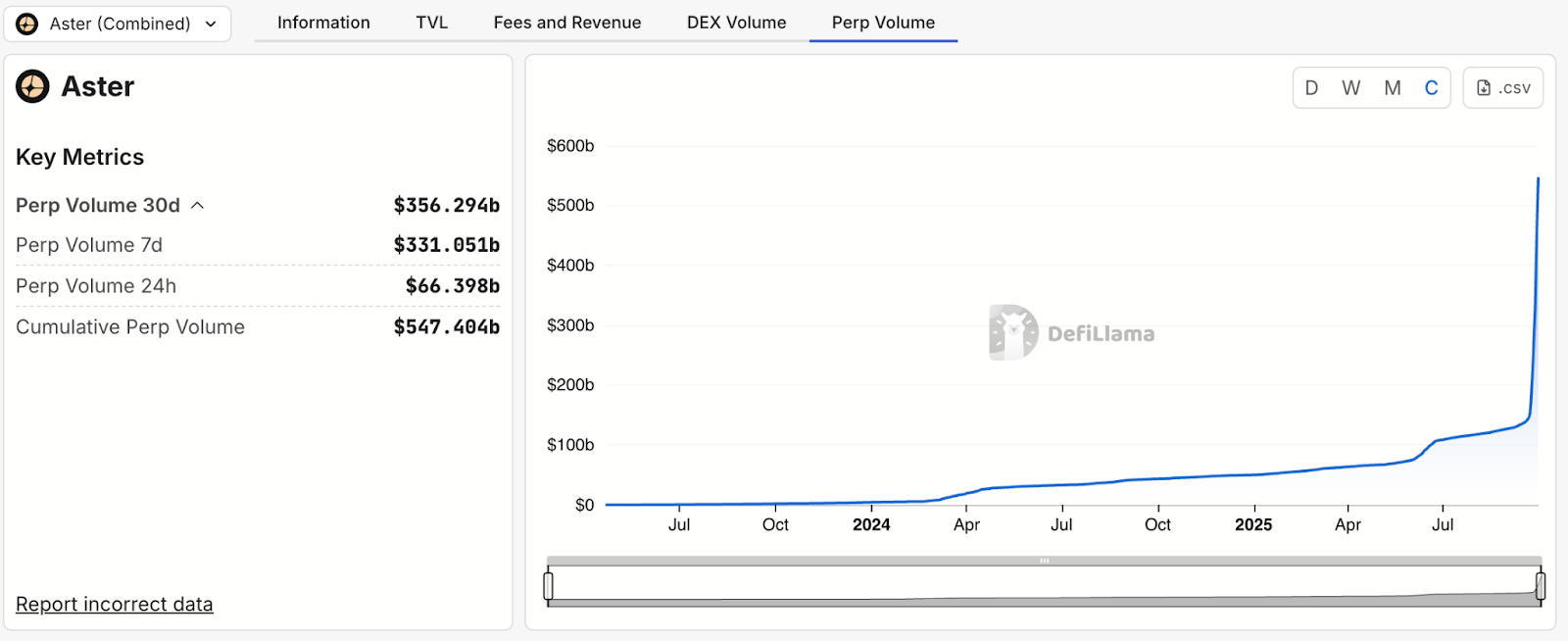

Aster is definitely the name everyone is talking about right now. According to Defilama, it has boosted its permanent trading volume of $66 billion in the last 24 hours, up to $331 billion in a week and $356 billion in the last month. This is almost three-quarters of all Perp Dex activities in a day, and is an almost surreal level of advantage.

Source: Defilama

However, the raw volume doesn’t speak to the whole thing. Looking at how much capital is actually locked within the protocol changes the image. Aster’s total protocol TVL is $2.2 billion, which sounds powerful, but the Perp side alone only locks $34.26 million across BSC, Ethereum and Solana. In other words, it is producing a quantity thousands of times greater than the collateral it holds. This is a sign of extreme capital turnover, high leverage, and perhaps heavy incentives.

Source: Defilama

At the same time, asters are not just smoke and mirrors. Daily fees exceed $25 million, putting it at the top of the entire defi landscape. It is a strong indication that the good part of this trading activity is authentic.

Tonomics:

- token: Aster (Released in September 2025).

- Utility: Powers both Perps and Spot Trading as well as features like running Mev-Aware.

- Vesting: Milestone-based unlock designed with staggered supply.

Aster for long-term growth

High fat

The high lipids were long enough to build a reputation for reliability. It has processed $7 billion in PARP volumes over the last 24 hours, $72 billion in 7 days and $280 billion in 30 days. It’s about 5% of the market, and although it’s quite behind Aster, it’s still comfortable among leaders.

Source: Defilama

It is the depth that makes high lipids stand out. Its public interest is around $12.93 billion, indicating that traders are willing to keep serious positions open. Also, unlike Aster, it has a collateral base to back it up. TVL is one of the largest in the industry, at around $2.7 billion. This will make fluidity robust and less reliant on short-term incentives.

For more information: High lipid deep dive: Understanding hype and HLP models

Source: Defilama

The platform runs perfectly on Hyperliquid L1, a custom build chain that runs on-chain order books. Instead of giving fees directly to token holders, almost all trading fees flow into funds that buy back their native tokens, hype.

High lipids hit an all-time high at $29 billion for a 24-hour volume and $7.7 million for a 24-hour fee. pic.twitter.com/uts0je5ch8

– hyperliquid (@hyperliquidx) August 15th, 2025

Tonomics:

- token: Hype.

- Mechanism: 99% of the transaction fees go to the support fund that supports the hype.

- Ecosystem: Supports both the Perp and Spot markets.

writer

Lighter ranked second in a perp volume of $8 billion a week, with $64 billion a week and $161 billion a month. This project is building something completely different. The book on ZK-Rollup Order Book on Ethereum allows everyone to check matches and liquidation in the chain. It’s about less trustworthy infrastructure than flashy campaigns.

Source: Defilama

That philosophy appears in that number. Lighter’s TVL is still relatively small compared to the number of transactions, so the same capital pool has been recycled many times. It can raise eyebrows, but the roll-up design at least ensures that the transaction is legal.

Source: Defilama

Tonomics:

- Token: Not released yet.

- Incentives: A point-based system is in place, and airdrop expectations are high.

- Technical Focus: ZK-Rollup with verifiable matching and liquidation logic.

Jupiter

Jupiter gave its name as Solana’s Go-To Swap Aggregator, but in 2025 he also became a permanent serious player. One day, it handles more than $1 billion in daily PARP volumes. According to Defillama, it is one of the most active Solana-based venues. It is clear that Jupiter will have an advantage over his rivals. Plugs on Perps were a natural next step as we already controlled most of the liquidity routing in Solana.

Source: Defilama

TVL figures are less eye-opening than trading flows, which hovering a liquidity pool of tens of millions. That gap suggests that Jupiter is leaning heavily towards aggregation efficiency rather than deep internal collateral. Still, open interest is growing steadily and at the heart of Solana’s ecosystem, Jupiter has the stickiness that new standalone perp dex cannot be easily replicated.

Tonomics:

- token: jup.

- Utility: Used for Jupiter aggregators and permanent market-wide governance and incentive programs.

- Distribution: Community air installation is already alive and has continued incentive emissions.

Avantis

Avantis is a new participant, but it’s quickly creating waves. Built on Arbitrum, it has established itself as a derivatives hub that offers a lasting future, options and structured products. Recently, daily PARP volumes have risen to hundreds of millions of dollars, and trading activities have put them just outside the top five.

Source: Defilama

What stands out in Avantis is its capital model. TVL has grown to over $50 million, a modest $50 million compared to giants like Aster and Hyperquid, but the protocol shares real yields from trading fees with its stakers. It helped to attract sticky liquidity, giving the market advantage where many platforms burn incentives without long-term alignment.

The project is transparent about publishing open interest and fee dashboards, making it easier to measure how sustainable sustainable growth is in fact. Although Avantis is still small from an absolute standpoint, its design suggests that it focuses on building a healthy base rather than chasing headline volumes.

Tonomics:

- token: AVT.

- Utility: Staking earns a share of protocol fees (“real yields”).

- Incentive: Emissions Program bootstraps liquidity live with Arbitrum.

For more information, Avantis is listed in Binance Hodler Airdrops!

Conclusion

On the surface, Aster appears unstoppable in three-quarters of all daily lords. However, once you stack up the TVL, the story isn’t that easy. Aster’s PARP side has very little collateral compared to its trading flow. It suggests that incentives and leverage are making many heavy lifts. In contrast, high lipids have billions of dollars trapped and have an open position of nearly $13 billion, giving them a more robust base. Writers bet on speed and verifiability, but they still work in a relatively small pool of capital.