Please participate telegram A channel that stays up to date to break news coverage

The US Securities and Exchange Commission (SEC) has approved new listing standards for products (ETPs) traded on exchanges that hold spot products, including Cryptos.

decision Exchanges such as NASDAQ, NYSE ARCA, and CBOE BZX can proceed with a list of proposed ETFs (exchange sales funds) by circumventing the 19(b) rule filing process.

Boom: The SEC has approved a general list standard that clarifies how Spot Crypto ETFs launch (without passing through all of this BS every time) as long as there are futures in Coinbase, which currently contains around 12-15 coins. pic.twitter.com/e9fxrnixrs

– Eric Balchunas (@ericbalchunas) September 17, 2025

This decision essentially streamlines the process, as ETF publishers can approach the exchange of ideas for products they want to list their lists. If the issuer meets general listing criteria, the exchange can proceed with the list of ETFs.

SEC Chair says the new listing standards will guarantee control of the US capital market

SEC Chair Paul Atkins said the decision was made to ensure that the US remains a dominant player in global capital markets, while at the same time reducing barriers to access crypto products in the regulated US market.

“By accepting these general listing standards, we ensure that our capital markets will remain the best place in the world to engage in cutting-edge innovation in digital assets,” he said. statement.

“This approval will help maximize investor choice and foster innovation by streamlining the listing process and reducing barriers to access digital asset products within the US trusted capital market,” Atkins added.

The move by the SEC is the latest in a change in agency stance since Atkins took over from former chairman Gary Gensler and Donald Trump entered the White House at the beginning of the year.

The Trump administration has chosen to accept digital assets. In addition to signing an executive order to establish a strategic Bitcoin reserve in the United States, Trump has also signed the law on acts of genius.

The president also established a digital asset working group. This will have made several recommendations on crypto policy and regulatory frameworks to institutions such as the SEC and the Commodity Futures Trading Commission (CFTC), and the United States will become the leader in the crypto space.

Both the SEC and CFTC then follow the recommendations in their report. CFTC recently announced its “Crypto Sprint” initiative, and the SEC launched the “Project Crypto” initiative.

Several Crypto ETF filings await SEC approval predict that North of 100 will be released in the coming months

The SEC’s decision to streamline Crypto ETF listings comes as more than 90 applications of crypto-tracking funds, such as Dogecoin (Doge), Solana (Sol), and Litecoin (LTC).

August 28th, Bloomberg Intelligence ETF Analyst James Safert I said There were about 92 pending applications sitting at the SEC desk.

With the new generic listing rules, he believes that a “wave of Spot Crypto ETP launches” will occur in the coming weeks and months.

oh. The SEC has approved a general listing standard for “commodity-based trusted stocks.” This is the Crypto ETP framework we’ve been waiting for. Get ready for the wave of Spot Crypto ETP launches in the coming weeks and months. pic.twitter.com/xdkcuj41mc

– James Seyfert (@jseyff) September 17, 2025

A similar prediction was made by his colleague Eric Barkunas.

“You can see north of 100 Crypto ETFs released in the next 12 months” Blachunas I said x.

His predictions include Balchunas also shared an earlier post by Matt Hougan of Bitwise. There, we speculated how generic lists would affect the cryptographic ETP space.

Hougan has created a general listing standard for traditional ETFs, referring to the “ETF rules” passed by the SEC in late 2019. This saw the number of these applications increase from about 117 a year to about 370 a year, he said.

“If generic listing standards come to cryptography this fall, expect the same kind of expansion,” Hougan writes.

First Us Doge and XRP ETFs are scheduled to be released today

With the number of Crypto ETF applications that Surge is expected, Rex Stock and Osprey Funds are preparing to launch Dogecoin and XRP ETFs in today’s US market. These are the first ETFs to track Doge and XRP.

Release tomorrow: rex-soprey™xrp etf, $XRPR& rex-sosprey™doge etf, $ doje.

The first US list ETF to provide spot exposure $ xrp and $doge I’ll go live tomorrow and give investors a way to access these digital assets via ETF structures.

I brought it to you… pic.twitter.com/nbyqqes1yq

– Rex Shares (@RexShares) September 17, 2025

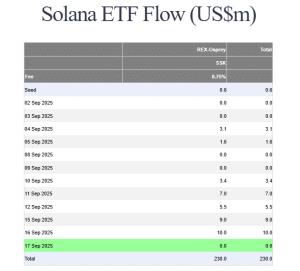

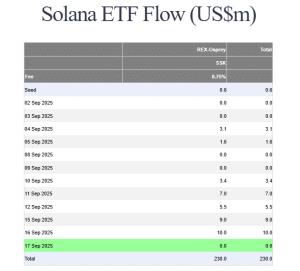

Both companies were able to quickly track their lists by applying for funds under the Investment Companies Act of 1940. This involves a process that is much faster than the Securities Act of 1933, commonly used by Crypto ETF issuers. According to data from Farside Investors, the same process was used in the Rex-Soprey Solana Staking ETF (SSK), but there was no demand for the product.

SSK Flow (Source: Farside Investors)

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage