HEMI is a modular layer 2 protocol designed to act as a “supernetwork” that natively bridges two largest blockchain ecosystems.

What is Hemi?

Hemi’s central mission is to solve long-standing challenges in interoperability and enable developers to build decentralized applications (DAPPs) that seamlessly utilize the robust security and large-scale liquidity of Bitcoin, along with Ethereum’s advanced smart contract capabilities. By creating this unified environment, Hemi aims to unlock new frontiers for Decentralized Finance (DEFI) and a wider Web3 space. The project attracted a lot of attention after being selected as the 43rd Project of the Binance Hodler Airdrops Program.

HEMI Interface – Source: HEMI Network

detail: HEMI (HEMI) is listed in Binance Hodler Airdrops

How does it work?

Hemi’s architecture is designed to create an unreliable and efficient connection between Bitcoin and Ethereum. This process starts with its uniqueness HEMI Virtual Machine (HVM)Bitcoin node is built in. This allows Hemi’s smart contracts to read Bitcoin data directly and natively, including transactions, balances, and UTXOS.

Source: HEMI Network

Source: HEMI Network

When accessing this data, hemi security is secured by a new consensus mechanism called Proof of Proof (Pop). Exclusive instead of relying on a unique set of validatorsly, the pop mechanism allows miners to record snapshots of the hemi state on the Bitcoin blockchain itself. By pinning data to Bitcoin, Hemi effectively “inherits” the unparalleled security of the world’s most robust blockchain, making it extremely difficult to change or attack its own transaction history. This combination allows DAPP to work with confidence using data and assets from both chains in a single, secure environment.

Important features

HEMI integrates several key features to realize the promise of a unified cross-chain ecosystem.

- HEMI Virtual Machine (HVM): EVM compatible engine with integrated Bitcoin nodes. Developers can use the familiar Ethereum tool while allowing smart contracts to natively read Bitcoin status without external oracles.

- Proof Proof (Pop): A unique consensus mechanism that locks the state of Hemi to the Bitcoin blockchain. This allows Hemi to inherit Bitcoin security and provide a very high level of finality and decentralization.

- HEMI BITCOIN KIT (HBK): A specialized library of smart contracts that simplifies the process by which developers build DAPPs that interact with Bitcoin. It provides the tools you need to access your Bitcoin status and enable use cases such as Bitcoin-based lending and resuming.

- Scalability and interoperability: As a modular framework, HEMI is designed to address transactional bottlenecks while providing “Bitcoin security as a service – service” and promotes an environment where applications can run on multiple blockchains.

Toconomics

HEMI tokens are native utility and governance assets of the HEMI network. Its talk name is designed to support ecosystem growth and security.

- Token name: Hemi (Hemi)

- Total supply: 10,000,000,000

- Circulating supply in listings: 977,500,000 hemi (~9.78%)

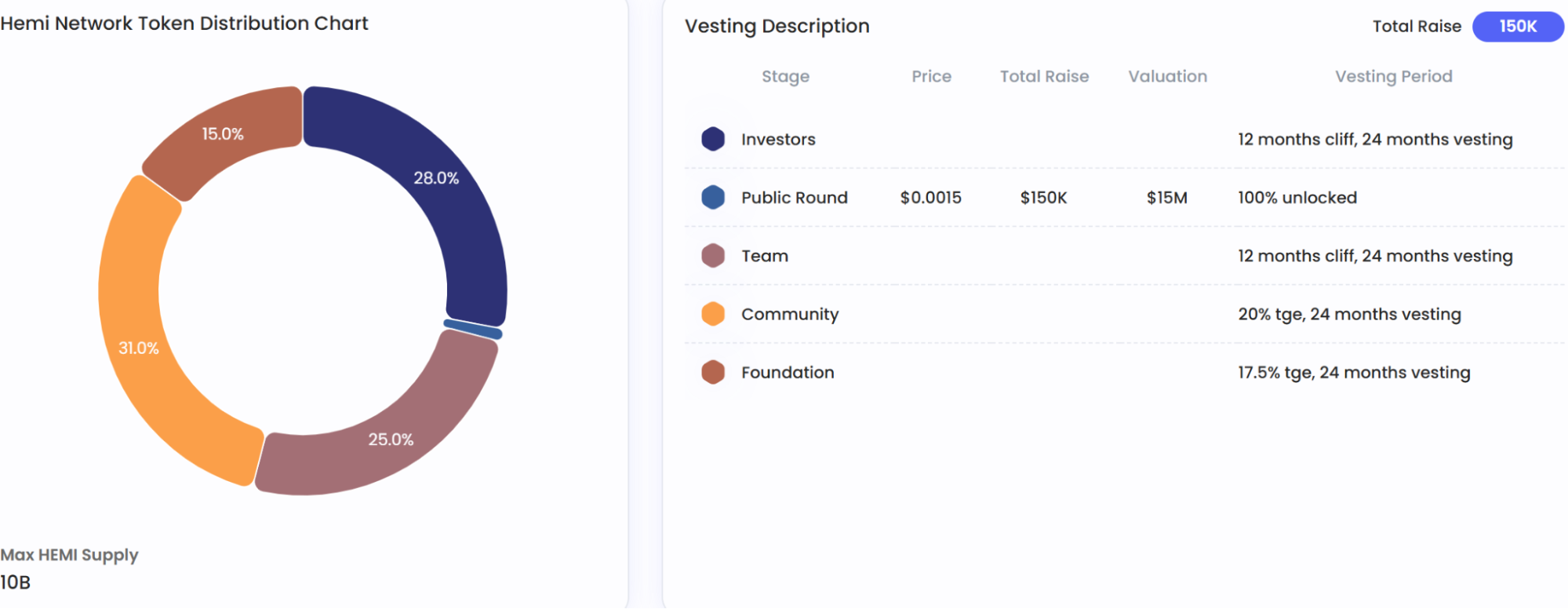

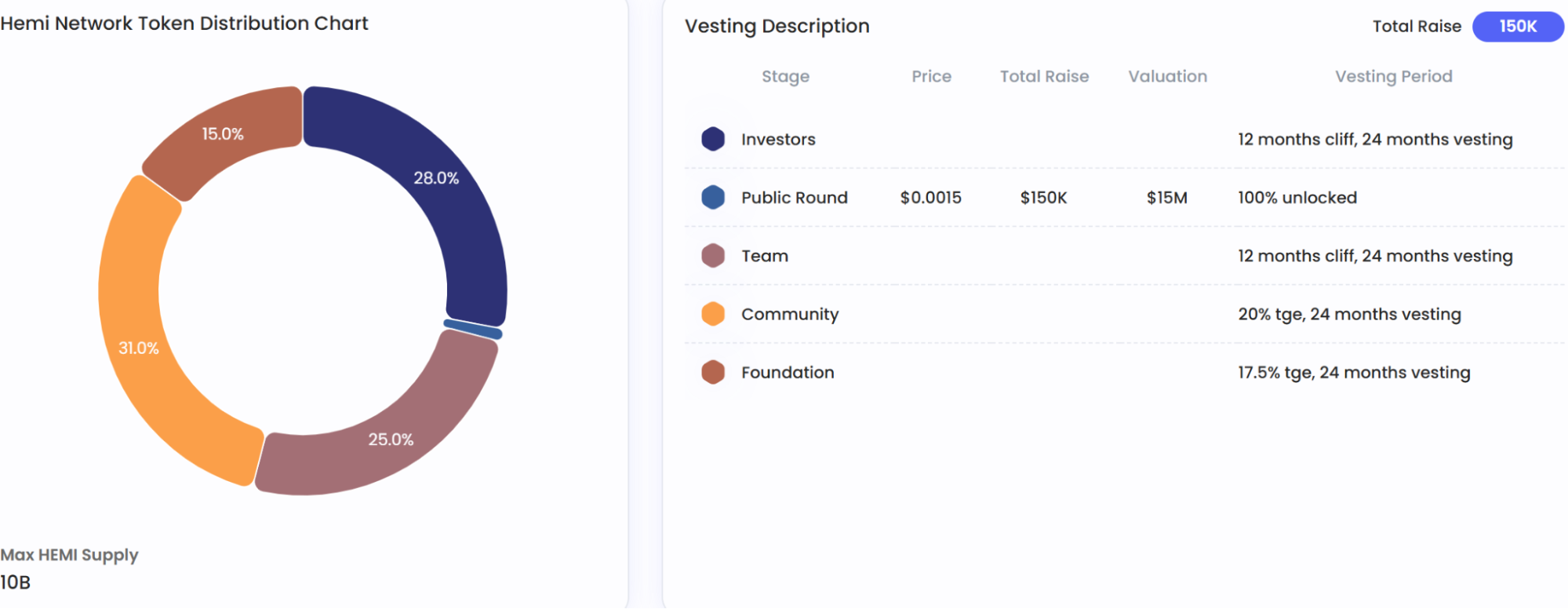

- Token Allocation:

- Community and Ecosystem: 32%

- Investors and Partners: 28%

- Team: 25%

- Foundation (Development Fund): 15%

- Market Performance: Once released, Hemi brought a record-high 550% rally to $0.12, driven by Binance’s list and airdrop hype. It was later fixed to about $0.097 as the recipients of the airdrop benefited. The token carries a Binance “seed tag.” This indicates that it is an early stage project with high potential volatility.

Source: ChainBroker

Investors

Source: ChainBroker

HEMI is supported by significant financial support from well-known venture capital companies in the crypto sector. This project successfully raised the total $30 million in funds. This includes a $15 million seed round Leading YZI Lab. Other notable investors include Republic Digital, Hyperchain Capital, Breyer Capital, and Has a big brainshowing strong confidence in Hemi’s long-term vision and technical approach.

FAQ

What is Hemi?

HEMI is a modular layer 2 protocol designed to act as a “supernetwork” that bridges the Bitcoin and Ethereum ecosystem. Its main purpose is to enable developers to build decentralized applications (DAPPs) that can seamlessly leverage Bitcoin security and liquidity with Ethereum’s smart contract capabilities.

How does Hemi connect Bitcoin and Ethereum?

HEMI connects two blockchains using a unique HEMI virtual machine (HVM).

How is the Hemi secured?

Hemi’s security is locked into the Bitcoin blockchain through a new consensus mechanism called Proof of Proof (POP).

How is Hemi different from the other Layer 2?

Most Layer 2, such as Kinkai and Optimism, focuses on scaling a single blockchain (Ethereum), but Hemi’s main goal is interoperability Intermediate Two different blockchains.

What are the risks of investing in Hemi?

The main risk is tied to being an early stage project, as indicated by the “seed tag” on Binance.

What are hemi tokens used for?

HEMI tokens have three core utilities within the network.

- Governance: Vote for proposals that will shape the future of the project.

- Gas fee: Payment for all transactions on the HEMI network.

- Staking: It helps to secure networks and earn rewards through proof mechanisms.

Where can I buy Hemi?

The Hemi token is listed in Binance Exchange. It can be used to trade with several major currencies and stubcoins, including USDT, USDC, BNB, FDUSD, and Try.