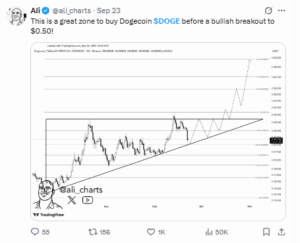

Market analyst Ali Martinez said Dogecoin (Doge) could be in the buying zone. Martinez writes to X, “This is the best zone to buy dog coins,” highlighting the rising triangle pattern. Formations where higher lows come across flat resistance ceilings are often linked to bullish breakouts.

Martinez predicted that tokens could rise towards $0.50 as bullish chart patterns will be formed along with fresh institutional and corporate recruitment. He suggested that the setup could raise DogeCoin to $0.50 if resistance collapsed.

Dogecoin traded today at $0.234 on September 25th, down almost 3% that day. The tokens retreated from the $0.30 high early in September, but according to Martinez, they are still in the preferred technical structure.

ETF launches and corporate finance ministry boosts Doge

The call follows the debut of the first US registered Dogecoin Exchange-Traded Fund. The ETF, published by Rex-Soprey, was released on September 18th under the ticker Doje. It holds approximately 60% in Dogecoin and 38% in Dogecoin ETP, which has 21 shares, providing regulated market access to assets for the first time.

Companies are also beginning to add dog coins to their balance sheets. On September 18th, Thumzup Media Corporation revealed that it had purchased DOGE 7.5 million for an average price of $0.2665. The company will also announce a $10 million share buyback program through 2026 and acquire Dogehash Technologies, a mining company with 2,500 rigs in operation.

Another US company, CleanCore Solutions, recently expanded its holdings to 100 million Doge, lifting its reserves of over 600 million tokens. The company also appointed Elon Musk’s attorney, Alex Spiro, to chair the board.

The filing further links Bit origins to Dogecoin’s reserves, with reports showing that the company raised $500 million in DOGE-related funding earlier this year.

The main support level can determine the next move

Dogecoin’s price structure shows a short-term setback within the broader integration phase. After rallying at $0.30 in early September, the tokens returned to $0.234, bringing support to about $0.238 with a 50-day index moving average (EMA). The 200-day EMA of $0.219 represents the next long-term support line if sales pressure accumulates.

The momentum has cooled since the rally. The 14-day relative strength index (RSI), which tracks the strength of the trading, is 43.9 from the condition that was bought over 70 earlier this month. This places the dogcoin in the neutral zone and allows room for movement in either direction depending on demand.

Analysts identify instant trading bands between $0.23 and $0.25. A recovery above $0.25 could prompt a retest of the resistance that had stalled in September, ranging from around $0.28-$0.30. Break through that ceiling and the flagged rising triangle Martinez is verified, bringing a $0.50 target into view.

The risk of the downside is that if Dogecoin Price loses support at $0.23, it could erase most of its September profits and drop to $0.20.