Stablecoins won’t circumvent existing payment platforms, including Visa and Mastercard, until Blockchain tokens have robust consumer protection, according to Guillaume Poncin, chief technology officer at payment company Alchemy.

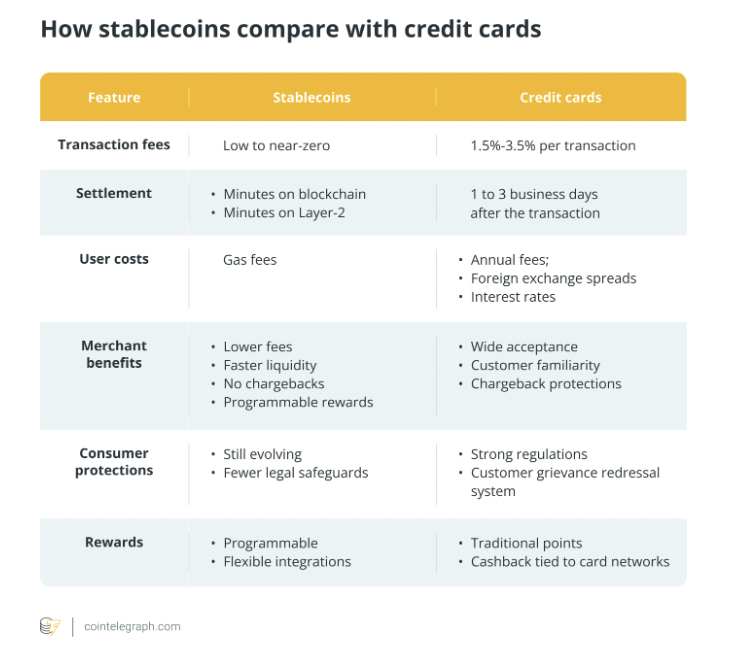

Traditional payment companies offer the chargebacks, fraud protection, contested transaction resolution and credit capabilities that consumers have come to expect. The Stablecoin project needs to integrate these features to attract everyday people, Poncin told Cointelegraph.

Consumer protection features can be built directly into smart contracts, but Stablecoin issuers and payment platforms can fund their own insurance pool for payments in the event of fraud, Poncin said. He said traditional payment rails and stubcoin will merge:

“All major payment processors expect to integrate Stablecoins, and all banks issue their own. The future is where traditional rails will be strengthened by blockchain efficiency and new use cases. Stablecoins have already won because of cross-border payments and emerging markets.

For domestic retailers, the hybrid model is displayed by combining immediate settlements and consumer protection,” he said.

Stablecoins offer 24/7 cross-border settlements at the cost of a fraction of traditional bank transfers, making them more practical for remittances and international commerce. This gives Stablecoins a competitive advantage over payment card providers in these markets.

Related: Coinbase says that stubcoin, which does not discharge bank deposits, calls it a “myth.”

The banking industry measures the potential impact of stubcoins on legacy systems

Crypto industry executives, commercial banks and market analysts continue to argue for the impact of stubcoin on existing financial institutions in payments and banking operations.

US Senate banks and their allies opposed stubcoin restrictions in March amid debate over guidelines and establishment of the US stubcoin bill.

At the heart of the pushback is the possibility that Stablecoin issuers will share some of the yields from US government securities that support the token along with their customers, which was banned in the final bill.

U.S. Sen. Kirsten Gillibrand argued that yield opportunities will lend out traditional banking systems and banks that home buyers and small businesses rely on.

Gillibrand asked the audience at the DC Blockchain Summit in March. “Who will put your money in your local bank and give you a mortgage?”

However, Jamie Dimon, CEO of Financial Services Giant Jpmorgan, recently said he was not worried about Stablecoins, replacing banks, adding that each has its own consumer base and will continue to coexist.

“From bad guys to good guys to certain countries, there are people who want to own the dollar through stupid and stupid people outside of the United States.

magazine: Tradfi is building Ethereum L2 to tokenize trillions in rwas: Internal Story