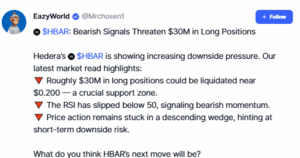

Hedera is facing downward pressure, and analysts warn that if support fails for $0.20, HBAR could bleed an additional $30 million market value. The tokens are sliding down under the formation of a downward triangle, and the failure to regain the average signal of the main movement could result in more losses.

Analysts warn that eye breakdowns with HBAR below $0.20 could lead to loss of $30 million

According to analyst Eazyworld, Hedera’s chart shows signs of weakness that puts the $0.20 level at risk. The descending triangle, which had been formed since August, finally fell, confirming its bearish structure.

Analysts explained that this pattern reflects the decline demand. There, buyers were unable to maintain a higher level, and sellers steadily pushed prices down. eazyworld specifically pointed out “The advantage could result in about $30 million being liquidated.” I hope that if HBAR prices fall below $0.20 in future sessions, I will bleed more.

The estimate of a $30 million decline in market capitalization is based on Hedera’s recent trading volume and liquidity map. The data shows bullish traders are already owing big losses. Traders have liquidated more than $431,000 in their HBAR positions in the last 24 hours, with Long losing $370,000 compared to shorts that cost just $60,000. This imbalance shows that leveraged long traders are being kicked out as prices go down, and they sell momentum.

Weak momentum and triangle decomposition refer to deeper losses

Hedera’s technical photographs have faded sharply. The downward triangle that induced prices from August onwards hit the downside of this week. Technically, this type of pattern usually means that the market is preparing to expand its previous downward trend. In this case, the seller is steadily making sure that he is an overwhelming buyer.

HBAR also struggles to surpass short- and medium-term moving averages. The exponential moving averages for 20, 50 and 100 days were all clustered between $0.22 and $0.23, becoming a barrier. All attempts to rebound to this zone are filled with new sales, indicating that these levels act as resistance.

Currently, the token sits at almost exactly 0.2117 on its 200-day exponential moving average. Traders often view this line as a split point between long-term bullish and bearish trends. When the Hbar falls below it and closes, the failure erases one of the last strong support levels remaining on the chart.

The momentum signal confirms this weakness. The relative strength index (RSI) that measures the balance between purchase and sale is 38. Readings below 50 indicate that the seller is in control. RSI still exceeds the 30 overselling threshold, leaving room for additional downward pressure.

If $0.20 in support gives way, analysts project the short-term move to $0.18. This is alongside the zone where Hedera prices were integrated earlier this year. In the deeper bear stage, the token can slide to $0.16, where a larger liquidity pool is located. In contrast, when $0.20 holds a rebound and sparks, the analyst gets a cap between $0.22 and $0.24. With clustering of moving averages and sales orders in that zone, there is no strong recovery at this point.