Please participate telegram A channel that stays up to date to break news coverage

High lipid prices have dropped by almost 2% in the last 24 hours due to trading Even if Fund Manager submits Bitwise Hyperquid ETF, it’s $42.26 until 12:30am.

News of ETF submissions for Bitwise’s hype initially brought a short boost in tokens.

ETFs are designed to provide investors with direct exposure to hype through regulated securities accounts in which Coinbase custody acts as custodians.

Just: Spot bitwise file S-1 $High Advertisement ETF. pic.twitter.com/rxdqhkwybk

– crypto.news (@cryptodotnews) September 26, 2025

ETFs are not eligible for Fast-Track SEC approval as they do not currently have hype futures contracts regulated. This means that the process of making an ETF live can take several months.

Hype Advertising Price Test Key $42 Support Bulls Eye Rebound

On the daily charts, the hype has fallen sharply from nearly $56 from its recent high, losing momentum as it crashed its 50-day Simple Moving Average (SMA) at $47.55. This moving average now serves as a resistance and must be retrieved for the bull to gain control.

The 200-day SMA is $33.68, providing deeper, long-term support if the seller continues to push.

Fibonacci’s retracement level is working. The coin currently holds a 38.2% retracement level at $42.03. Below this, the next support is around $37.72, 50% retracement and 61.8% Fibonacci at $33.41.

The $42 level is especially important. If it’s held, the analyst likes Ali Chart See potential stepping stones for rebounds of $55 or more. However, if it breaks, the price could go below $38.

HypeUSDT Analysis Source: TradingView

RSI (Relative Strength Index) shows a reading of nearly 38. This is close to the level of “overselling”. This could suggest that bounce will be possible soon if the buyer returns. Meanwhile, the MACD indicator remains bearish as the signal line is still negative, indicating that it is currently in control by the seller.

Analysts remain divided on the direction of short-term hype prices. Some say that if ETF News and Treasury Buy-Ins can bring fresh hype, prices could soon regain the $47.55 level and move into the $50 and $55 resistance zone.

However, the overall market sentiment is cautious, and most agree that a break below $42 is likely to cause a move to the $38 or $33 range.

High lipid on-chain analysis

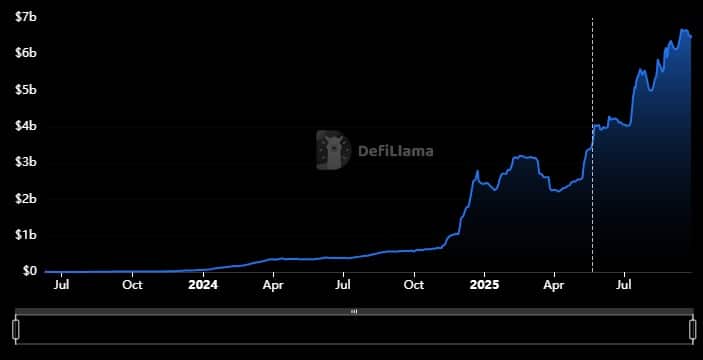

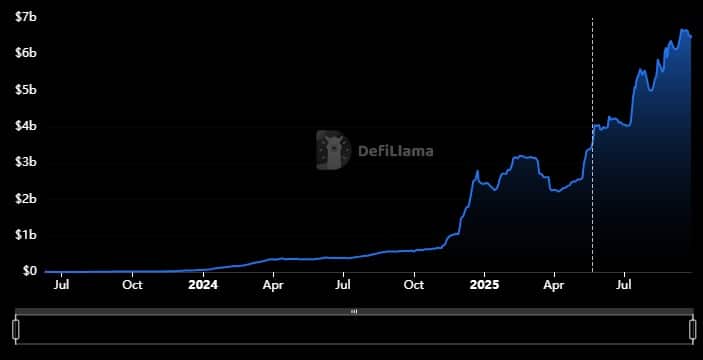

Data on the chain shows that high lipids continue to steadily grow their decentralized financial ecosystem. Locked Total Value (TVL) has reached over $5 billion annually, reflecting a 70% increase in user funds locked to the protocol since January 2025.

Every week Influx Average $58 million, signaling consistent investor interest despite challenging market conditions.

The whale activity has been notable recently, with the recent $10 million purchase of $10 million by the whale, shifting capital from the vault to accounts, showing strong confidence from the large owners.

Furthermore, future technical upgrades such as the HIP-3 market creation capabilities aim to further diversify protocols and increase community engagement. These on-chain metrics support a careful optimistic view of the long-term foundations of hype, despite the mid-term struggles of prices

Big purchases from players at institutions like Hyperion Defi have recently added $10 million worth of hype to their finances, helping to maintain confidence and offer backstops with big price drops.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage