Kazakhstan has launched the Alem Crypto Fund under the Ministry of Artificial Intelligence and Digital Development. The Crypto Fund, which supported the state, made the BNB the first purchase through Binance Kazakhstan. The fund is operated within the Astana International Financial Centre (AIFC) and is managed by the Qazaqstan Venture Group.

The authorities discussed a long-term preparation approach for digital assets. Deputy Prime Minister Zhaslan Madiyev said

“Our focus is to create reliable vehicles for long-term state-level investments in digital assets.”

The original allocation for the Alem Crypto Fund remains unpublished. The launch continues with steps to close unlicensed exchanges by Kazakhstan.

This announcement has been added to the context of publication and chaining. Former Vinanest Chief Changpeng Zhao referenced X’s first purchase. He posted a photo from a previous meeting from 2022, writing, “Kazakhstan will buy #BNB for long-term holdings.”

Kazakhstan’s Alem Crypto Fund: Details of the provincially supported crypto fund

The Alem Crypto Fund is a state-backed crypto fund with a clear mission. Kazakhstan has placed the fund within the AIFC to use its rules and courts. AIFC Setup supports licensing, custody and auditing of digital assets.

The management role was sent to the Qazaqstan Venture Group. The team handles asset selection and risk management for the Alem Crypto Fund. It also coordinates AIFC monitoring and reporting to meet the Kazakhstan rules for digital assets.

The authorities tied the fund to previous executions. Kazakhstan opposed the unnecessary license exchange before this release. The Alem Crypto Fund routes transactions through licensed venues within AIFC.

First purchase at BNB Binance kazakhstan: custody, access, compliance

The first Alem Crypto funding is obtained through BNB. Binance Kazakhstan carried out a trade in the Crypto Fund that supported the state. This will maintain control, settlement and reporting under the AIFC rules.

Licensed access reduces operational risks in Kazakhstan. Binance Kazakhstan offers isolated custody of digital assets. Its structure provides the Alem Crypto Fund with a clear ownership record and audit.

BNB holdings can include network rights. The token supports the staking flow and governance features of the BNB chain. The Alem Crypto Fund did not publish its staking plan. However, participation in the chain is possible within policy and risk limits.

AIFC and Qazaqstan Venture Groups: Structure, Monitoring, and Names

The AIFC framework fixes the Alem Crypto Fund in known legal zones. Kazakhstan uses AIFC courts and regulators for its digital assets. This will help the state’s supportive Crypto Fund apply their tested compliance tools.

The Qazaqstan Venture Group manages the daily operations of the Alem Crypto Fund. Set risk limits, select assets, and arrange audits. The manager also ensures that it meets the requirements of AIFC and Kazakhstan.

Public comments added details to the launch. Nurkhat Kushimov, general manager of Binance Kazakhstan, said

“This initiative demonstrates that state support reserves and global crypto infrastructure can coexist when governance, licensing and transparency are prioritized.”

The statement focused on Kazakhstan’s regulatory access.

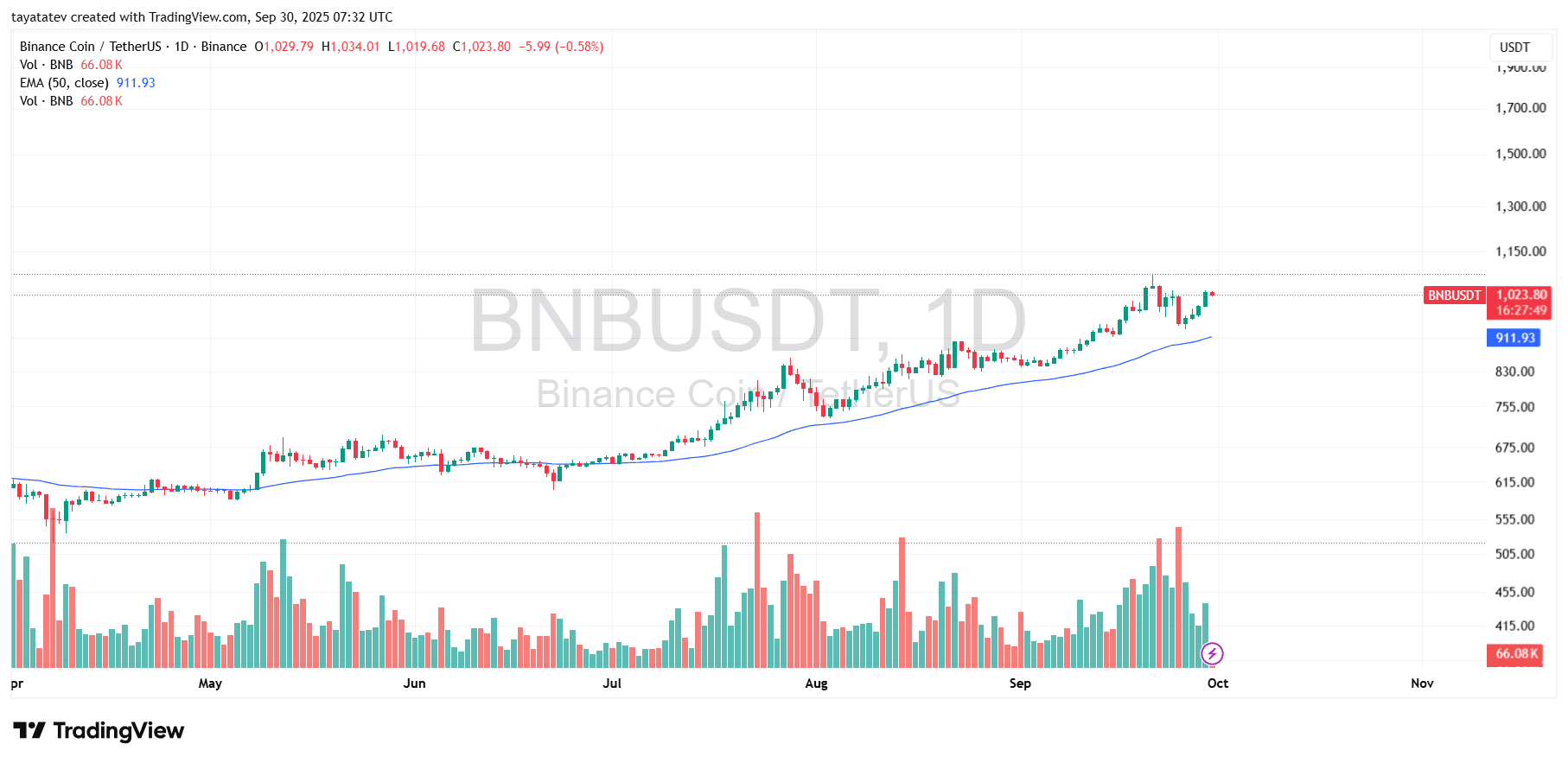

BNB trades nearly $1,023.80 on the BNBUSDT, 1D chart. Today’s session saw O$1,029.79/h$1,034.01/L$1,019.68/C$1,023.80, a 0.58% decrease. The 50-day EMA is $911.93. The reported volume is 66.08K on Binance.

Prices are well above the 50-day EMA $911.93. This will result in a higher major trend in this time frame. The Intray Range ranges between $1,019.68 and $1,034.01.

The move follows Kazakhstan’s Alem Crypto Fund, which confirms BNB as its first asset. The chart provides immediate context. BNB has consolidated around $1,020-$1,035 after recent profits. There is key support near EMA $911.93 for 50 days. The short-term resistance coincides with today’s $1,034 height.

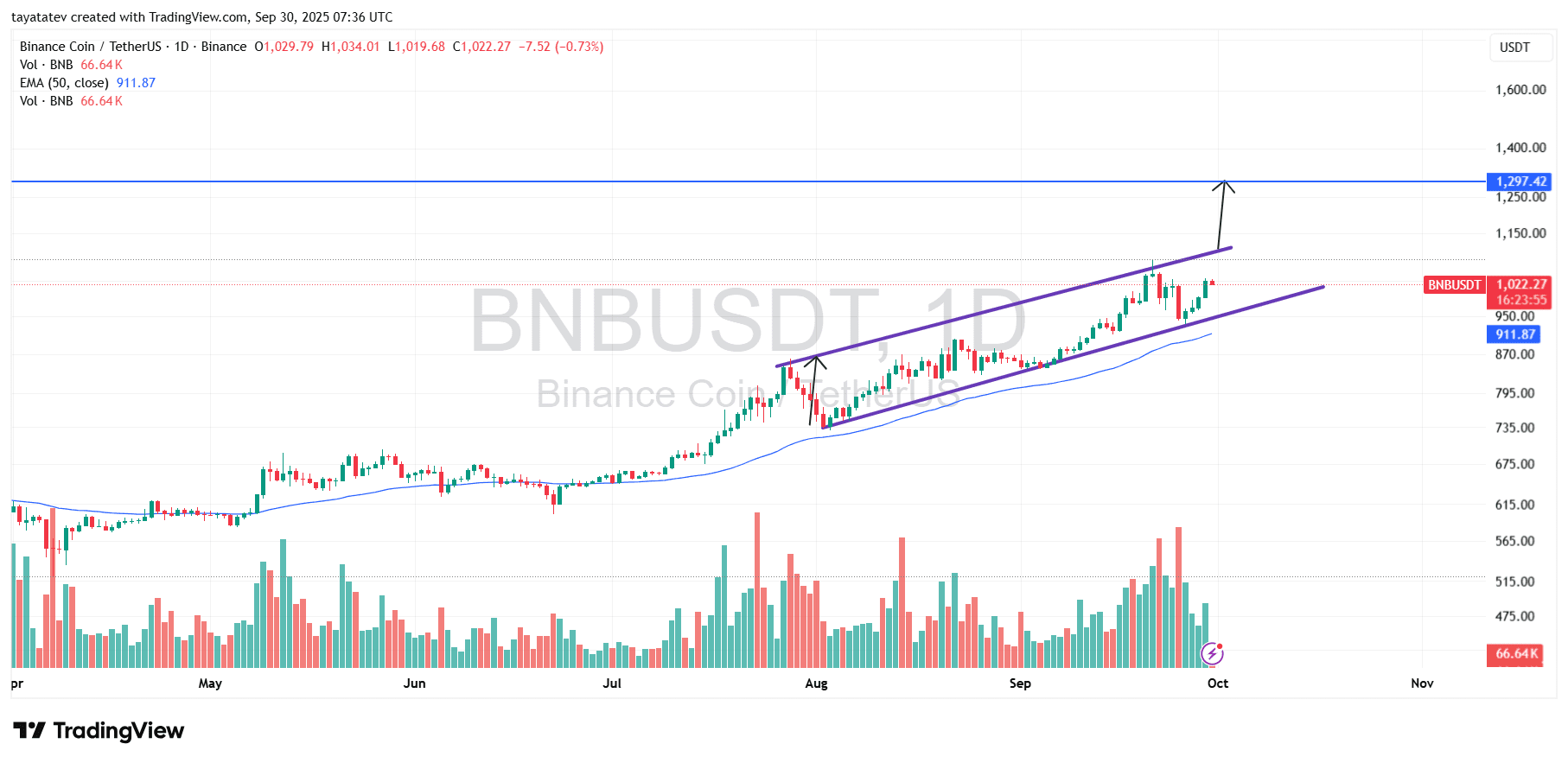

BNB Rising Channel Pattern – September 30, 2025 (Adjusted Universal Time 07:36)

BNB will trade at $1,022.27 on BNBUSDT on a one-day chart captured in 07:36 adjusted universal time, September 30, 2025. The chart shows the rising channel patterns. The rising channel is two upward parallel trend lines connecting higher and higher low values.

Price respects both channel boundaries. After August, candles have swarmed near the upper rail after a steady low. The 50-day index moving average (EMA) is $911.87, and the price is far above that. The volume reported in the session is 66.64,000 for Binance.

The instant range prints a high $1,034.01 and a low $1,019.68. In this view, upper channel rails line up between $1,140 and $1,160. The thick horizontal line on the chart shows a high reference close to $1,297.42. The lower channel rail is around $950 and tracks 50 days of EMA $911.87 as secondary support.

Using channel gradients and current closures, the pattern supports measured projections. Starting from $1,022.27, a 26% extension means $1,288.06. That level is just below the marked reference for $1,297.42. So, if the price is maintained on top rails in volume, the chart context allows you to move to ~$1,288 within the channel’s trajectory.

However, the channel pattern may fail. A clean break under the lower rail will postpone the projection. In that case, attention will first shift to $950, 50-day EMA $911.87. Until then, the Rising Channel will keep the bias constructively in this time frame, frame a 26% upside marker at nearly $1,288.

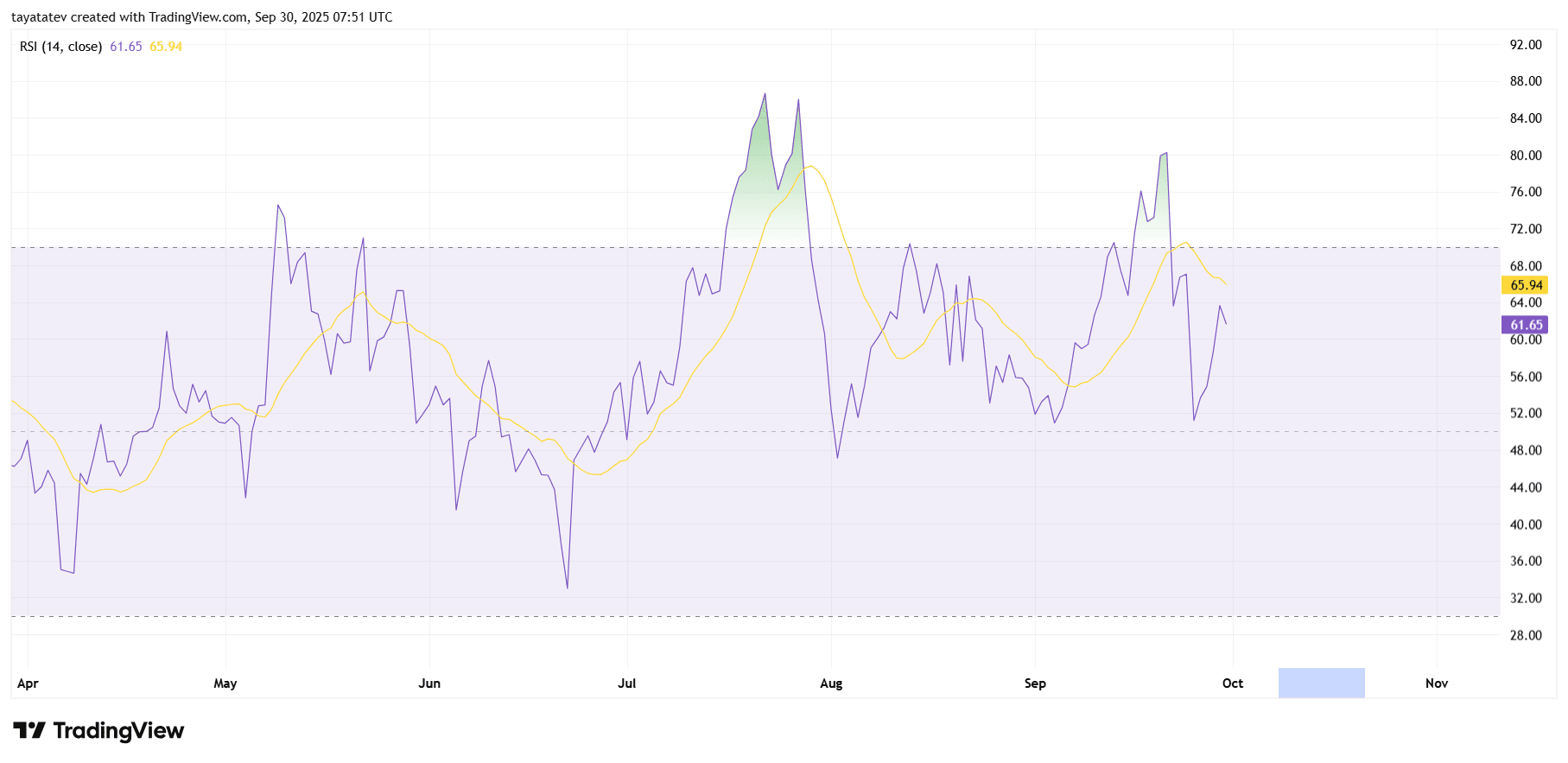

BNB RSI Momentum – September 30, 2025 (Adjusted Universal Time 07:51)

The relative strength index (RSI) for the 14 period is printed at 61.65, with a signal/average of nearly 65.94. The RSI is above neutral 50 bands and below excess zones (custom dotted guides near 68-70 on this chart). Price momentum remains positive, but below-average RSI trading shows easing intensity compared to its peak in late September.

The recent swing has pushed into the 70s in late September, showing a rapid decline and rebounding back to low 60s. The sequence shows that while momentum has cooled from extremes, buyers still control trends in their daily time frame. As long as the RSI exceeds 50, the wider uptrend bias will remain intact. A critical movement through 68-70 marks new accelerations, while a slip towards 50 reduces momentum.