Please participate telegram A channel that stays up to date to break news coverage

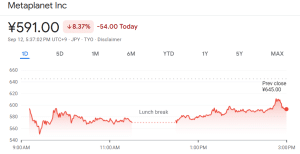

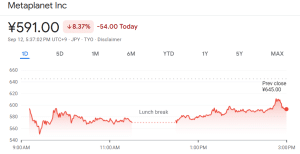

Metaplanet stocks plummeted 8% after UBS resumed short positions and joined Morgan Stanley with a bet on Asia’s biggest Bitcoin holder.

UBS had shut down its previous shorts, but reenters at a position of 73.1 million shares, highlighting pressure from Wall Street as a weaker Bitcoin price, and Metaplanet’s slide stock price threatens to undermine both its business model and its ability to raise funds for more purchases.

While some peers like Goldman Sachs and Citigroup have recently cut their positions, investment banks, including Jefferies and JPMorgan, remain short. They bet that if investors cut stocks short, the stock price will fall.

Metaplanet stocks have fallen by more than 31% over the past month. Google Finance.

Metaplanet stock price (source: Google Finance)

Bitcoin has fallen by almost 3% over the past month.

Morgan Stanley is the biggest short

Morgan Stanley Mufg has the largest short position at Bitcoin Stacking Company, holding nearly 20 million Metaplanet stocks in that position. According to a post from X’s Vincent, one of the company’s trading desks slightly reduced their short positions, while the other of the trading desks added more shares.

Institutional Short Position (Metaplanet 3350) Analysis, September 11, 2025

1. The biggest short holder: Morgan Stanley Mufg has added 19.2 million shares at nearly 20 million shares (2.83%).

2. MorganStanley Mufg (second line item): Another desk shows a 1768m stock, with a slight reduction… pic.twitter.com/k31umwu0gp

– Vincent (@Vincent13031925) September 15th, 2025

While UBS resumed its short position, Jeffries increased its position nearly two million shares.

Some other banks have closed short positions on Metaplanet.

Goldman Sachs has reduced the size of its short position by more than 6 million shares. Similarly, JP Morgan and Citigroup amplified order sizes 4 million and 9 million shares, respectively. Barclays also trimmed 4.5 million shares.

“The cost of borrowing to shorten the Metaplanet (3350) has skyrocketed to 54% per year, indicating that there is a very shortage of available stocks and short circuits are very expensive,” Vincent said.

Metaplanet Premium continues to collapse along with other data

Metaplanet is ranked globally as the sixth largest Bitcoin holder with 20,136 BTC on its balance sheet, according to data from Bitcoin Treasuries.

Top 10 Big Corporate BTC Holders (Source: Bitcoin Treasures))

It holds more BTC in the reserve than CleanSpark, Crypto Exchange Coinbase and Elon Musk electric car maker Tesla.

Metaplanet aims to grow Bitcoin Stash at 30K BTC by the end of this year.

However, Bitcoin prices have been trading completely over the past week, while Metaplanet shares have slipped over 15%. This puts pressure on the company’s “Bitcoin Premium.” This is the difference between the company’s capitalization and the value of Bitcoin held in its balance sheet.

In June, investors had paid more than eight times the amount of Bitcoin Meta Planet owned to buy shares in the company. That’s currently only twice the value. Analysts warn that this drop in premium could put the company’s Bitcoin accumulation strategy at risk.

Metaplanet is not alone in its premium struggle. Other Digital Assets Treasury (DAT) companies also have risks. Michael Saylor’s strategy (formerly MicroStrategy), the world’s largest Bitcoin holder with 638,460 BTC on its balance sheet, saw its share price fall by more than 9% last month.

Tomorrow will see an increase in foreign investors’ payments of $1.444 billion

Despite the decline in premiums, Metaplanet has turned to offshore investors, raising more capital and increasing Bitcoin reserves. The company has recently said it will issue 385 million shares via international offerings to raise approximately 200 billion yen ($1.44 billion).

Payments for these stocks are scheduled for tomorrow, with delivery set for September 17th.

Of the $1.44 billion that the company is trying to raise, approximately $1.25 billion in revenue will be used to purchase more Bitcoin between September and October this year. The remaining $138.7 million is allocated to expand the company’s Bitcoin revenue generation business.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage