As Ethereum (eth) It’s fallen Cryptocurrency exchange reserves also recorded a sharp decline in the market-wide pullbacks, falling below $4,000 for the first time since August 8th. In particular, major crypto exchanges such as Binance and Coinbase Advanced have resulted in a rapid increase in ETH leaks.

Ethereum remains at a high decline in vinance, Coinbase

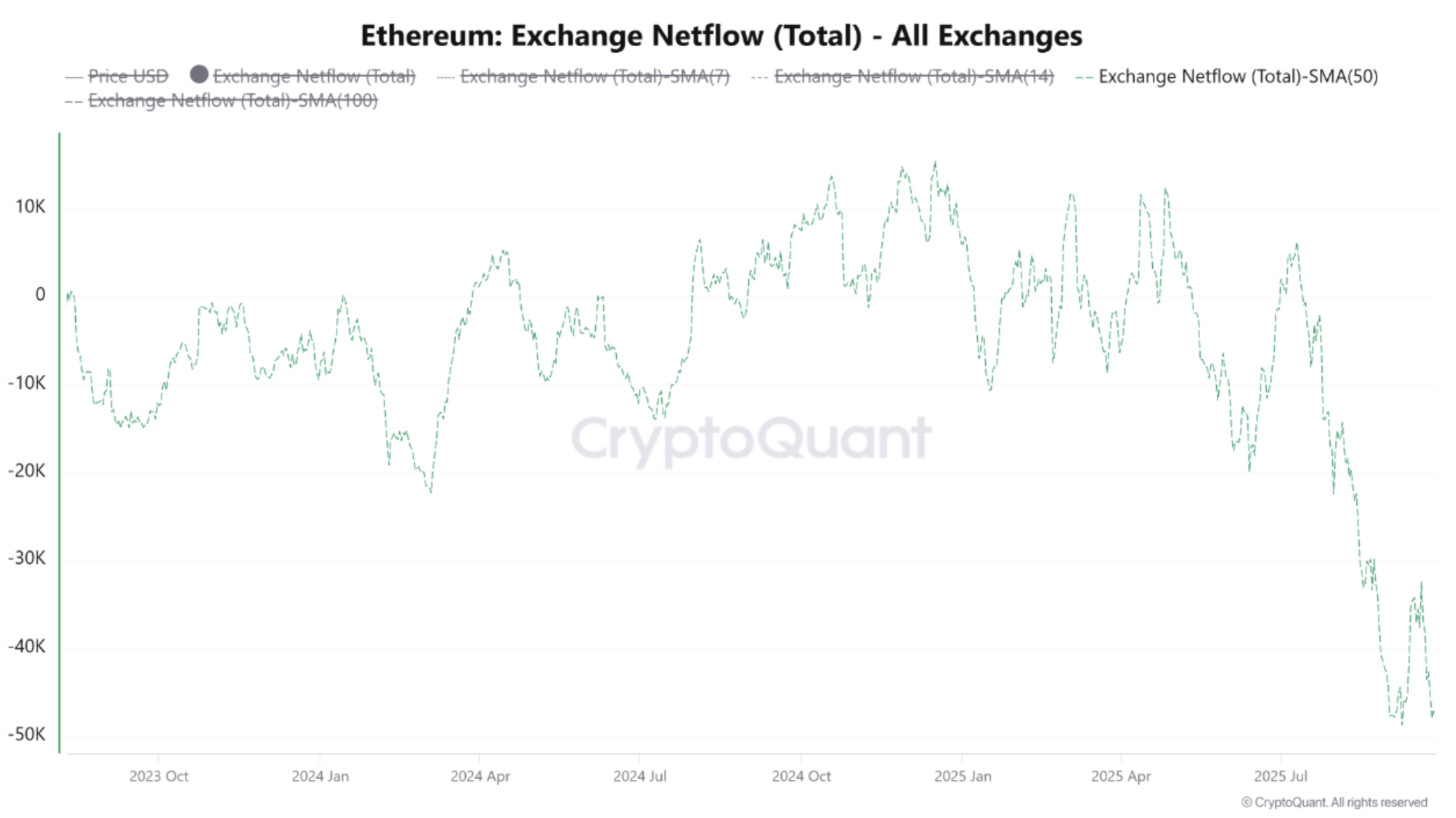

According to a contributor CryptoonChain’s encrypted quick take post, Ethereum leaks across all major crypto exchanges are surged. From August to September 2025, the 50-day Simple Moving Average (SMA) Netflow fell below -40,000 ETH per day, the lowest level since February 2023.

Related readings

The 50-day SMA, below -40,000 ETH per day, indicates a decline in the supply of the spot market and potential upward price pressure. Analysts shared the following chart to illustrate this dynamic:

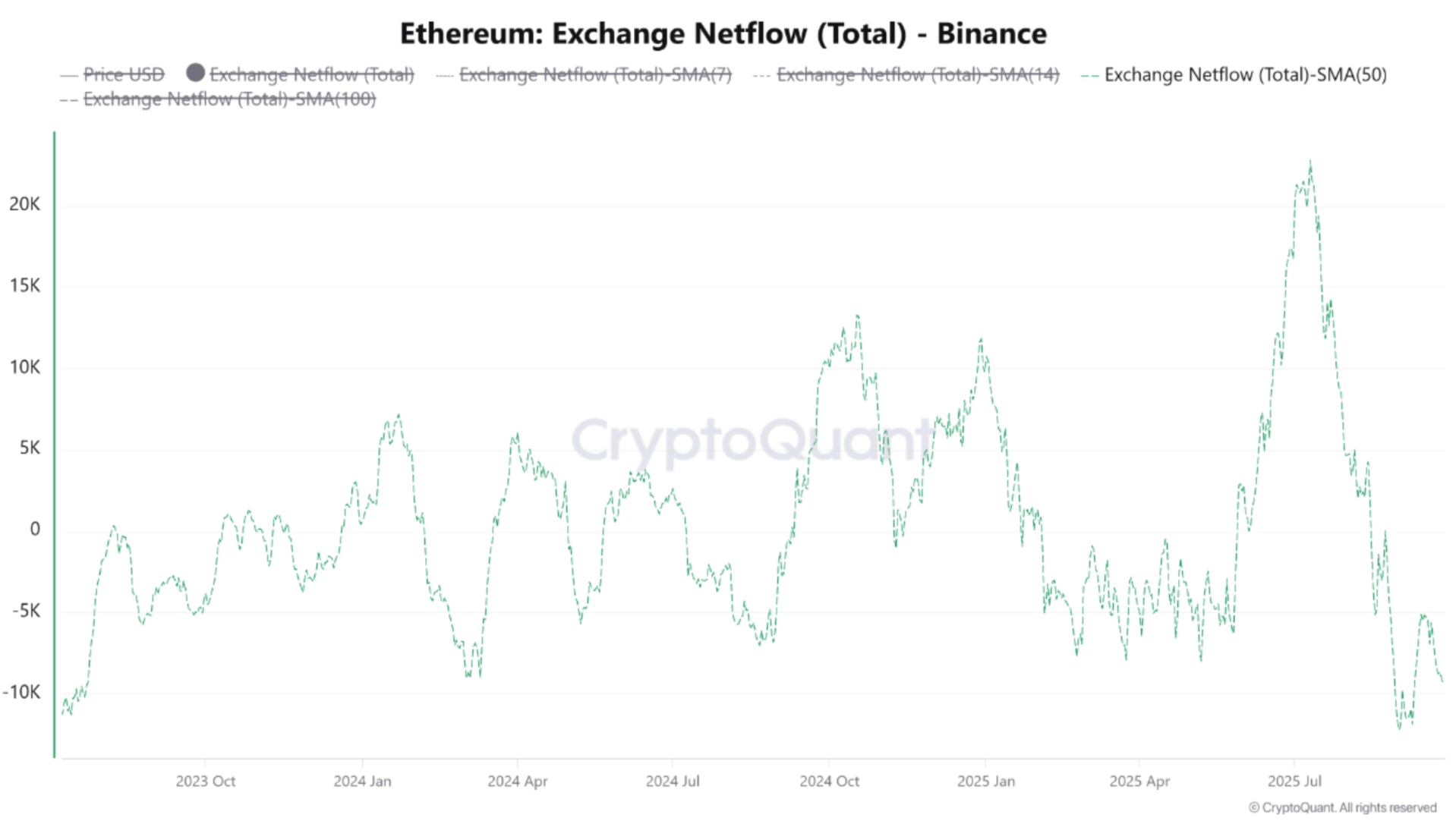

Meanwhile, Binance Crypto Exchange data shows Netflow fluctuations over the past two years, oscillation between positive and negative values. However, there has been a clear movement towards heavy spills over the past few months.

The following chart shows that the 50-day SMA reached its lowest level in Binance in two years. This indicates a decline in liquid holdings of vinance in line with broader market trends.

A similar trend can be observed at Coinbase Advanced, a leading crypto trading platform that serves institutional investors and US-based clients. Here, the 50-day SMA dropped to around 20,000–25,000 ETH, marking the lowest level ever for this exchange.

Cryptoquant contributors noted that a significant decline in Coinbase since early summer 2025 indicates a massive asset transfer. Perhaps these will be done by institutional investors on cold wallets or non-obligatory platforms.

CryptoonChain concluded that, in combination with Coinbase Advanced’s all-time lows, it shows a structural market-wide trend for ETH withdrawal from exchanges. They added:

This type of fluid drainage usually reduces immediate supply and sets the stage for potential medium-term bullish movements.

ETH whales preparing for another rally?

ETH’s momentum has been bearish over the past few weeks, but on-chain data reveals that ETH whales (wallets with a considerable ETH holding) are quiet Accumulation Digital assets ahead of another potential gathering.

Related readings

Recently, Crypto analyst DarkFost highlighted that ETH accumulator addresses are rising at an unprecedented rate. Especially with nearly 400,000 ETH Added On these specialist wallets on September 24th.

ETH whales accumulate digital assets despite lower price performance over the past few weeks point Heading towards potential future rally for cryptocurrency. At press time, ETH will trade at $3,900, a 2.8% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts