Shiba Inu’s core team says the Shibarium Ethereum Bridge will remain offline following the Balidator-Key Exploit on September 12th. The developers assembled pauses as needed while completing security reviews and third-party audits.

Project Communications outlines the immediate containment measures taken after the incident. The team locked the keys, strengthened custody and restricted the bridge’s operations as investigators mapped the attack route.

As of today, the reopening date has not been made public. Updates continue through official channels, whilst forensic work and external evaluations progress.

What the developer said happened

In a detailed post, developer Kaal Dhairya said that validators are now enabled, which are not permitted to enable malicious checkpoints/exits that withdraw multiple assets via POS bridges. This memo is attributed to short-lived stake amplification, combining vectors with forged proofs.

The update accepts leadership responsibility for key management in the early stages of Shibarium, saying that decentralization will increase as part of the revision. The team also highlights ongoing control and strengthening custody policies.

The document adds that findings may evolve as the audit is completed. The developer has pledged to share the explanation via a FAQ that tracks the latest status of the investigation.

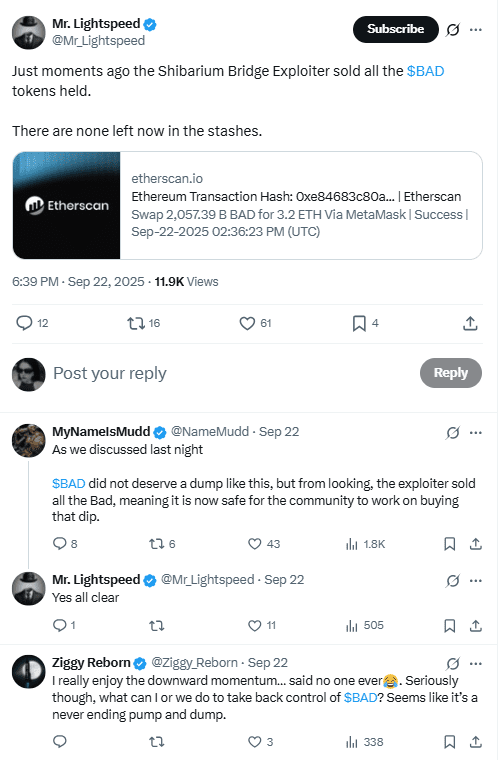

Chain-on-chain fallout tied to attackers

According to ecosystem tracking, addresses linked to the incident have recently moved and sold some of the siphoned tokens. This week’s coverage specifically flagged the disposal of bad (bad idea AI) possessions caused by bridge attackers.

Previous team notes also referenced the sale of other assets from exploit flows, including ETH and SHIB, but the bridge continued to pause. These movements form part of the wider forensic image.

The project has not released details of the recovery, but it involves authorities and external experts. The standing message first focuses on hardening, monitoring, and documenting, and then resumes the operation.

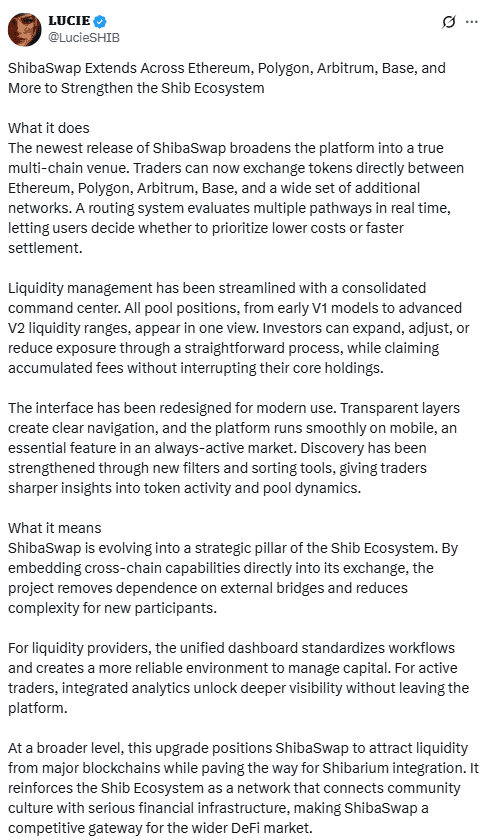

Apart from the Bridge incident, Shibaswap Dex recently launched a refresh. This release combines trading, liquidity and analytics to highlight multi-chain routing across key networks.

Community posts describe the redesign as a usability push intended to streamline core actions for ecosystem users. This update came ahead of this week’s security communications.

The Live Shibaswap site continues to promote swap and liquidity features as usual, highlighting that a wider range of tools are still active while the bridge repairs are underway.

What’s next?

Short-term milestones revolve around audits, validator controls, and clearer reopening criteria for bridges. The team keeps the timeline open until those steps are finished.

The Ecosystem Channel will guide users to status changes and official FAQ posts. This approach aims to reduce rumored updates while technical work is finished.

For now, the operational story remains at two tracks. Continue to incident responses around the bridge and deliver products like Shibaswap. Details are expected as a third-party review wrap.

AltSeason Chart claims that Shib and Altcoins could outperform

According to the Viral Post, Shiv and other altcoins are set up for large gatherings. This post quotes the monthly TradingView ratio, excluding the top 10, of which the total crypto market capitalization is excluded from Bitcoin. It highlights the run-ups in 2017 and 2021, showing similar climbs in 2025.

The chart tracks relative performance. As the line rises, a smaller cap will give you value against Bitcoin. Therefore, the author frames this movement as an early AltSeason signal. Because the time frame is monthly, each candle compresses the month’s transactions into one bar.

Context is important. Liquidity, Bitcoin advantage, and ETF flow often lead to this ratio. Regulation news and exchange terms may change capital turnover. History shows two previous surges, but the sample size remains small. As a result, this pattern suggests a setup, but does not confirm broad outperformance on its own.

Chart flags flags potential sive breakout setups

A new post from Shib Possessor presents a weekly chart that frames Shiba Inu inside a long descending trend line on top of a wide range of “major weekly support” bands. The chart suggests that buyers continue to defend their base while buying compress towards trendlines. Depicts a possible breakout scenario if the shib closes above a horizontal resistance drawn near a high in the previous range.

The graphics map some upside targets as vertical projection bars. These targets sit on prominent resistance and appear to stagger to reflect continuous levels of expansion. The author pairs the projection with an arrow from the support area, meaning a path that first regains resistance and proceeds towards the next higher target.

However, setup depends on checking. The chart means validating breakout ideas near the trendline and horizontal cap week, and trading within the support band means keeping the scope unharmed. As always, liquidity, market width, and Bitcoin dominance could affect whether Altcoin’s breakout will be held after the initial move.

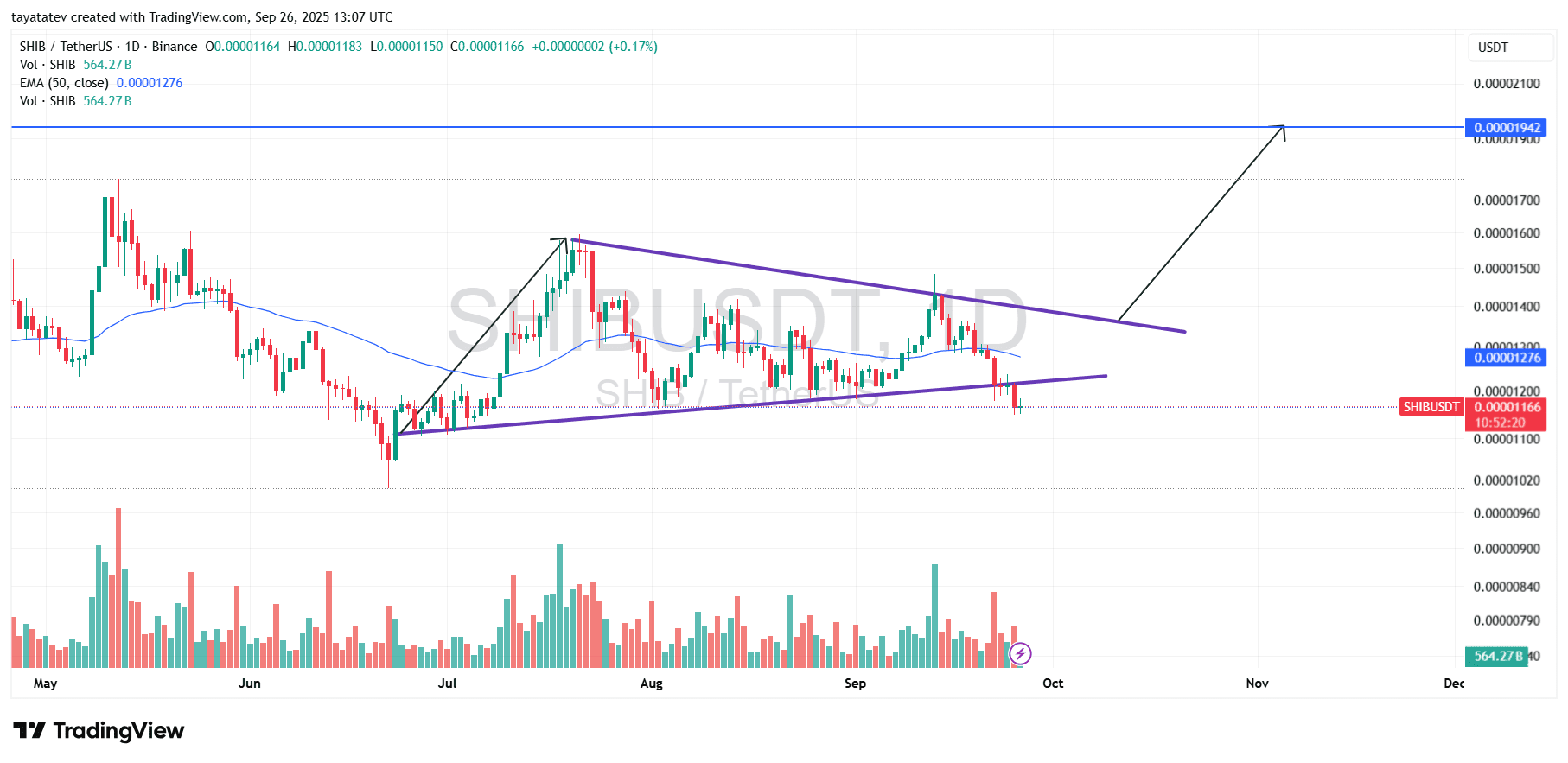

The Shiv slides under the rising wedge. The path refers to 0.00001942 (+66%)

Shiba Inu’s Shib/USDT Daily Chart, created on September 26, 2025, shows prices below the rising wedges painted from the late June highs to the peaks in late July. While momentum fades, as prices rise within a trend line where prices converge with two upslopes, an increasing wedge forms. As demand weakens near resistance, it often resolves lower. Here, after some rejections on the downward topline, the candle was closed under the lower limit of the wedge and confirmed the break.

However, context is important. This movement occurred during volatile market sessions, with a wider than average daytime range and heavier selling volume. As a result, a breakdown could overshoot support before the average price rebuttal. The 50-day index moving average is near 0.00001276, and now serves as the first level recovered. The critical nearest above the broken wedge line signals absorption and reduces downside follow-through.

Measured risk rewards still give an advantage to attempts to recover. From the current printing around 0.00001166, the charted projections and previous reaction zones line up near 0.00001942. This is about 66% more. That target matches the horizontal level highlighted on the chart and matches the supply from June. If the buyer regains the 50-day average and clears the downward upper wedge line, the momentum will rotate towards the objective of 0.00001942 and the volume will see the push. Failure to recover 0.00001276 will cause the price to remain within the choppy base, delaying the movement.