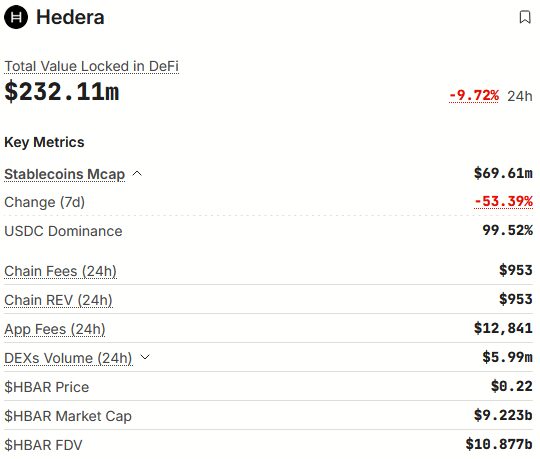

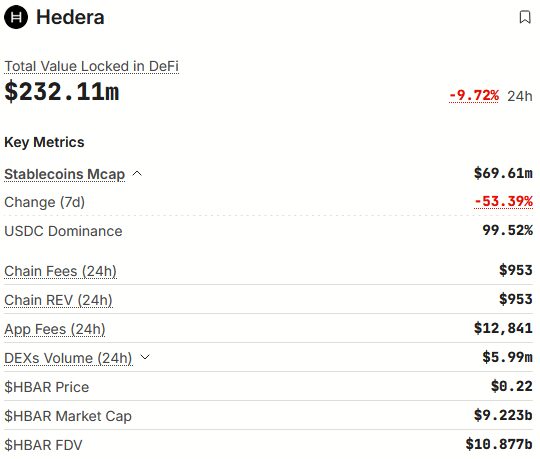

With Hedera’s native Hbar Coin just collapsed 7.38%, major issues are detected by chain detectives regarding network fluidity. According to Defilama’s Blockchain Explorer, the distributed ledger technology (DLT), which employs the HBAR network, shows a creepy bearish change as the crypto market was blew by 53.39% in the stubcoin market, showing a creepy bearish change.

After this on-chain liquidity flop, Stablecoin’s liquidity is currently over $69 million, with the majority of which being dominated by Circle USD (USDC). Zooming out, the total locked value (TVL) of Hedera’s native chain took a soft hit, reducing its market capitalization by 9.72% from the previous day.

Main HBAR price scenarios and key events

Hedera (HBAR) relies heavily on a major support level for future price transfers of $0.21. This corresponds along the lowest layer of Boll, and serves as a catalyst for the Cryptobulls to retrieve the handle. Currently, Bull Bear Power (BBP) metrics tell us the super-intense storyline of the 4-hour chart. Similar sentiment is felt among crypto whales when BBP metrics post the worst results since July 25, 2025.

To date, the largest HBAR holders are still reducing their position, with Chaikin Money Flow (CMF) flashing to -0.18.

On top of that, the popular altcoin is projected to change the tide to a new history high if any of the two HBAR ETFs are approved this year. Luckily, Bloomberg ETF analysts have a 90% chance of this happening by the end of the year, but Hedera (HBAR) is competing with other popular Altcoin gusts, such as Ripple (XRP), Litecoin (LTC) and Solana (SOL).

Thus, today’s decentralized finance (DEFI) has resulted in a crunch of short-term liquidity, but the popularity of HBAR in cross-border payments, including ongoing Swift testing, draws a bright picture in the long run. For now, HBAR investors should support themselves for the September 29, 2025 update on Project Acacia’s use of Hashsphere.

Dig into DailyCoin’s top Crypto Scoops:

PI Network Provides Key KYC Updates: What Pioneers Should Know

Large-scale liquidation lock crypto. Healthy shakeout or market top?

People ask:

Hedera’s Stablecoin market capitalization tanked 53% over the past week, down from $150 million to $700 million per Defillama data. This indicates a quick exit for fluidity. This means you will have less money to flow through the network for transactions and apps.

It is linked to weaker user activity and the uncertainty of the broader crypto market. Fewer people deposit stable items like USDC and USDT for Defi or payment. This creates a “liquidity crunch,” slowing the transaction and scaring participants.

HBAR fell 7% in a week to around $0.24, approaching its 2025 low. Low liquidity means lower demand for HBAR (used for fees) and further pushes prices down. Analytes will see more negative aspects if they do not rebound.

Bad News Short Term: Fewer transactions can hamper your app or partnership growth. But push enterprise stuff like Hedera’s Stablecoin tokenization can turn the script upside down.

There’s no need to panic. Such things are common in cryptography. If you’re in long-term bullish with Hedera technology (fast and inexpensive TXNS), keep and monitor Stablecoin Bounts. Beginners: In these bear atmospheres, avoid dyor, diversifying and leveraging.