Hedera completed its mainnet upgrade to v0.65.1 at 17:24 UTC on Wednesday, September 24th. The status page lists the completed maintenance and network behavior. The windows started at 5pm UTC and ran on schedule.

This release advances state management and record handling. The document highlights the enforcement of “virtual megamap” max_custom_fees Improvements from HIP-991 for scheduled transactions and blockstream. These features target clean transaction records and forward compatibility.

The operation resumed immediately after verification. Nodes report operational reports across council hosts, and mirror services will rise. The upgrade continues with testnet work prior to this month.

Hedera will upgrade TestNet to V0.66 on Thursday, September 25th from 17:00 UTC. The windows are scheduled for approximately 40 minutes. Status page flags are expected to be intermittently confused during changes.

PreviewNet is already running V0.66. This indicates that you are ready before the testnet rollout. The operator can verify the touring and integration there before pushing it to the testnet. This page shows that the PreviewNet component works.

Developers should plan short service interruptions during the maintenance window. Mirror rest and GRPC endpoints usually track the testnet state immediately after the node returns. Hedera posts completions in the same status feed.

Hedera marked a year since donating its codebase to the Linux Foundation’s decentralized trust initiative, creating the Open Hiero Codebase on September 16, 2024. Anniversary post outlines the progress of governance and collaboration across the stack.

Another Linux Foundation release focuses on today’s new members, Hiero’s graduation track, and the program’s smart contract privacy project. The announcement features Hedera’s contributions within the broader open source roadmap.

Together, the posts constitute the past year as a shift towards vendor-neutral stewardship. Developers gain a transparent process, allowing companies to see independent foundations for long-term maintenance.

May 8th, the brand name for the unified ecosystem. The HBAR Foundation became the Hedera Foundation, and the Hedera Management Council became the Hedera Council. Both entities remain independent, but operate under a more clear and shared brand.

The changes began in late 2024 and followed a renewal of leadership at the foundation, which came into effect in 2025. The publication and release highlight the clarity of its role in funding, governance, and ecosystem growth.

This alignment simplifies external messages for partners and developers. It also keeps accountability clear. The Council implements mainnet governance, and the Foundation focuses on ecosystem programs.

The HBAR/USD chart shows a symmetrical triangular tightening between a falling resistance near $0.24 and a rise in support near $0.22. Prices printed lower and higher lower prices until late September. Therefore, the first decisive closure outside the triangle must set the path for the next leg.

Because it’s on top, a powerful daily close above $0.24 marks a breakout. Traders often project measured movements using the initial height of the triangle. Here, its ranges between $0.08 and $0.09. This places a target of about $0.31 after an upside down break along the post target. Usually, follow-throughs improve when volume grows with breakouts and are improved again as support during previous ceiling daytime or daily retests.

On the downside, if daily closures fall below $0.22, we will disable the upward hub and ensure that the break is low. Using the same height method, the projection will land near $0.14, matching the author’s roadmap. In that path, a failed rebound often acts as a continuation signal, but by reducing the volume of the bounce, you can warn the seller that it will continue to control it.

In both cases, confirmation is more important than the initial core. Therefore, note that a clean candle near the boundary, the accompanying volume surges, and, obviously, the retest was successful. The pattern remains coiled until that sequence is displayed, and the noise within the band has limited information value.

HBAR is currently trading under the 50- and 100-day moving averages after daily closures. That attitude weakens momentum and shows a more severe risk tolerance for long distances. Additionally, price is within a wide contract range where resistance falls and support rises beneath it. The next session will show whether buyers can protect their current shelves and force rebounds on average.

The double bottom of the textbook requires a solid hold near the front trough, then you need to push back the midrange neckline. Therefore, the Bulls first need clean daily closures of more than 50 days. After that, you will need to reset the trend intensity for 100 days. If that recall occurs, the pullback to those averages will often turn to support and check for accumulation. Until then, they will gather on moving average face supply.

However, failure to stabilise results in recent low sweeps. The base’s decisive break opens the room towards the analyst’s 0.16 area, alongside the lower limit of the long-term range. In that case, note that volume expansion and weak bounces return to the lost average at the time of failure. As always, the correlation risk remains high as Bitcoin direction can accelerate or disable these signals.

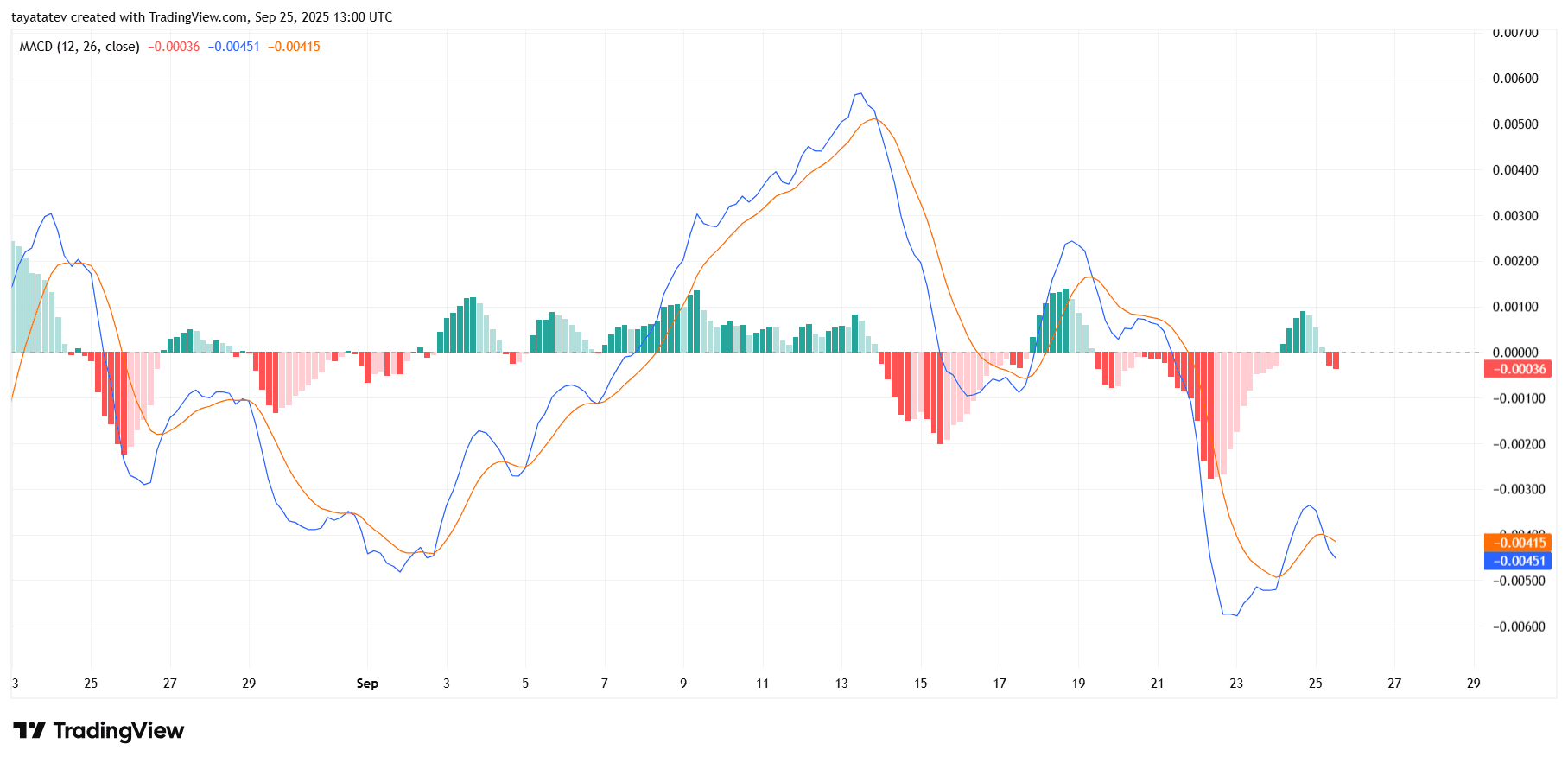

The daily MACD of the HBAR is below the signal line and below the zero axis. The histogram was again slightly red to near -0.00036 after a short green bounce. This arrangement shows a weak bearish bias, but the negative pressure is relieved as the bars shrink towards the baseline.

The momentum has been whipped over the past week. The MACD tested positive around September 19th, and suddenly turned around on September 22nd-23rd with a deep red bar. Since then, both the MACD (≈ -0.00451) and the signal (≈ -0.00415) have been rounded high, narrowing the gap. Therefore, sellers are no longer dominant as they did at the beginning of the week.

Check out the sequence here. A clean MACD crossback over the signal checks for updated positive momentum. A subsequent push through the zero line enhances that shift. However, once the MACD rolls over and the histogram expands red again, the Bears could regain control and wander out September’s attempts to rebound.