Ethereum (ETH) prices were recovered on September 29th by passing through the $4,100 area. Momentum remained vulnerable, but higher pushes could change market dynamics.

Eth Bulls targets price levels of $4,200 to improve the likelihood of resuming token rallying. Furthermore, accumulation of short liquidation above current levels suggests that the recovery will be covered by traders and amplify upward pressure. Such movements run the risk of causing shorter apertures. Analysts maintained their view on ETH and measured whether rebounds could expand to stronger profits.

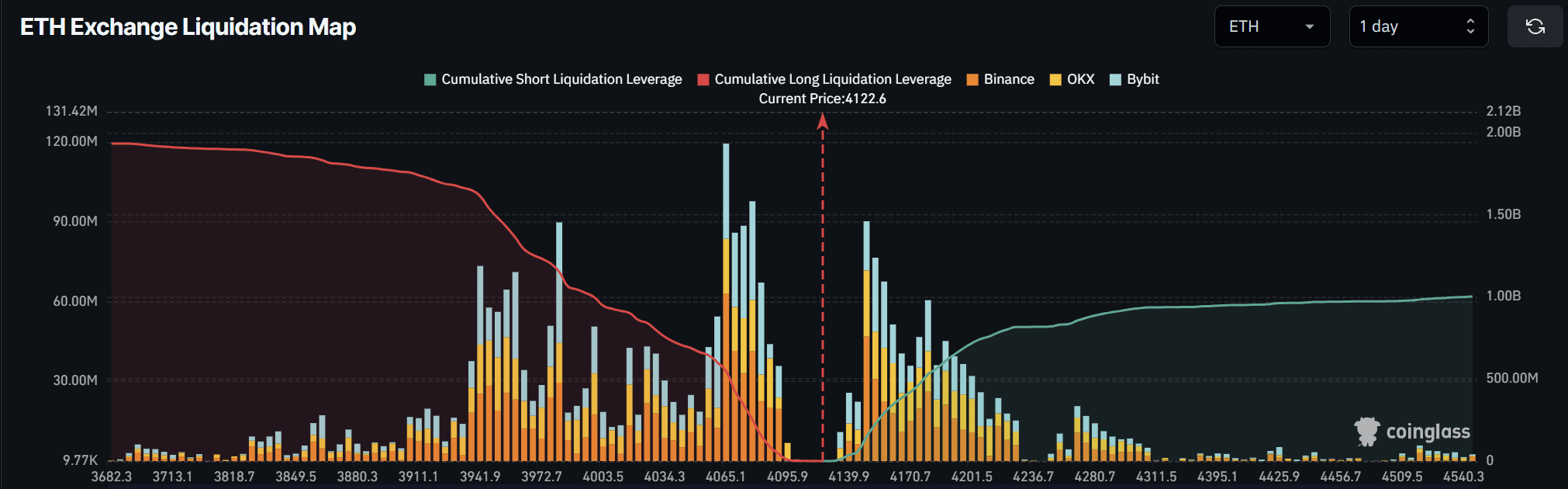

Shorts stacked on current levels will squeeze the risk of squeezing

The weak recovery left Ethereum at a sensitive point, but placement data shows that the stakes were heavier.

The Coinglass liquidation map revealed a sharp cluster of short liquidation just above the $4,100-$4,250 band. This alignment meant that even a modest expansion could force traders to lose their bets and turn defensive exits into aggressive buying pressure. Additionally, the data highlighted that moves above $4,200 will risk liquidation of more than $717 million in short positions.

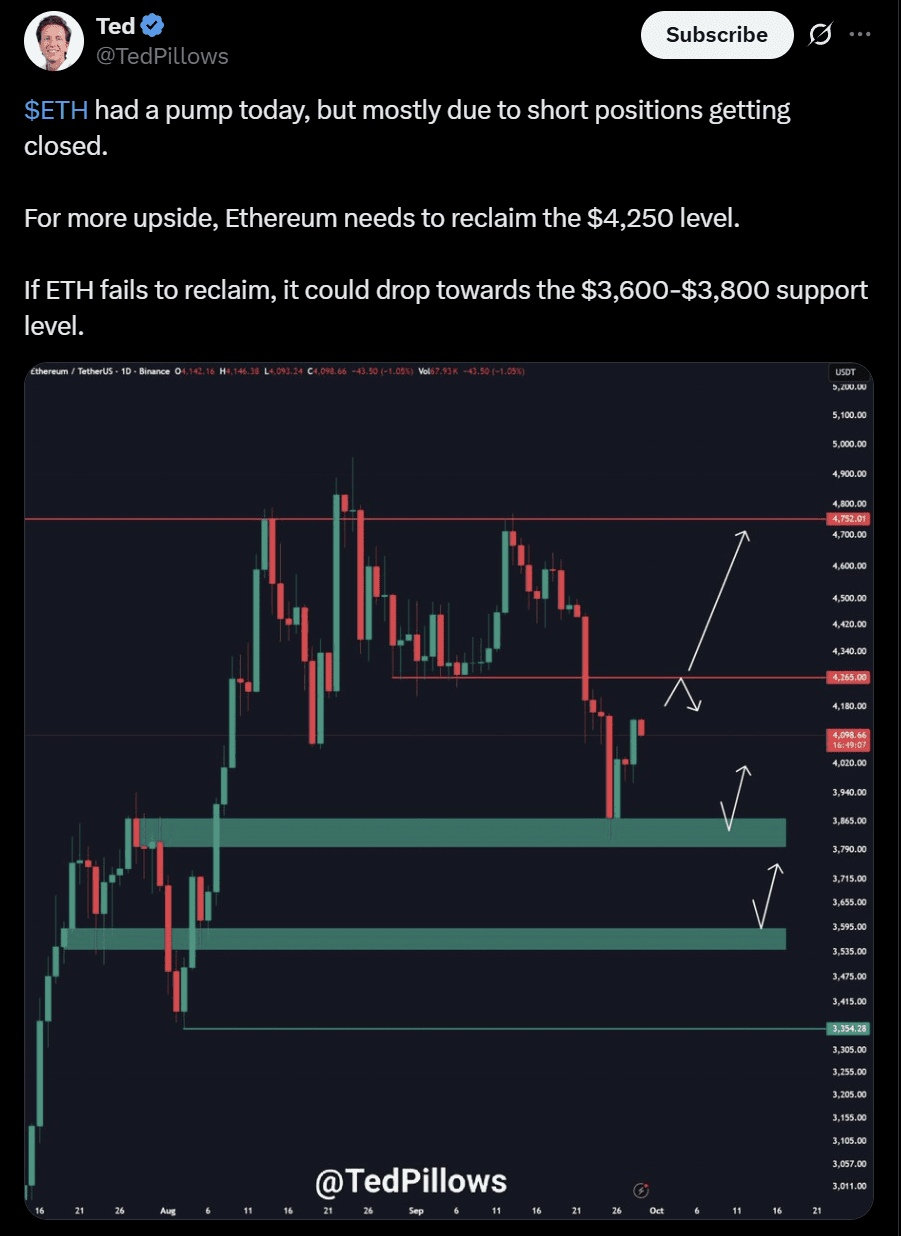

The setup resonated with analyst Ted’s outlook on September 29, noting that the latest rise in tokens came mainly from the closure of shorts.

Ted emphasized that ETH needs to regain the $4,250 region to avoid fresh shortcomings towards $3,600-$3,800. The overlap between his chart and the liquidation heatmap quickly added weight to the photo. If that recovery occurs, the price rise could change quickly.

The combination of liquidation pressure and visible recovery zones shaped the short-term narrative. With the large stack of shorts, Ethereum needed momentum to tilt the balance. Market history has shown that similar setups often result in rapid and oversized movements after liquidation levels have been breached. In that context, we explained why traders would bounce less as a routine recovery and frame more bounce as a potential pressure.

By late September, ETH had not yet confirmed such a break. Still, the underlying accumulation of short exposures provided a defined trigger. If momentum passed these liquidation bands, the response made a greater stride by inverting the defensive deal and returning it to sudden fuel.

Analysts are divided into ETH recovery claims and correction warnings

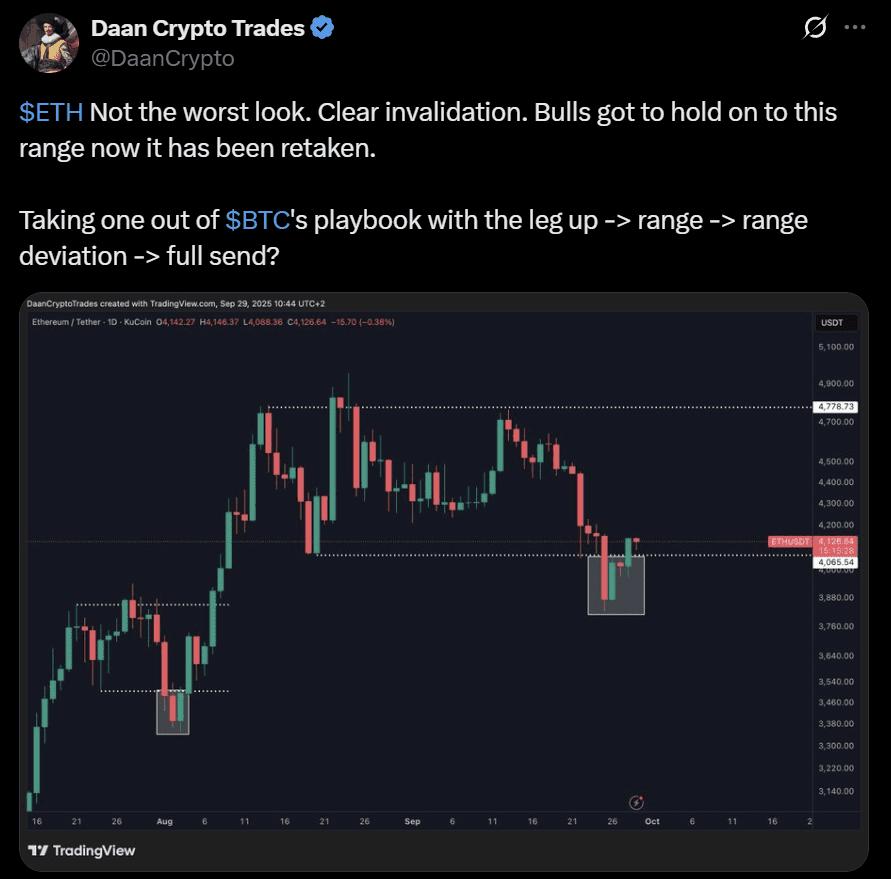

The short squeeze risk was not present alone. Analysts tracked the other signals that shaped the Ethereum path. Some leaned against bullish continuation, pointing to structural retrieval patterns that often precede stronger gatherings. Independent market commentator Daan Crypto Trades pointed out on the X-Post that the ETH USD pair regained key range after a failed failure.

Analysts argued that the Bulls needed to protect this recall, and framed it as a potential springboard to turn it back further. Dahn’s view reflects the range deviation that caused previously fast expansion after momentum stabilized.

A different layer has been added to the long-term chart. Analyst Ted noted that Ethereum prices earned almost 250% from the cycle bottom.

Analysts argued that the correction was natural, but after short-term weaknesses occurred, the broader structure continued to support a higher rating. With an ultimate focus on returning to growth, he placed his recent volatility within the larger bullish channels that have led prices for years.

Still, not all signals are tilted in the same direction. Max Crypto highlighted the CME gap around $4,050, warning that futures gaps often work like price magnets.

This suggestion implies that ETH may retest lower zones before installing stronger pushes. The Validator Exit queue also highlighted potential pressure, with over 2 million ETH waiting to withdraw. A meaningful release of that supply could shift liquidity conditions in a way that is restricted to immediate upside down.

Technical gauges have been added to the careful tone. Daily RSI has recovered from oversold levels, but remains below neutral, indicating that momentum has not been completely reset. Rebound to the rebound clustered moving average of ETH also accumulated the above resistance. This consistency suggested that the Bulls would need more convictions to maintain their breakout.

Do you need to know which Fed reports monitor this week? Read more here.