According to an analysis published this week in WinterMute, nearly half of all EIP-7702 approvals since May 7 (768,000 out of 1.58 million people) are related to phishing or fund theft. This report reconfigures security features as a mature target for crime. The developers and wallet team have moved topics to queue.

In WinterMute’s dataset, 48% of EIP-7702 activations are related to criminal activity, placing the tool at the heart of the safety debate. The figures were released on May 7th to cover activities to quantify the issues suggested by users.

EIP-7702 temporarily converts externally owned accounts into smart contract wallets and approves actions. Attackers weaponize the flow by keeping users malicious approvals and turning the safer signature path into an abuse vector.

Core contributors flagged mitigation in recent adjustment calls and weighed the UX guardrail and shadow fork dry run to verify the fix before wider rollout. The agenda places security checks along with scheduling pressure for the next upgrade:

The Ethereum client and infrastructure team set up a step-by-step Fusaka timeline for Holešky, Sepolia and the new Hoodi Testnet from late September to October to October, setting the stage in preparation for the mainnet. Blog Briefing outlines cadence and staging logic that reduces risk between forks.

Some outlets report the mainnet’s Fusaka target on December 3, 2025, pending testnet results and audits, and teaming up on the public day while maintaining emergency space. The community continues to treat dates as schedule guidance and is not an immutable deadline.

The All-Core-Devs execution notes explain that you run a shadow fork before Holešky and then run again over each subsequent testnet. This narrows the unknown, catching regressions early and shortens the gap between the forks without skipping safety steps.

The same note reconsiders whether to maintain a week or two between Halsey and Sepolia, showing a positive discussion of speed and guarantee. Organizers prefer consistent and clearly communicated windows to assist with operators and DAPPS plans. Forkcast’s ACDE #220 recording document these decisions in real time and provides a reference to the touring team in reducing client implementers and release candidates.

Eligon shipped v3.1.0 “Pebble Paws” and shipped with release notes highlighting changes such as default receipt persistence, updated dependencies, and operational adjustments. The team reviewed the series and linked the documents publicly. The node runner gets a path that works with existing data.

Together, these releases aim to keep the execution layer stable while the testnet is flipped over. Operators will find that as the network approaches the Fusaka window, there will be fewer clearer defaults and edge case stalls.

Consensus briefings should be aware of the ongoing work on buglists feeding directly into BLOB parameters, audit tracks, and mainnet preparations. TestNet Forks is scheduled, so rather than expanding functionality, the emphasis is on predictable execution.

Meanwhile, stateless and ethereum work logs show an aggressive plan for binary tree testnets and client sequences, with Geth’s state layer affecting the timing of the reads. These threads tie today’s fork to tomorrow’s state-sized relief.

In reality, teams mean shipping, measuring and adjusting.

Once the Testnet moves forward and Halsey finishes, Ethereum’s short-term story is operational. Client hygiene against stage changes, audit results, and price movements.

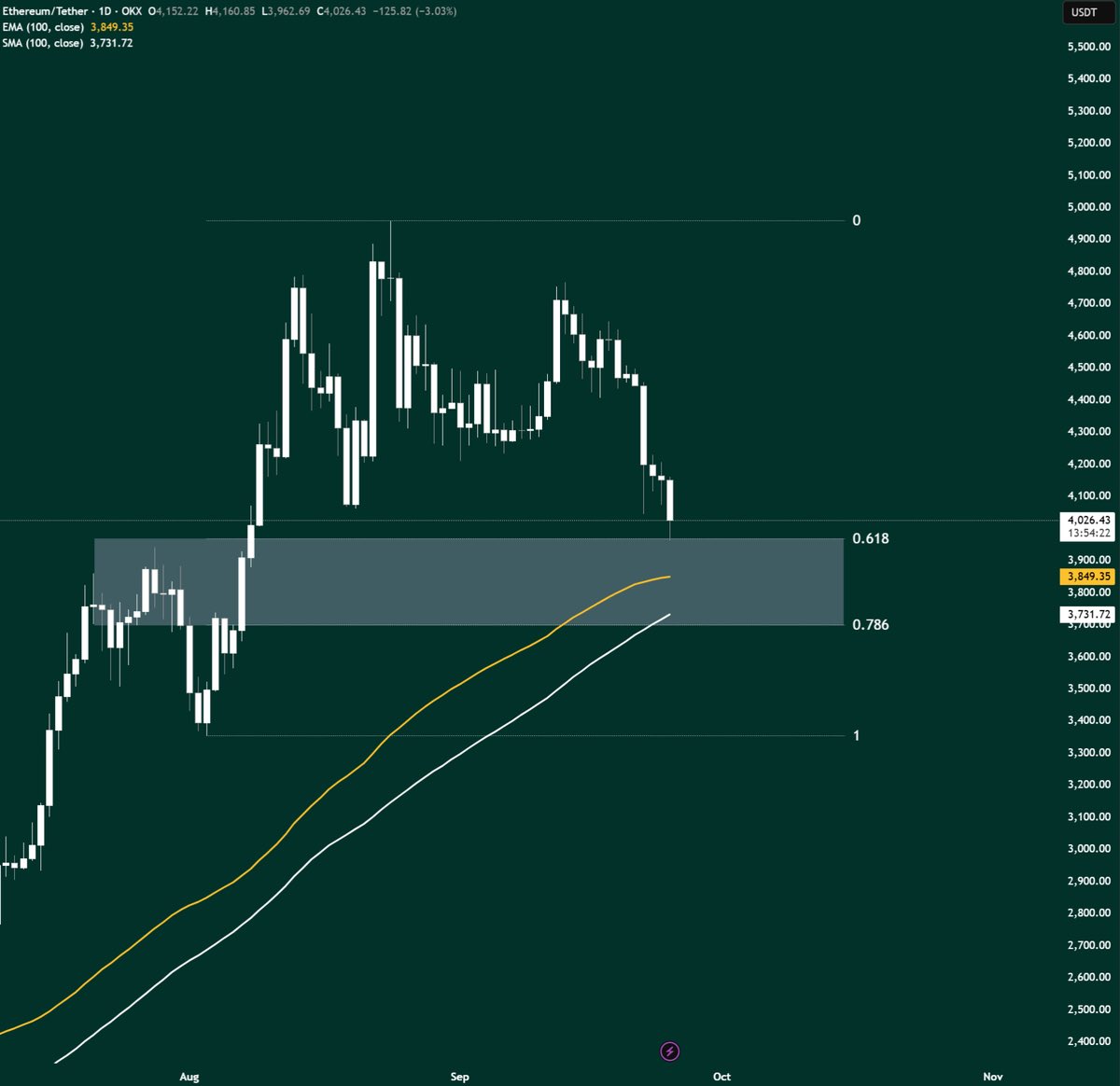

Gordon’s Daily ETH/USDT Chart marks a gray support box from about 3,900 to ~ 3,800, to match the 0.618 and 0.786 Fibonacci retracement levels of the latest swing. Prices are currently pushing the top of that band after a few days of pullbacks from the early September high. The rectangle overlaps with the previous August integration. This often serves as a memory area for bidding.

The overlay shows that 100 days of EMA (~3,849) curls up into the box and 100 days of SMA (~3,732) is just below the 0.786 line. That stack creates a moving average confluence below the price, and setup technicians monitor absorption in the first test. The candle prints long underneath wicks into the zone and notifies you of attempts to do a dip view, but follow-through remains unconfirmed by daily nearby.

Post proposes frame this area as a “long-term purchase zone” and accumulate it here. In the news, this claim is worth noting as Fibonacci levels are widely seen as rising mid-trend gauges. However, confirmation usually arises from a clean landfill on the box top or a higher or lower than 100-day EMA. A decisive daily closure of less than ~3,730 weakens the case and shifts attention to the next marked shelf near the “1” label on the chart.