Simply put

- High lipids are from $9.26% to $44.11 for the only top 10 code in Green, with the remainder of the market at 1.8%.

- BNB drops 0.14% to $947.55 as the worst performer in the top 10 after the aster-driven spikes fade.

- Code horror and greedy indicators show the most bearish reading since April. Here’s what the chart says traders can expect:

Crypto Market is nursing a nasty hangover after a massive panic episode earlier this week. Crypto’s total market capitalization fell 1.8% to $3.75 trillion.

However, in this red sea, at least one token floats. Hyperliquid’s hype is at a rebellious 9.26%, standing as the only cryptocurrency in the top 11 showing the green of the day.

Meanwhile, traditional markets play completely different songs. The S&P 500 rose 0.22% to 6,619 points, while gold rose 0.33% to $3,762 per ounce. Additionally, President Donald Trump has announced a tariff package set to take effect on October 1st.

The terror and greedy indicators of the code have plummeted firmly to 28 in the territory of “terror” and the most pessimistic reading since April when Trump’s previous tariff announcements sent the market to the tailspin.

Still, Dex Wars unfolds an attractive subplot that turns traditional wisdom into a mind.

High Fat Price: Has the Hype returned?

Its rival Astor has been stealing headlines with a chin-drop surge since its launch last week, but Hyperliquid has quietly mounted its own comeback.

High lipids are both its Layer-1 blockchain network and decentralized exchanges specializing in persistent futures. Derivatives expire, become hedge risk for crypto traders, and can essentially bet on the future prices of digital assets such as Bitcoin.

The exchange has a token of the same name that exchanges for hype, and both the exchange and token have experienced a rush of interest over the past few months. In the context, despite recent ups and downs, hype has risen by more than 20% over the past three months, nearly 600% last year, and is now heading an impressive market capitalization of $12.2 billion.

High lipid tokens today have skyrocketed from a low of $40.376 to the current price of $44.114, representing a 9.26% increase in all other bleeding markets.

Looking at the technical breakdown, the hype shows what traders would interpret as the end of a potential major revision. After all, coin prices have fallen by nearly 10% over the past 30 days.

The relative strength index (RSI) is one of the technical indicators that traders rely on. RSI measures price momentum on a 0-100 scale that indicates overselling, beyond signal overselling conditions of 70 or more.

High lipids are located in 41 (technically bearish territory), but here’s what traders need to understand: After the token has been fixed from $56 to $40, the RSI of 41 actually shows healthy integration rather than debilitating. This is like a reload zone where smart money accumulates before the next leg rises. Traders usually see measurements of RSI between 30 and 45 after a large revision – the chart is not on an upward trajectory yet – as a purchase opportunity, not as a sales signal.

The average directional index (ADX) for the hype is 29, indicating that it strengthens trend momentum. ADX measures how strong price trends are, regardless of direction. Readings confirm established trends, and at 29, hype is coming out of the consolidation stage. Major Dip cooled the ADX a lot, but still wasn’t enough to clear up the upward trend.

An exponential moving average, or EMA, gives traders a sense of price resistance and support by taking average prices for assets over the short, medium and long term. High lipids are still young coins and have no trading history for assets like Bitcoin, but EMA photos look bullish.

At this point, Hype’s 50-day EMA is above 200-day EMA. In other words, the average price for the short term is higher than the average price for the long term. This configuration shows that short-term momentum usually overwhelms long-term pessimism, suggesting that there is a high pathway with minimal resistance.

However, as a warning sign, the gap between both EMAs is closed, which could potentially lead to a cross-formation of death when the EMA50 falls below the EMA200. In this scenario, some traders may choose to set up a purchase order near the EMA200 because they believe that the token may continue to make a bear correction before it bounces.

Myriad has been developed by the forecast market DecryptionParent company Dastan’s sentiment towards the hype has yet to reach the bullishness displayed on the charts. At this point, countless traders don’t expect the price of the hype to rise to $69 anytime soon, and those odds are only 30% when measured against odds below $40.

Key Level:

- Immediate Support: $36.00 (EMA200)

- Strong support: $28.00 (displayed on the chart as previous resistance)

- Immediate resistance: $48.00 (EMA50)

- Strong resistance: $$ 56.00 (previous high zone)

BNB Price: Pay the price for Aster’s success

Today’s BNB story is the classic “sell news” scenario as Binance issued tokens in the last 24 hours drop at $947.55 to $947.55, making it the worst performance of the top 10 cryptocurrencies by market capitalization.

As we discussed earlier this week DecryptionBNB has been on fire recently, and was the only coin in the top 10 market capitalization on Tuesday. Much of the price movement can be attributed to increased activity in the BNB network as a result of the explosive growth of Aster, the BNB chain’s high lipid competitor.

But as we’ve seen many times in the market, it must be that rising will ultimately come down. And at this point, the hype around Aster is slowing down. And it appears that BNB is a hit as a result.

The RSI of BNB is 51, which indicates the equilibrium market that is located neutral and normally awaits the next catalyst. For traders, this dead center reading often precedes sharp movements in either direction as the market breaks out of indecisiveness.

The 36 ADX confirms a strong, established trend, while the squeeze momentum indicator shows an ongoing bearish impulse.

If ADX is high but has a weak momentum, it usually means that the seller is in control, and DIP buyers should be careful. This combination often produces continuous pressure until ADX drops below 25, indicating trend fatigue.

Looking at the price action on the chart, BNB opened the day around $946, reaching close to $959, but then retreated to $947.55. Today’s doji (a candlestick without a body basically shows that the opening and closing price are roughly the same) shows great volatility and sales pressure with resistance of rounds. The 50-day EMA far surpasses the 200-day EMA and maintains a bullish long-term structure, but immediate price action below both the opening price and the psychological $960 level suggests short-term debilitating.

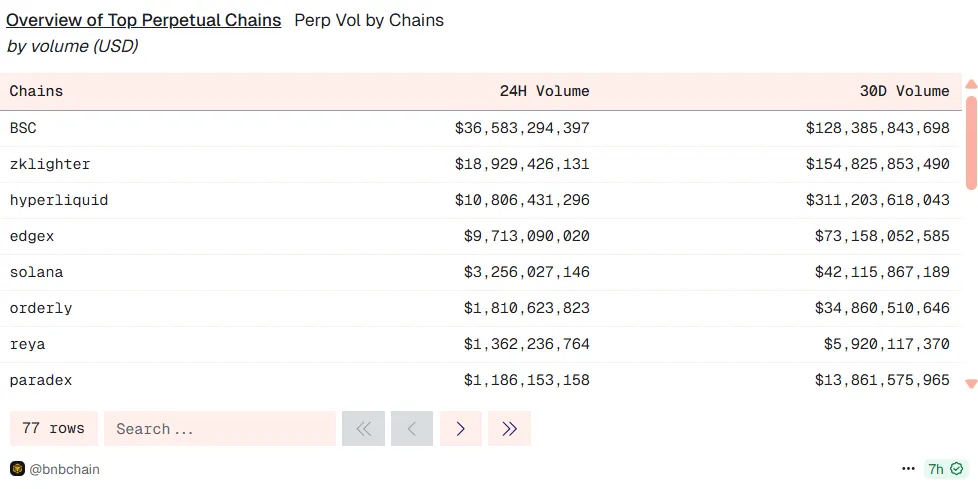

The catalyst for the first surge in BNB was clear. The BNB chain’s 24-hour permanent volume was $36 billion, overtaking Hyperliquid’s $10.8 billion, driven primarily by the rise of Aster’s meteors. However, today’s revision suggests that traders are profiting from Aster-led rally.

Key Level:

- Immediate Support: $920 (visible support on the chart)

- Strong support: $880-$900 (EMA50L)

- Immediate resistance: $1,000-$1,080 (psychological rounds and the highest ever)

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.

Daily report Newsletter

Start daily with top news articles now. Plus original features, podcasts, videos and more.