Binance Research has published its 2025 10 Charts report, providing data-assisted insights into how liquidity, regulatory, and institutional participation this year is reshaping the crypto landscape. The findings suggest a more mature, different paced cycle compared to past bull practices.

2025: Year finally appears

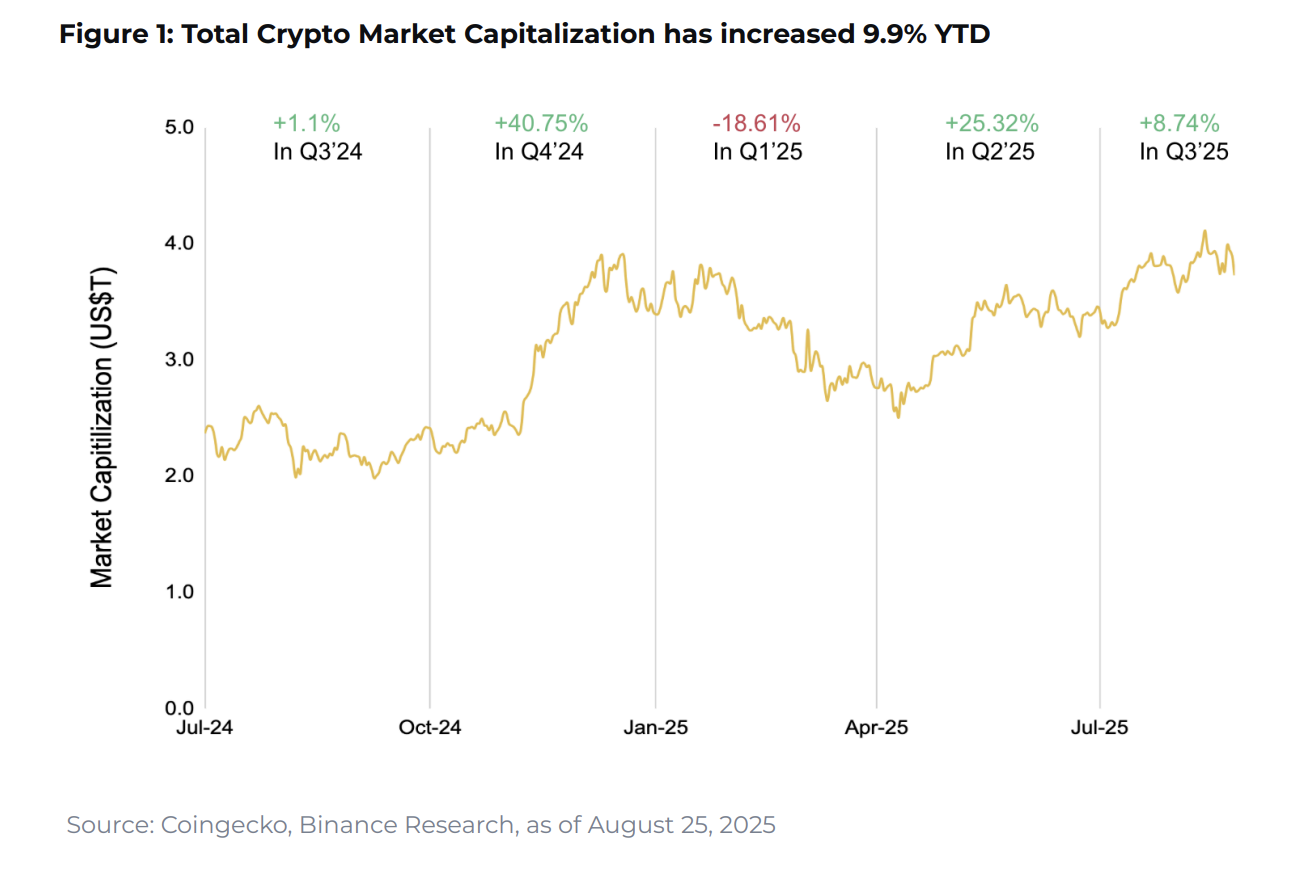

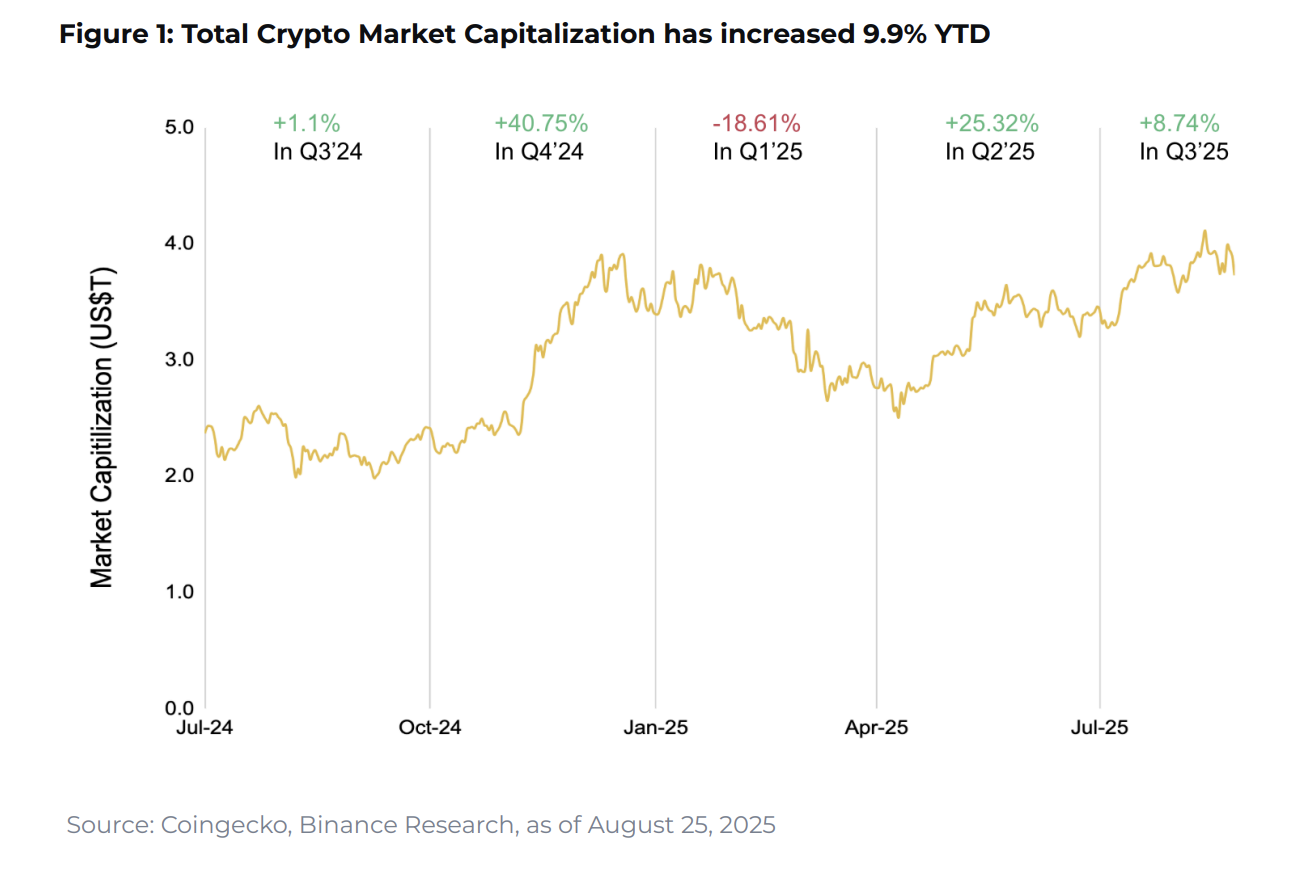

Crypto Markets bounced back in 2025, up 9.9% this year, adding more than $600 billion to its total market capitalization. After a weak first quarter, the market rebounded strongly in the second quarter, keeping momentum through the third quarter, with some major digital assets set at all-time highs.

Written by macro researcher Moulik Nagesh and research intern Asher Lin Jiayong, the report categorizes 10 key charts showing the crypto market that truly moves, from macro liquidity conditions to the development of cryptographic natives in Defi and Tokenization.

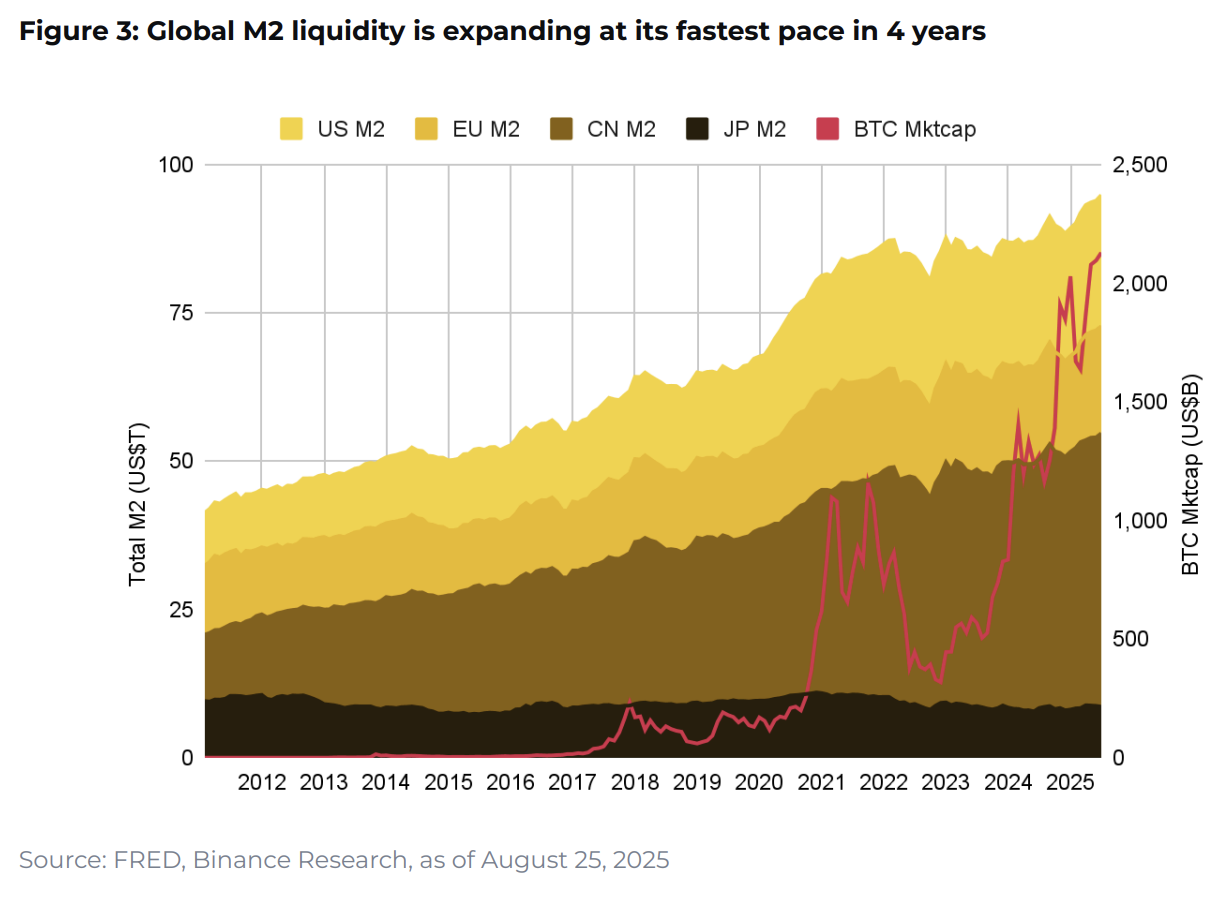

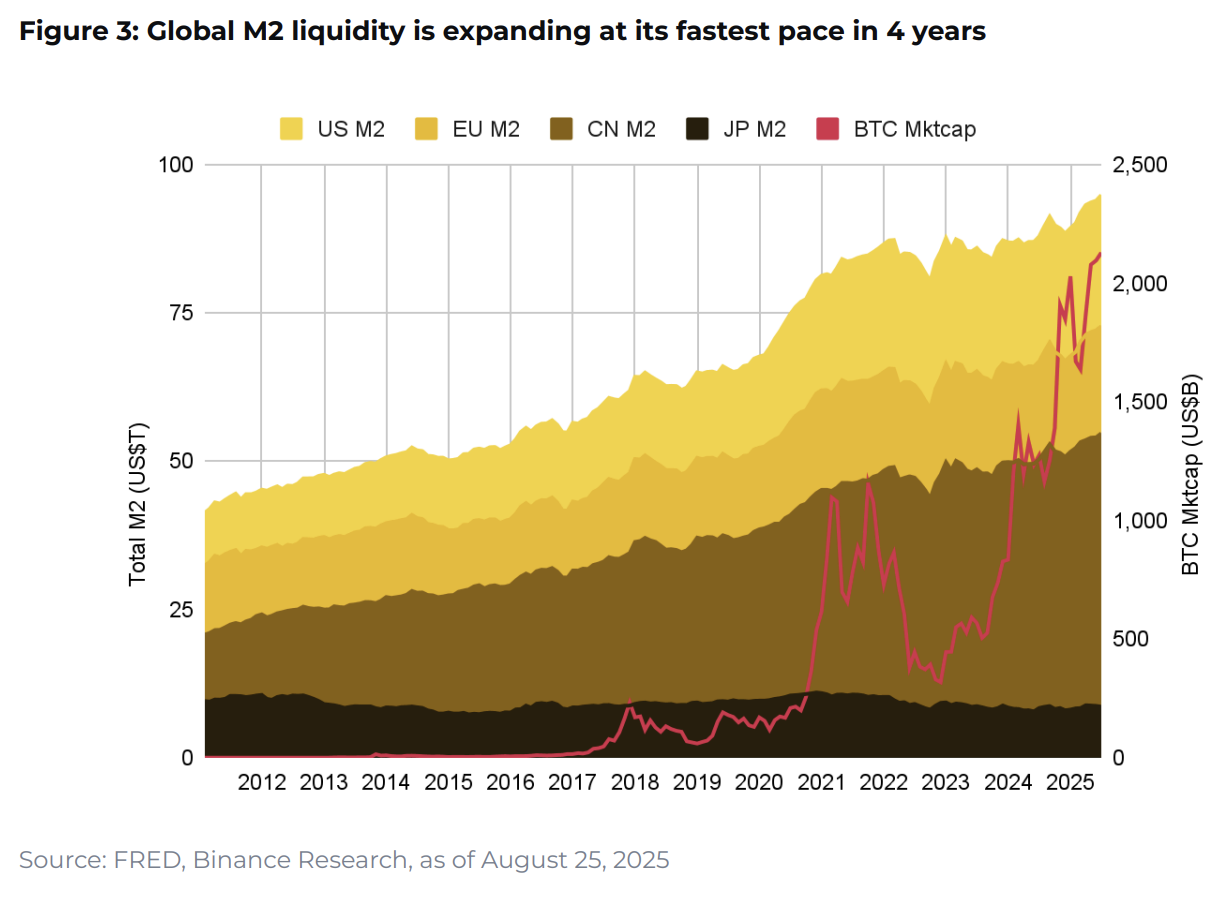

Chart 1: Global liquidity peaks over four years

Global M2 liquidity has expanded to the highest level in four years, marking its strongest six-month increase since 2021, with a wide range of $5.6 trillion in money supply. All this extra money floating around is suitable for Bitcoin and other dangerous assets.

The Federal Reserve effectively disrupts quantitative tones while maintaining a cautious attitude, and other major economies continue to have a kind policy. Federal Reserve Chair Powell’s recent statement on potential policy adjustments has set a stage for further liquidity support, particularly to benefit digital assets, as investors are in favor of risk-on positions.

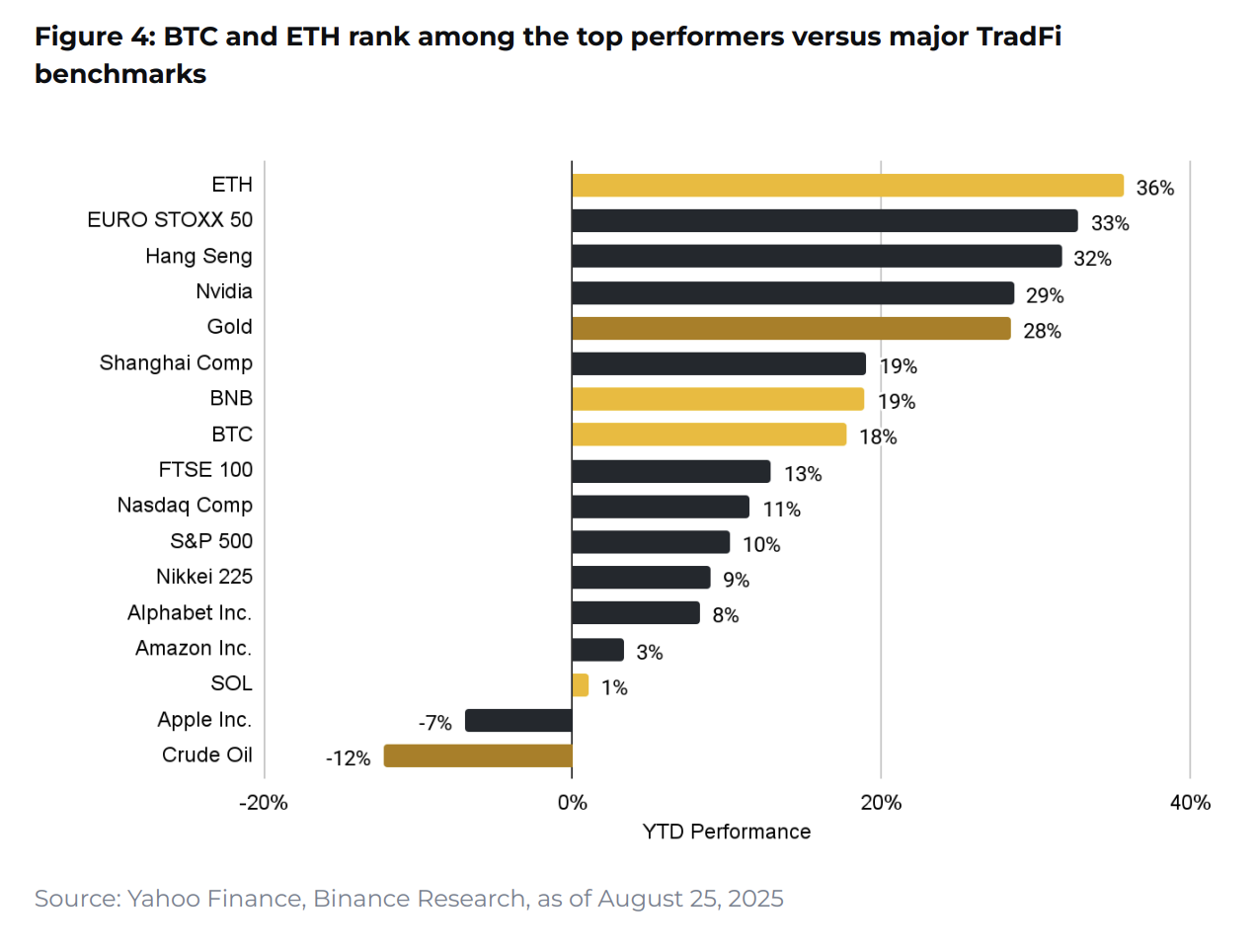

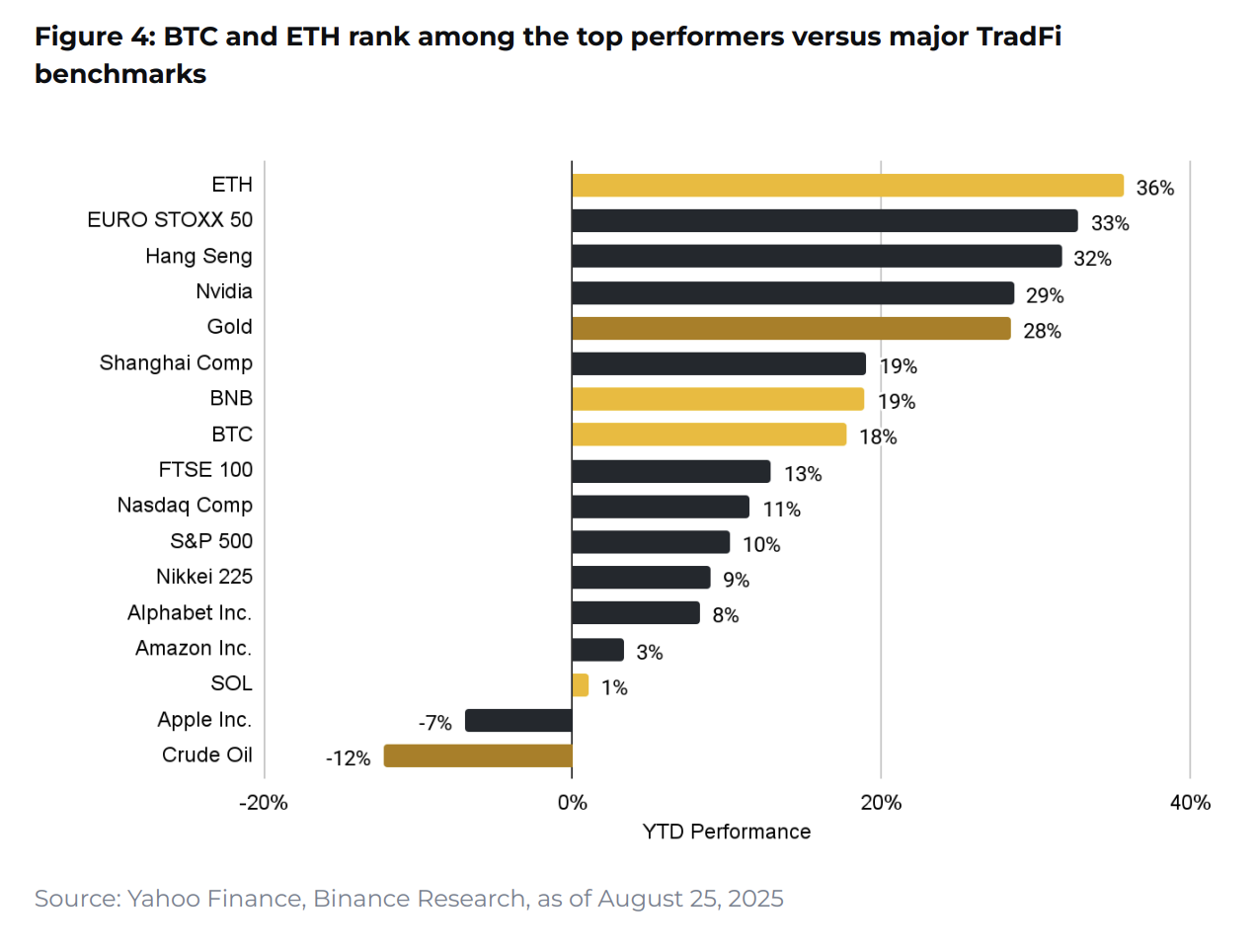

Chart 2: BTC and ETH are better than traditional benchmarks

Ethereum won 36% and led all major assets. Bitcoin rose 18%, surpassing most stocks and products. This performance highlights the evolving role of Crypto in its diversified portfolio, with Bitcoin showing unique dual properties as both macro hedges and risk-on assets.

Gold remains one of the most powerful traditional performers, but the comparable returns of Bitcoin, which are less correlated, highlight its diversifying value. Along with Ethereum, these digital assets have established themselves as legitimate components within traditional financial portfolios.

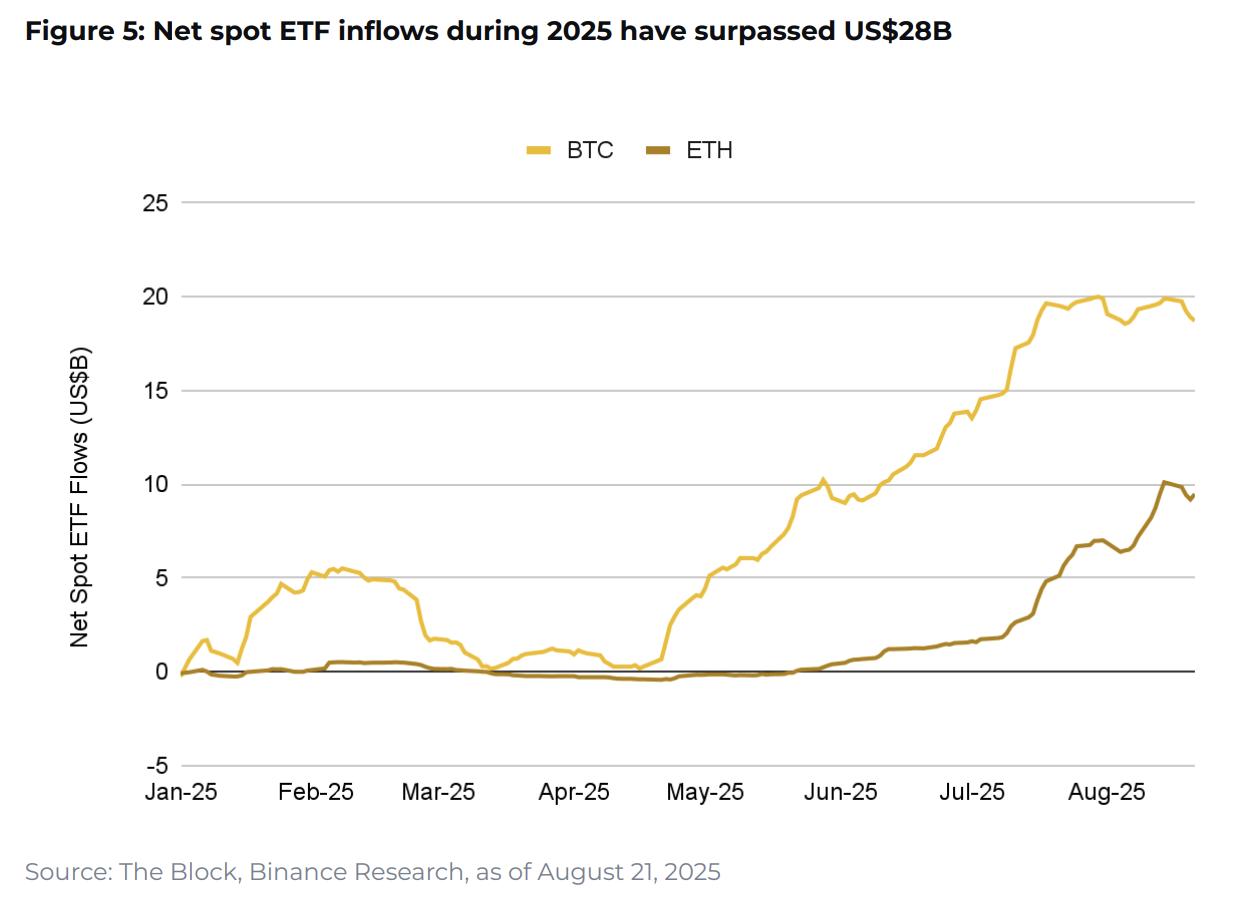

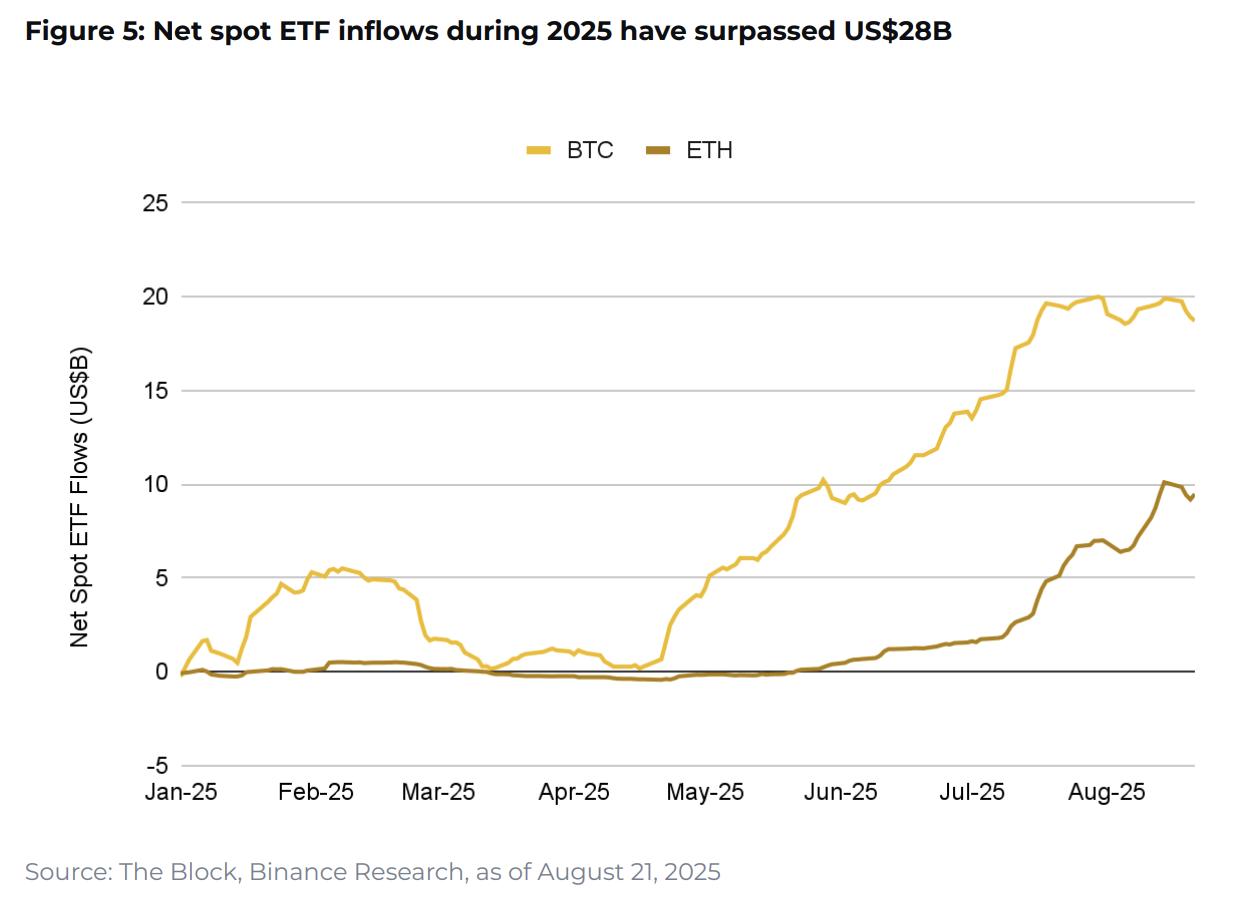

Chart 3: ETF influx exceeds $28 billion in historic adoption wave

US Spot Bitcoin and Ethereum ETFs attracted more than $28 billion in net inflows in 2025, with cumulative flows currently exceeding $52 billion. ETF Holdings has reached 1.29 million btc (approximately $154 billion), indicating that the agency is finally buying, unlike previous bull runs driven primarily by retailers.

BlackRock controls space with over $58 billion in managed assets, well above the second-place Fidelity $12 billion. BlackRock essentially controls the Crypto ETF space. Recent moves to redemption of physical properties have further reduced the volatility and trading friction of large allocators.

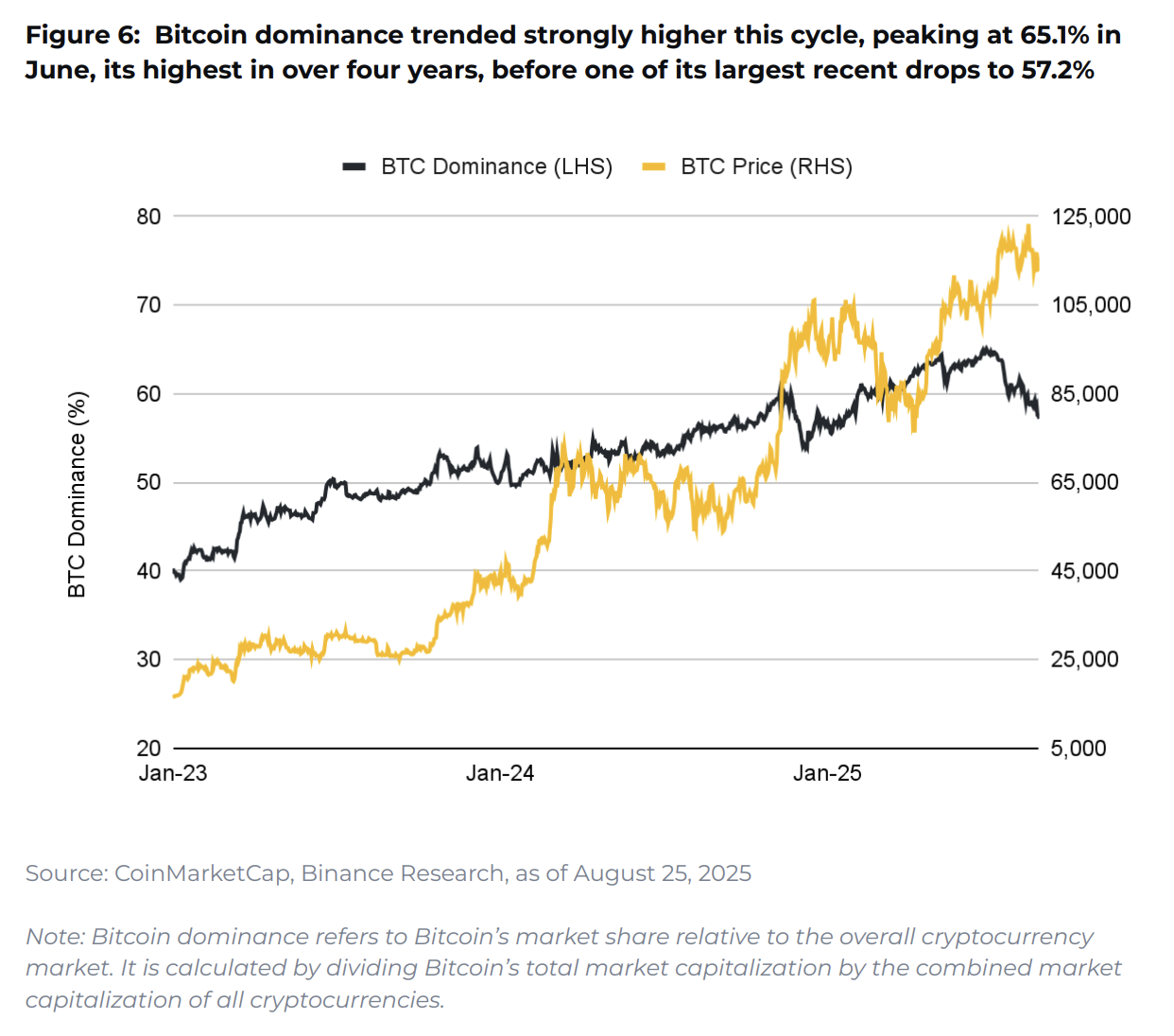

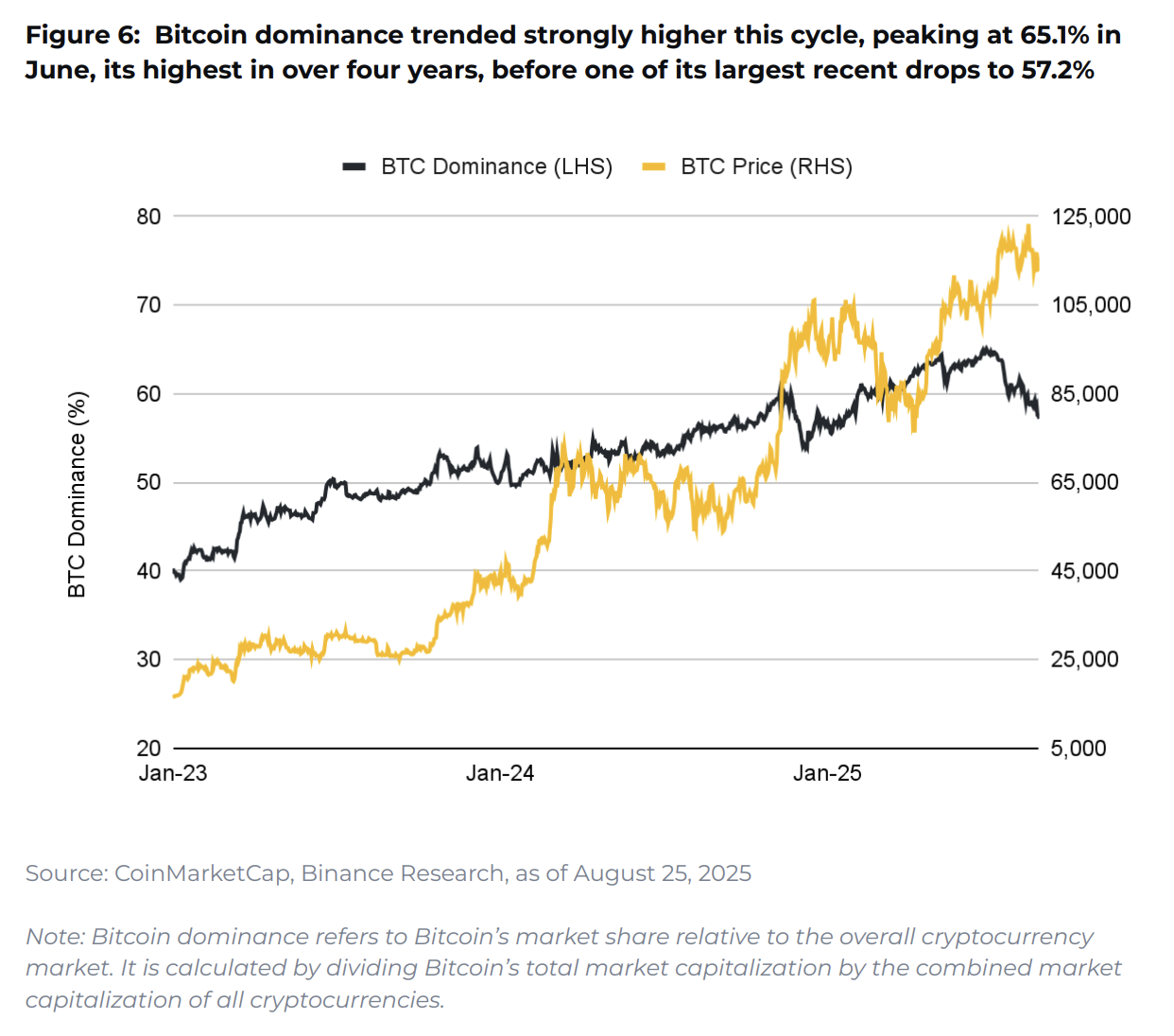

Chart 4: Evolution of the Bitcoin Dominance Signal Market Cycle

Bitcoin’s advantage skyrocketed from 40% to 65.1% this year before falling to 57.2%, indicating a shift from Bitcoin-driven accumulation to potential altcoin turnover. Peak domination was driven by accumulation of long-term holders, hiring of the Ministry of Corporate Treasury, and deeper traditional financial integration through ETFs.

This drop could mean that money is beginning to flow into the altcoins. This usually happens when bitcoin is cooled a little. The balance between Bitcoin’s growing institutional demand base and emerging altcoinflows could define the next market stage.

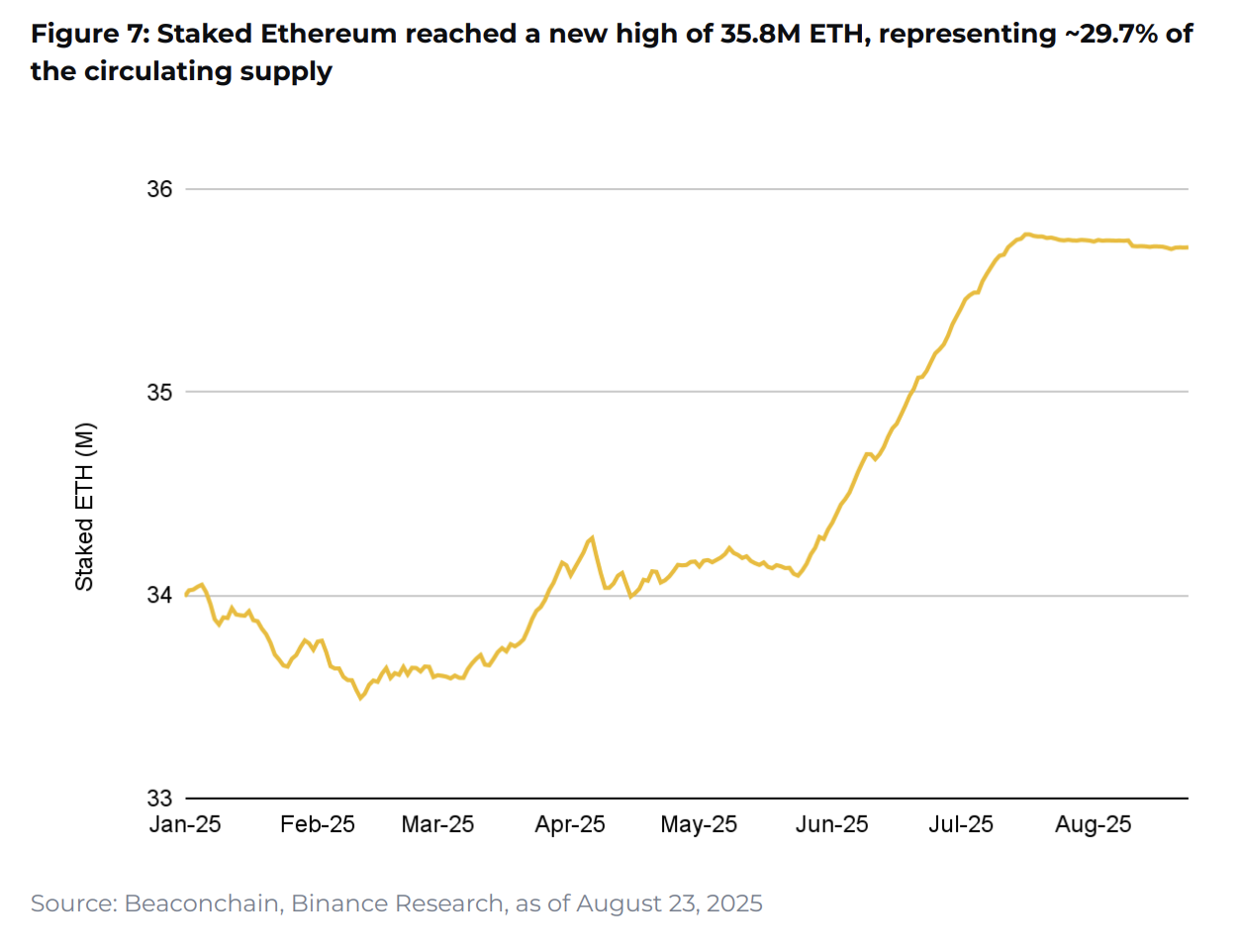

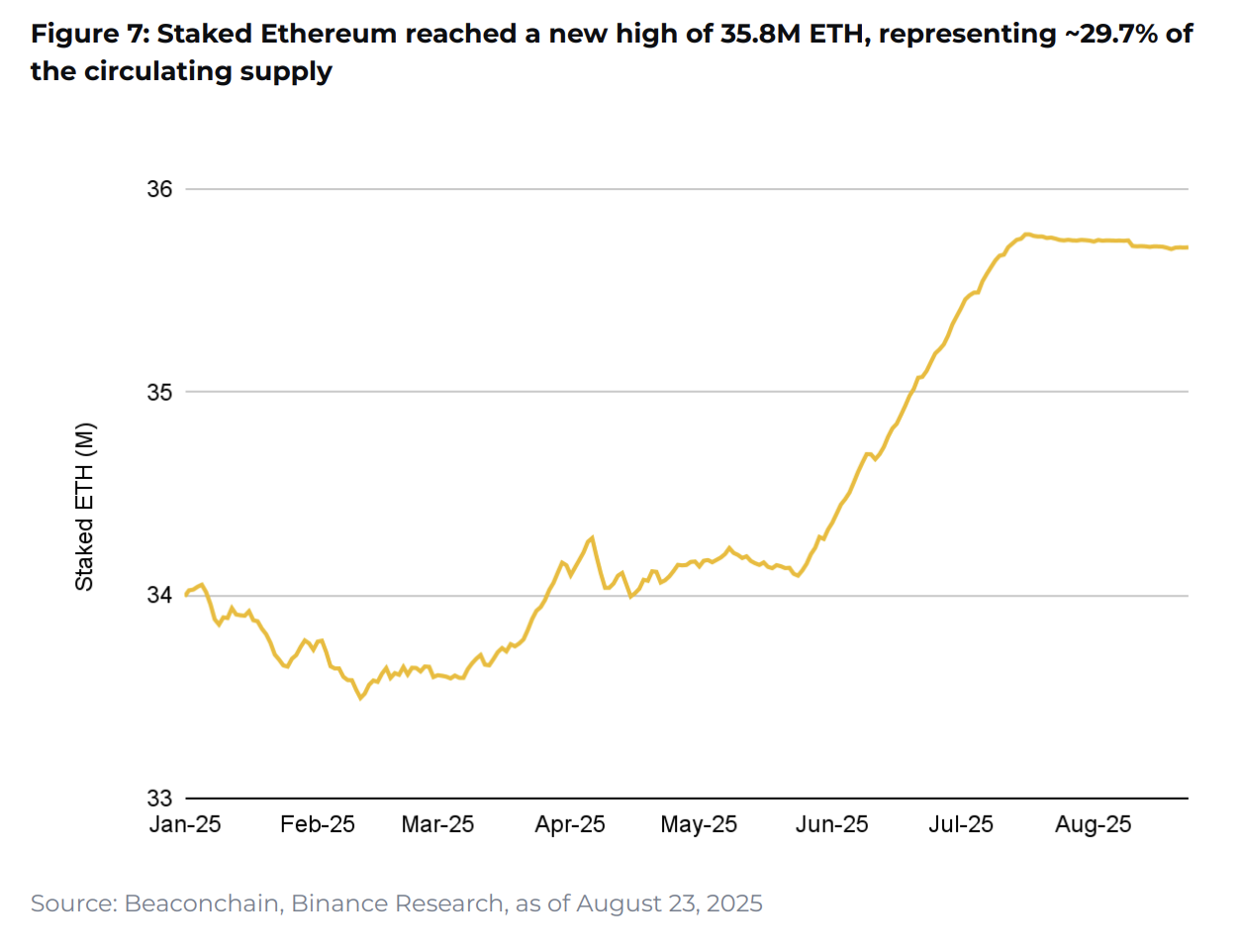

Chart 5: Ethereum Staking reaches a record 35.8 million ETH

Ethereum Staking has risen to a historic level, with 35.8 million ETHs stake (29.7% of total supply). The May 2025 Pectra upgrade was a critical catalyst, increasing the maximum effective balance per validation factor from 32 ETH to 2,048 ETH via EIP-7251.

This upgrade allows large stakers, such as exchanges and institutions, to integrate their holdings into fewer validators, making them cheaper and easier to run. The SEC’s recent ruling that liquid staking tokens are not securities has been further clarified, increasing institutional confidence in staking strategies.

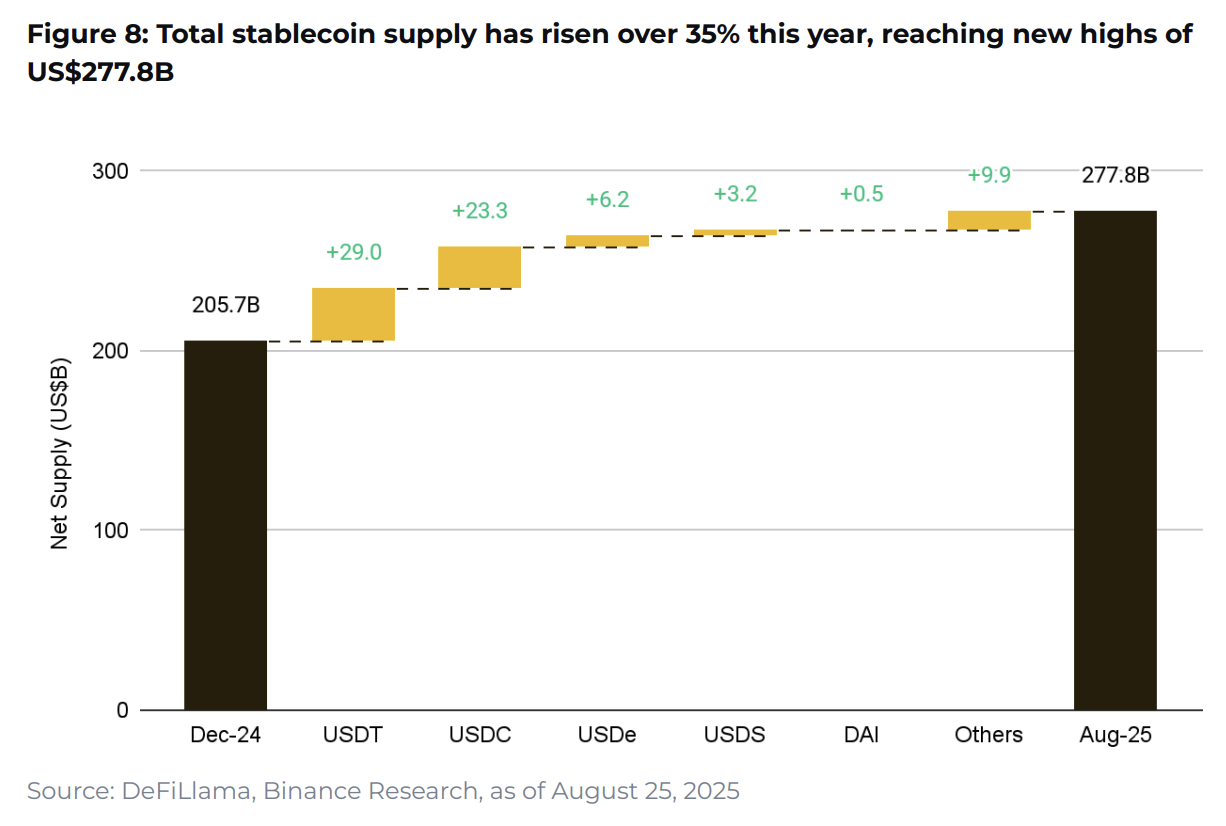

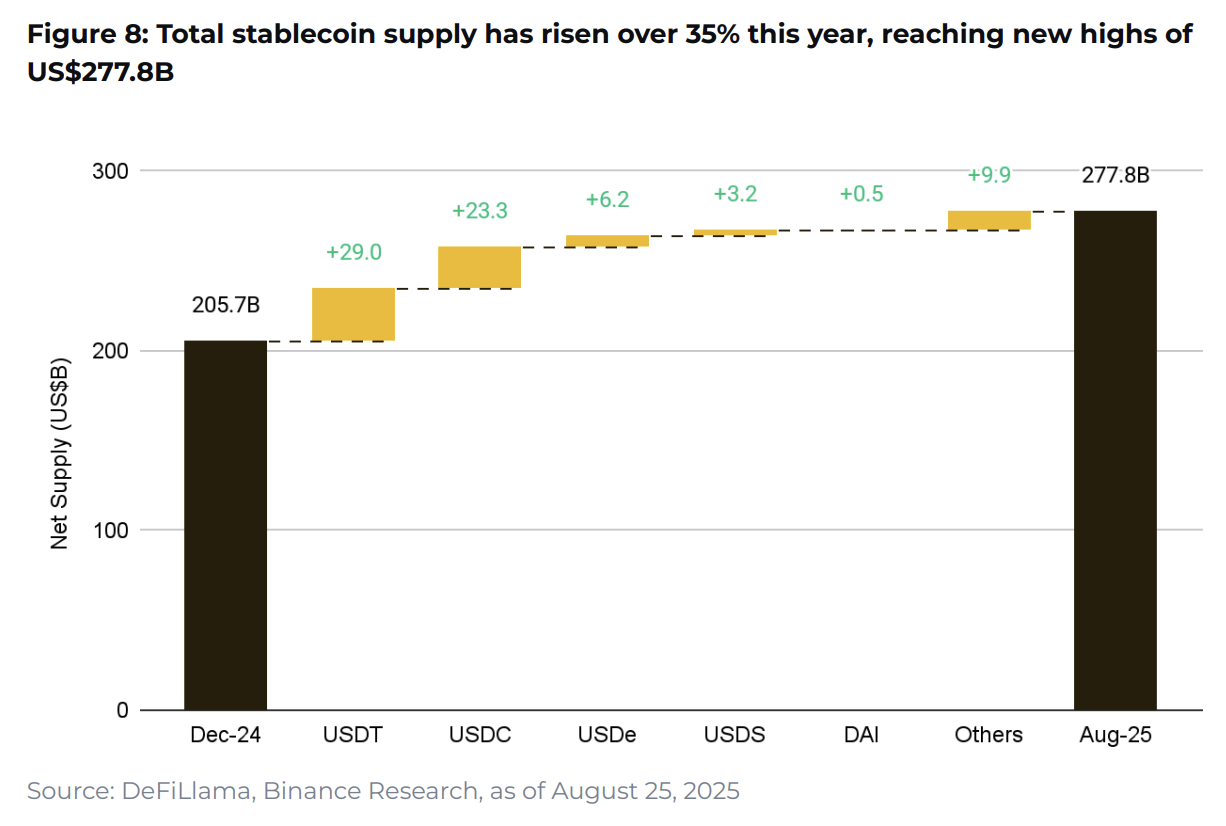

Chart 6: Surge in stablecoin supply hits $277.8 billion at 35%

Stablecoin Supply breaks its all-time high, rising above 35% to $277.8 billion, reflecting a fresh capital inflow into the crypto market. This growth shows not only increased purchasing power, but also expands real-world use cases beyond trading.

The recently passed Genius Act provides regulatory clarity and requires full reserves and compliance with the bank’s secret laws. This makes more institutions more comfortable with projects like JPMorgan’s Kinexys demonstrating interbank transaction applications, using Stablecoins for real payments as well as transactions.

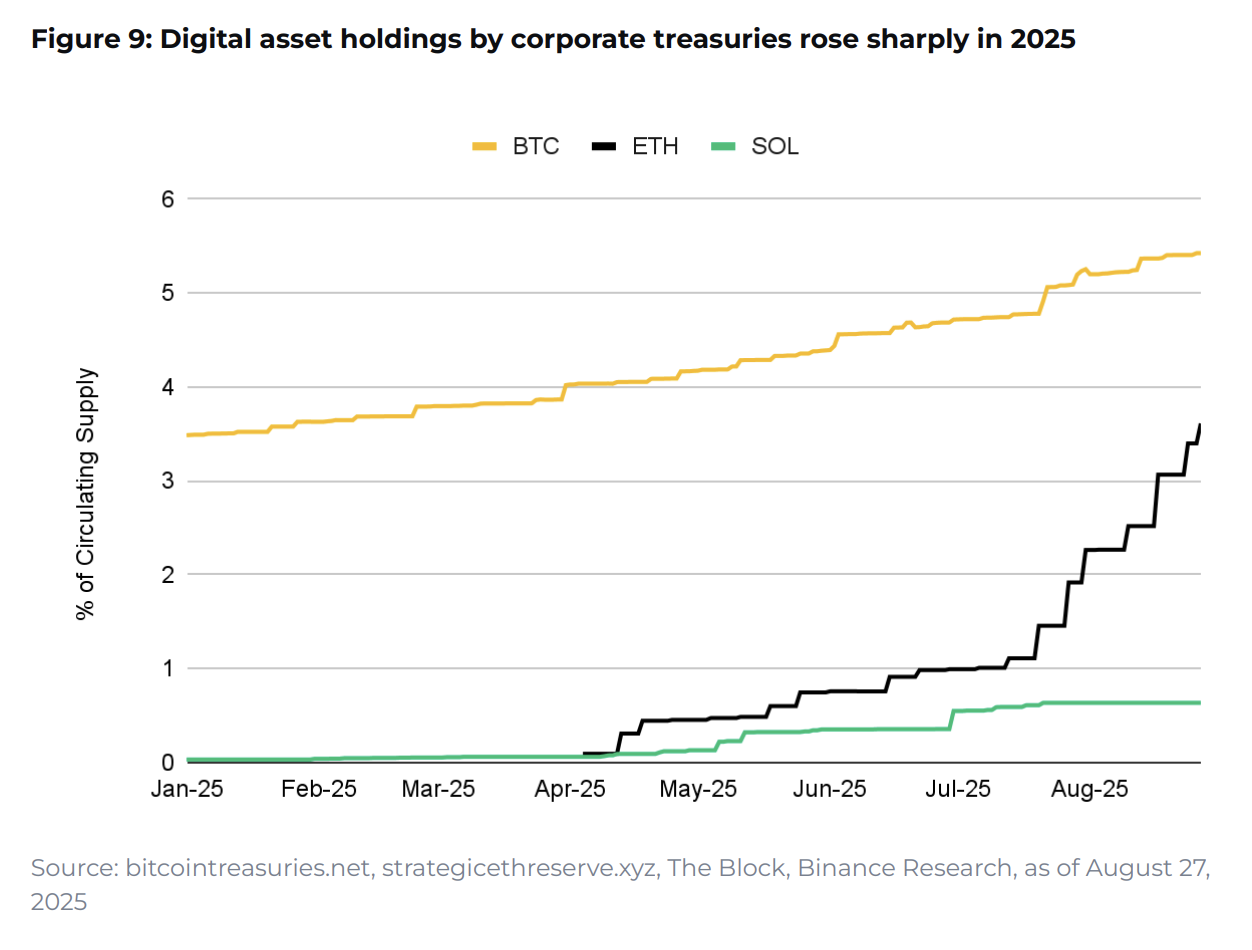

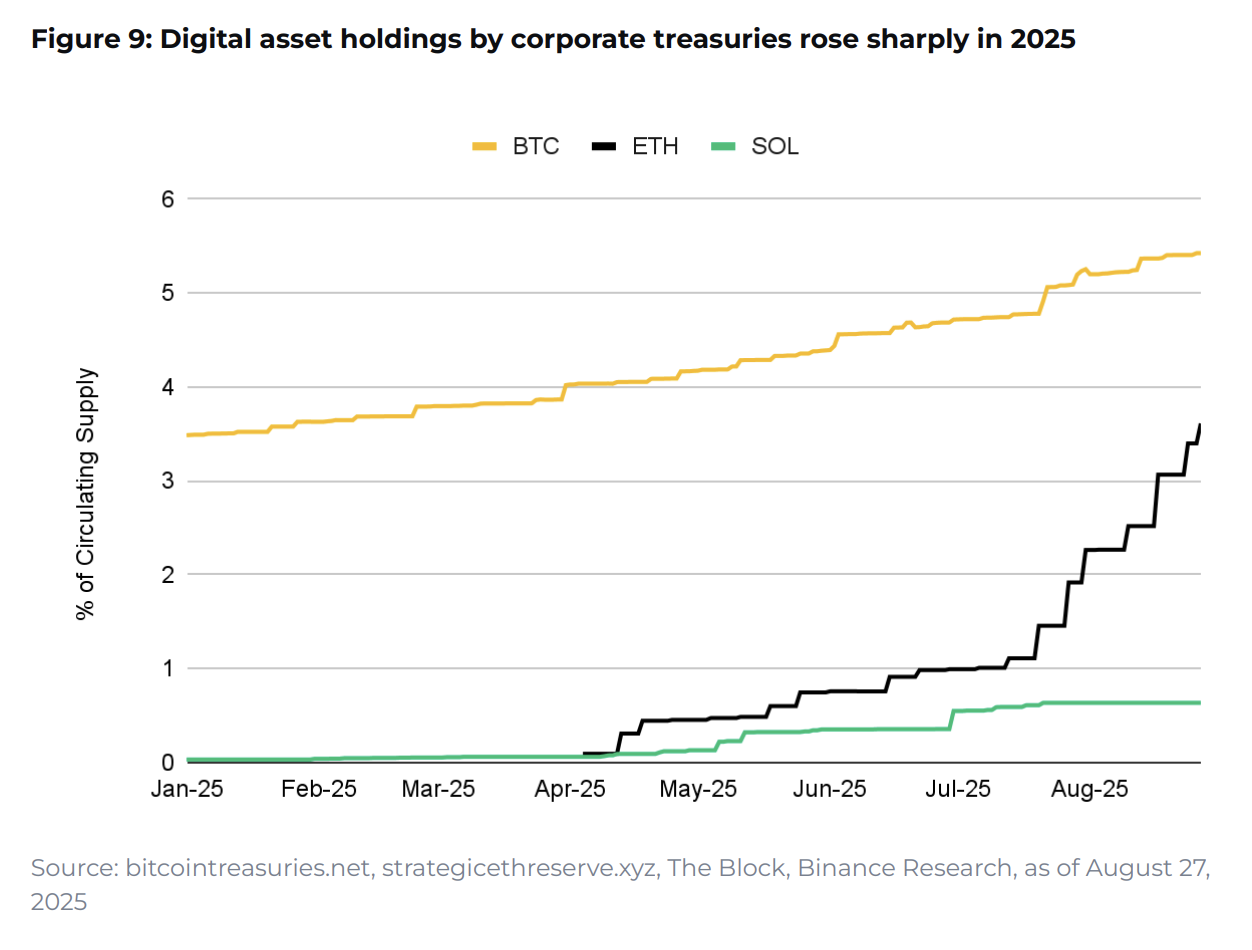

Chart 7: Corporate digital asset ownership accelerates

Public company Bitcoin Holdings has reached 107 million BTC (5.4% of distribution supply) across 174 companies, and MicroStrategy owns approximately 59% of the company’s BTC reserve. Ethereum’s corporate recruitment is accelerating even faster, with holdings at 4.36 million ETHs, up 88.3% over the past month.

This represents the largest monthly increase in companies’ record of Ethereum holdings, with over 70 entities collectively holding ETH, accounting for around 66% of ETF-controlled ETH. Companies want to not only buy ETFs, but also hold ETH directly.

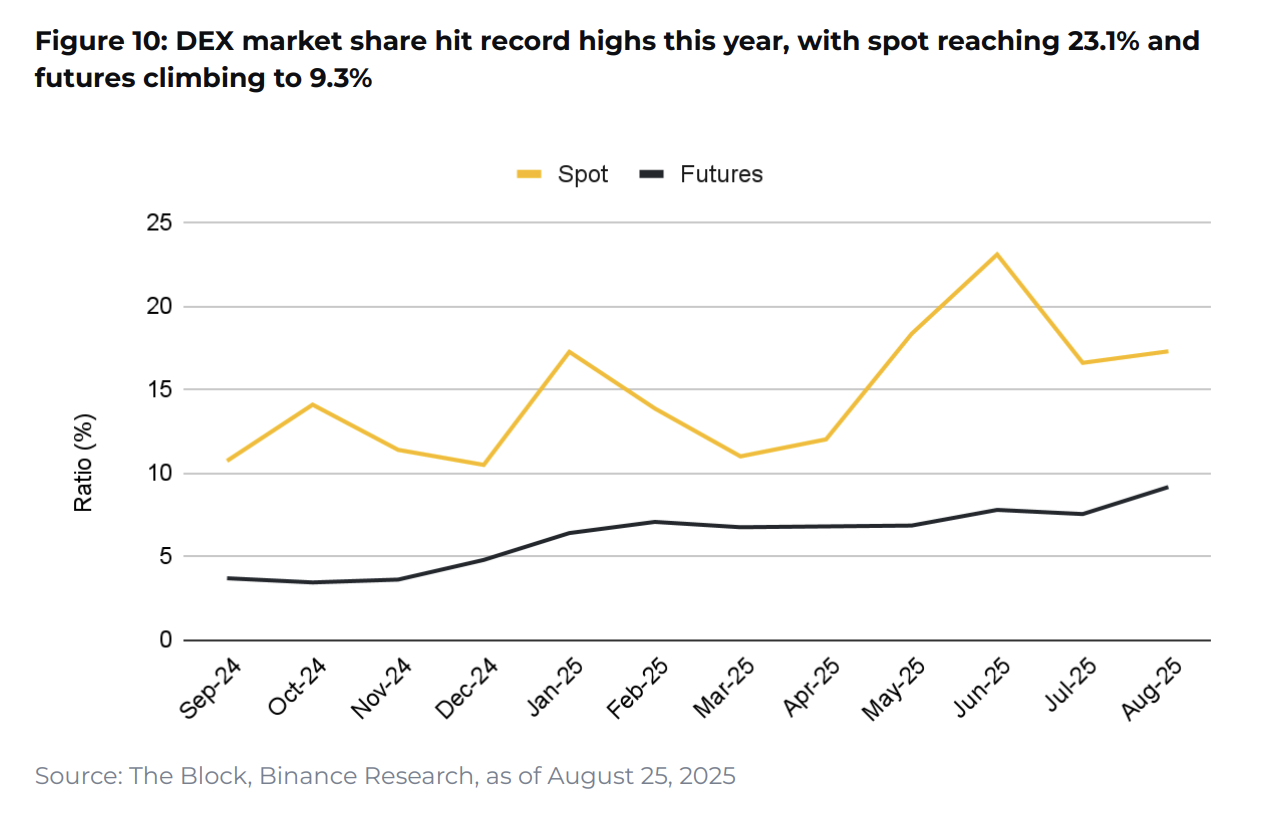

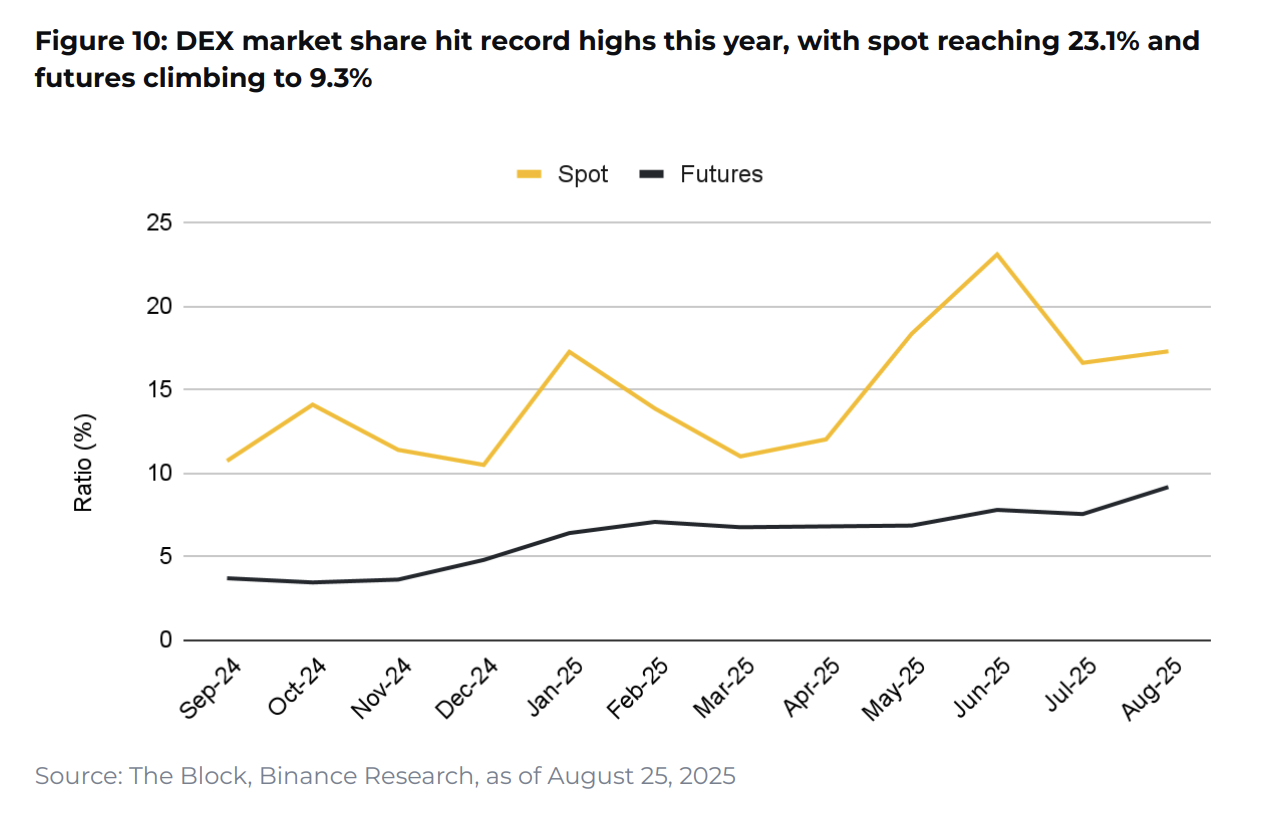

Chart 8: DEXS captures record trading market share

The decentralized exchange gained unprecedented market share, with spot trading reaching 23.1% and futures rose to 9.3% of total crypto volume. Dex Spot volume has more than doubled over the past year, but centralized exchange volume has dropped from $2.9 trillion to $1.6 trillion.

High lipids promoted the growth of derivatives, with constant amounts rising from $1.97.9 billion in January to nearly 360.3B by August. Pancakeswap has driven significant spot volume growth and increased its share from 4% to 16% thanks to improved alpha trading and Infinity upgrades.

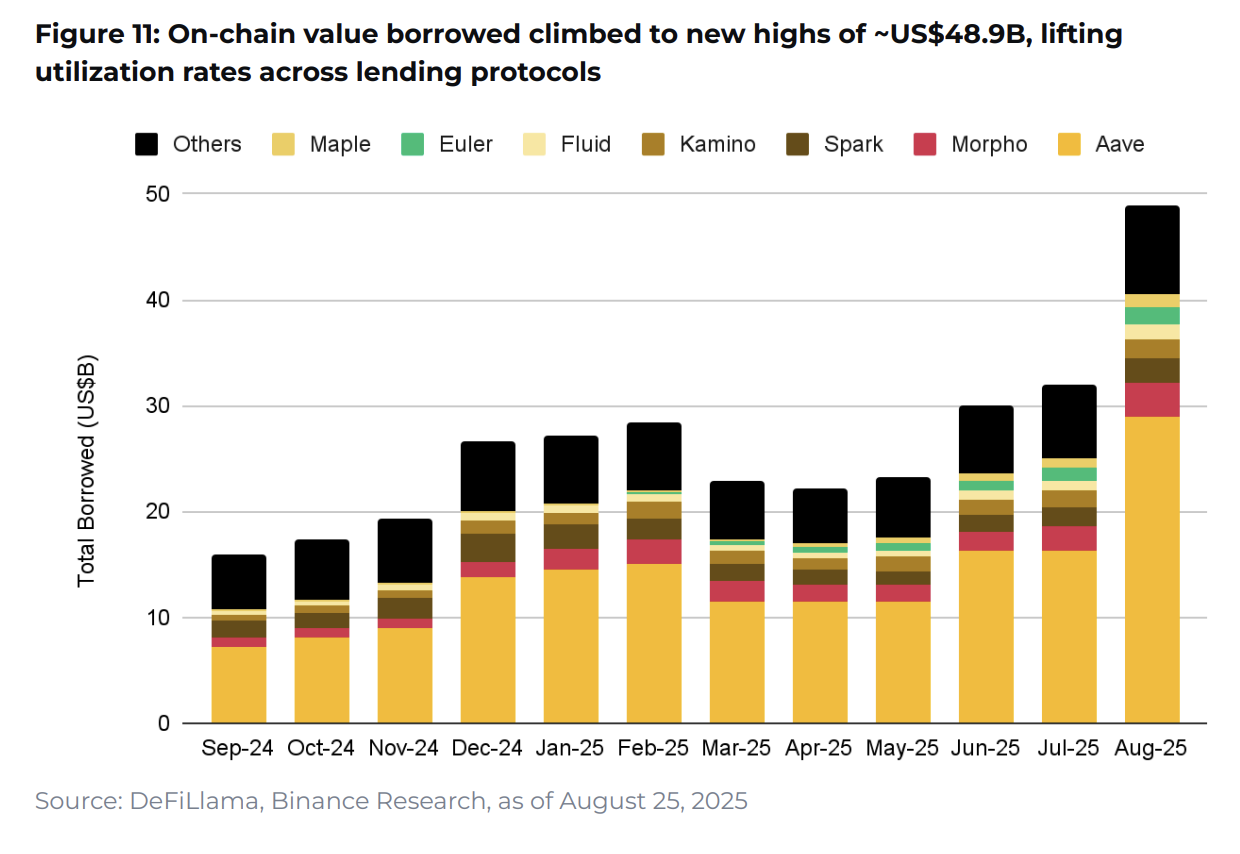

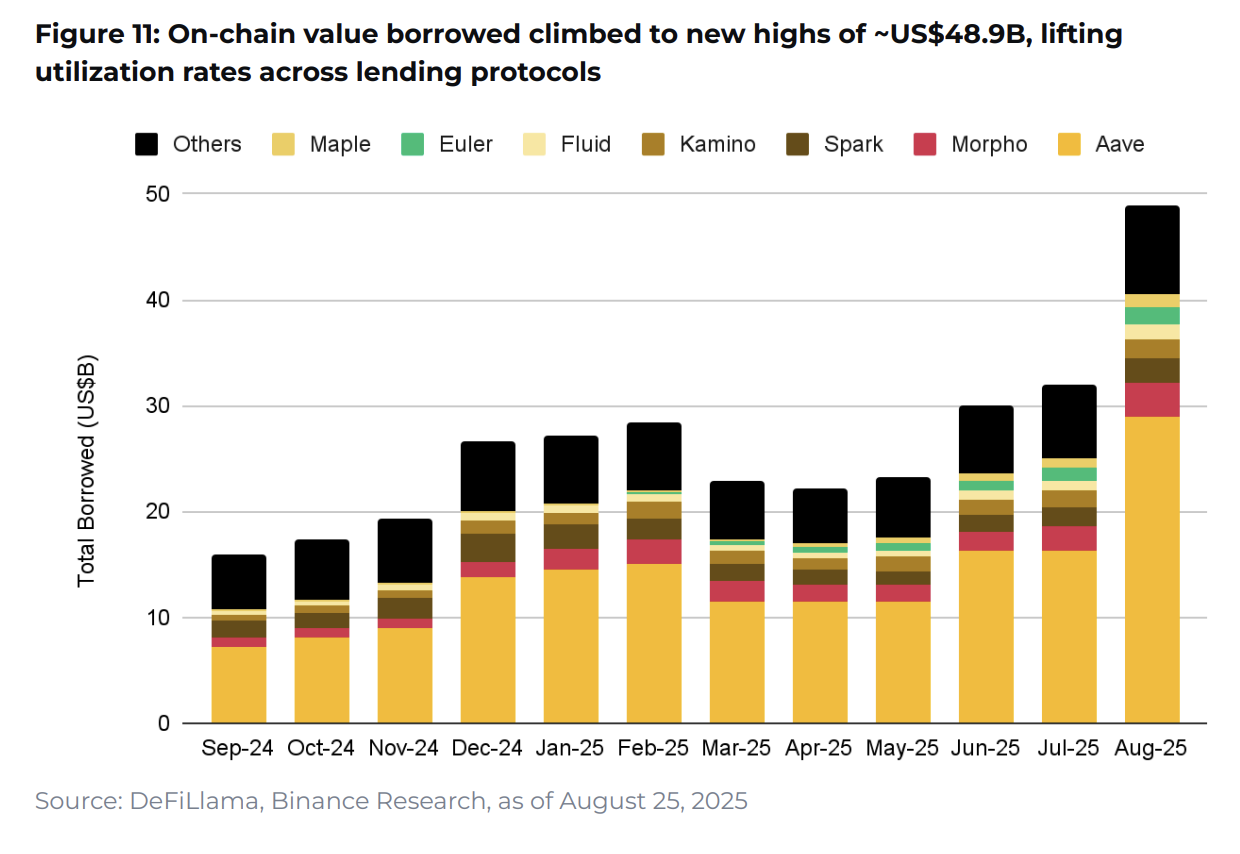

Chart 9: On-chain lending shifts to active use

The total value of locked loans rose 65% to $79.8 billion, with borrowing activity surged by 80%, indicating a transition from passive growth to active capital deployment. In addition to park in protocols, people are actually borrowing codes to lend.

Aave maintains market leadership at $12.4 million with a $39.9 billion TVL (50% market share) and a 30-day protocol fee. New entrants such as Morpho, Euler, and Maple are driving modular and real-world asset-centric architectures, allowing a wide range of investors to find lending options that will work for them.

Chart 10: Tokenized Inventory Reflects Early Disaster Growth Patterns

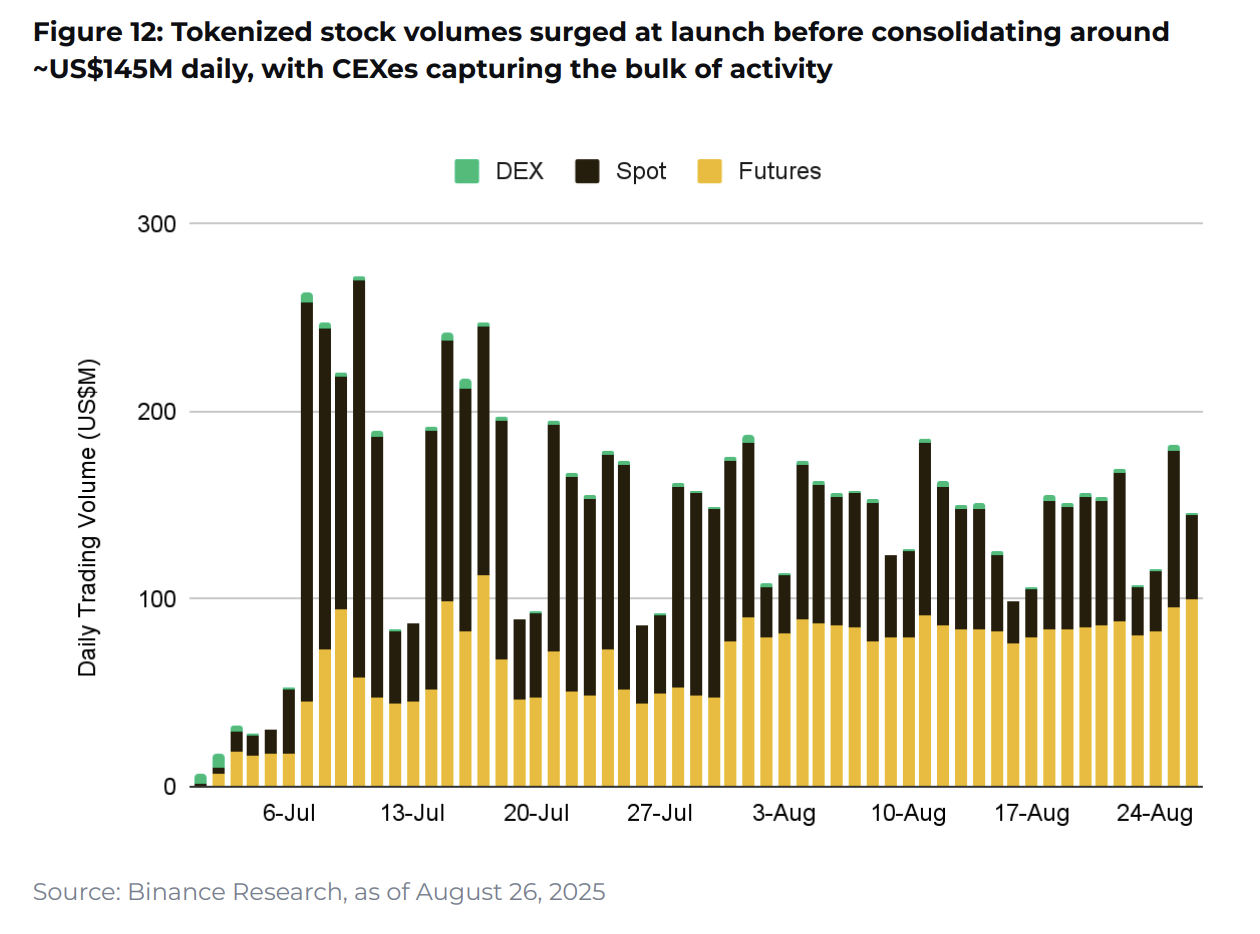

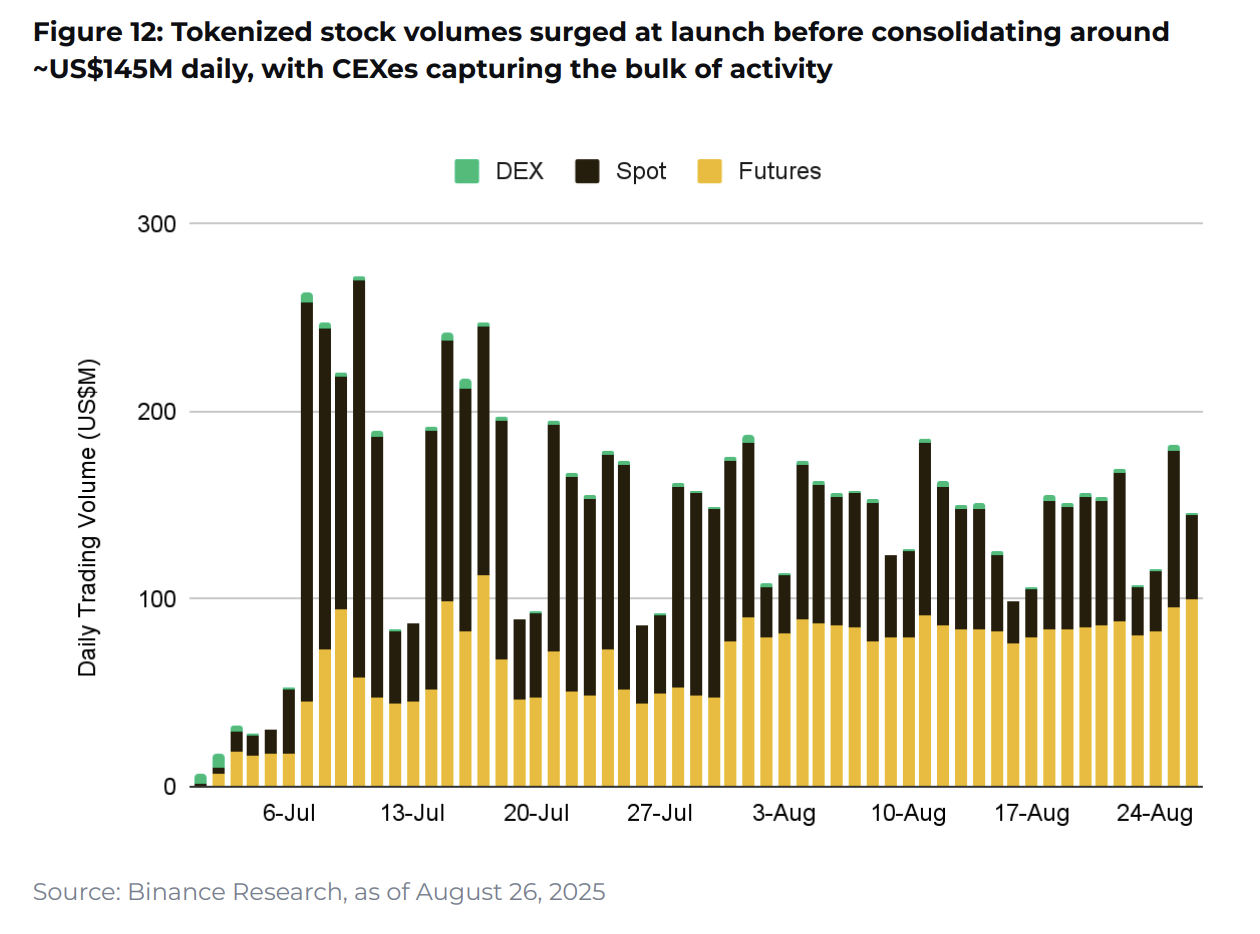

Tokenized stocks reached a market capitalization of $349 million, supported by infrastructure improvements, new trading venues and clearer regulatory guidance. Assets such as TSLA and Spy have grown by more than 378% since July, signaling tokenized stocks as key drivers in the wider real-world asset cycle.

The active on-chain holder almost triples from 22,400 in July to over 66,500 in August, reflecting the early adoption pattern of Defi’s experiments. DEX participation remains small compared to intensive exchange activities, but integrating tokenized assets into the Defi protocol creates a natural synergistic effect for future growth.

Market Outlook: Structural Power Promotes Continuous Growth

ETFs, company purchases, clearer rules and better cryptographic technology are all coming together to support the market. With the decline in Bitcoin’s dominance and regular highs and ridiculous reservations, the foundation exists for participation in a wider ecosystem.

Short-term volatility could increase along with anticipated Fed rate cuts and ongoing trade tensions. Crypto appears to be growing, with large institutions involved and real-world use cases taking off.

The complete 10 Chart Shaping 2025 report provides a detailed analysis of each trend, including technical implementation, market impact, and future-looking insights for investors and industry participants navigating Crypto’s evolving landscape.

Information published on Coinrevolution is for general knowledge only and should not be considered financial advice.

We aim to keep our content accurate and up-to-date, but there are no guarantees regarding its integrity, reliability or accuracy. Coinrevolution is not responsible for any losses, errors or decisions made based on the materials provided. Always do your own research and consult a qualified professional before making any financial choices. Please refer to our Terms of Use, Privacy Policy, and Disclaimer for more information.