- Currently, the RSI is 67.13, approaching an excessive level.

- For the first time since January, the fantastic oscillator has reversed positively.

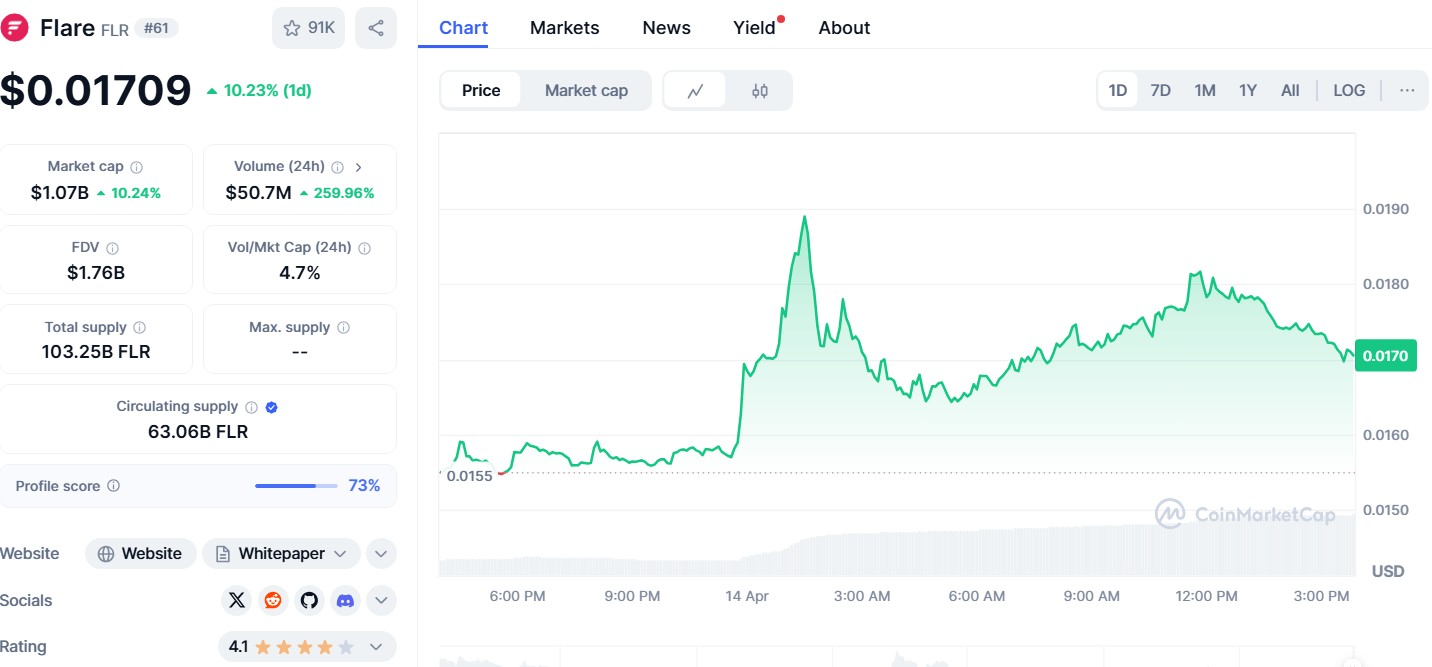

- FLR broke past resistance at $0.016.

Flare (FLR) appeared this week as one of the most powerful performers in the Altcoin market, gaining a 57% increase over the past seven days to a new local high of $0.018 at the time of writing.

Source: CoinMarketCap

The move marks a continuing bullish rally that began on April 9th, with the FLR hitting new daily highs every day.

Key technical indicators such as the Relative Strength Index (RSI) and Awesome Oscillator (AO) suggest that strong purchasing activities outweigh sales pressures.

However, as RSI levels are approaching the area of overbuying, analysts warn that if profits are strengthened, pullbacks could be on the horizon.

RSI of 67 shows strong buying trends

Flare’s relative strength index stands at 67.13 at the time of writing, approaching the important 70 mark, which usually indicates the condition that was bought.

The RSI indicator tracks momentum on a scale of 0-100 by comparing the magnitude of recent profits and losses over a set period. An RSI above 70 suggests that you can overbuy assets and fix them quickly, while a value below 30 indicates the opposite.

The upward trend of FLR RSI suggests that buyers currently dominate the market and reflect a sustained interest in assets. Although the 70 threshold has not yet been exceeded, the current value indicates that the FLR is approaching a potential inflection point.

As the current momentum continues, RSI will quickly see overbuying signals, increasing the chances of a short-term price drop.

AO reverses positive for the first time in two months

In addition to bullish emotions, Flare’s amazing oscillator has been positive for the first time since January 26th.

The AO consists of histogram bars measuring the difference between simple moving averages for five and 34 periods, providing insight into market trends and reversals.

The bar has recently flipped over the zero line, showing an increase in height, indicating an increase in positive market momentum.

When the AO bar exceeds zero, it usually refers to a reinforcement trend. In the case of FLR, the consistent growth of these bars means bullish convictions are built across the market.

This technology development supports the idea that FLR’s recent profits are not merely short-term spikes, but are part of a wider uptrend driven by improving investor sentiment.

Price exceeds $0.016 resistance, and eyes $0.021

A recent FLR meeting has surpassed the resistance level, a price range that previously kept the upward movement down, at $0.016. Maintaining beyond this level is considered an important factor in determining whether the meeting can be expanded.

If $0.016 is held as new support, analysts suggest that AltCoin can rise further and test the next key resistance at $0.021. However, the possibility of short-term profits could challenge this bullish prediction.

A new wave of sales pressure could push flr back to under $0.016 and $0.010, particularly if RSI has been acquired across territory and market participants are trying to lock in profits.

Technical signals support short-term benefits

Overall, the technical indicators of FLR remain largely positive. The combination of rising RSI, positive AO crossovers, and breakouts above previous levels of resistance show continuous bullish momentum in the short term.

However, traders are advised to monitor RSI closely. Moving beyond 70 could indicate that the correction will be due, especially if volume starts to drop or if the candlestick pattern suggests hesitant among buyers.

At this stage, integration capabilities above $0.016 could determine the next stage of price action.

Technical Flash over-purchase first appeared on Coinjournal, resulting in a 57% post-flare (FLR) spike in a week.