Two months ago, Crypto Exchange Bybit sacrificed one of the biggest attacks in the history of the crypto sector, losing around $1.5 billion in ether (ETH) to cybercriminals. While major trading platforms have recovered significantly from the impact of the attack, market experts have analyzed data showing how they navigated the incident.

A posthumous report obtained by crypto facility grade research firm BlockScholes reveals how deeply the hack has influenced the broader crypto market, bid-ascending spreads, and role roles of BYBit’s new retail price improvement (RPI) orders in platform recovery.

How the Bibit hacks have affected the market

Remember that this attack targeted one of Bibit’s Ethereum cold wallets. BlockScholes has made it clear that the sales following the incident are not inherent to the code.

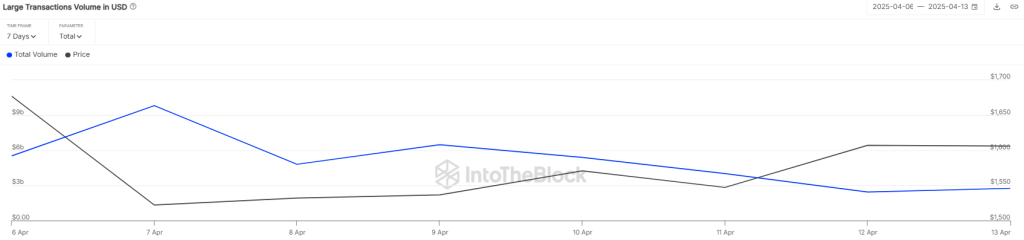

Analysts analyzed the impact of hacks on spot trading volumes and looked at short-lived spikes in hourly trade volumes of all tether (USDT) pairs away from the average. After the spike, within the next day the trading volume of Bitcoin (BTC) and AltCoin fell sharply.

Buybit’s share in the spot trading volume market fell from 11% to 4%, while BTC’s share fell from 50% to less than 20%, while ETH volume was relatively stable. These volumes have not yet returned to the high levels seen at the beginning of the year, but there has been a major recovery. Overall spot trading share rose a few points to 6-7%.

Despite the sharp decline in trading volume, Bid Ask spreads remained tight. This metric measures the difference between the lowest asked price and the highest bid price. A closer spread is more liquid and shows a lower execution risk.

Quick recovery

After the Hack on February 21st, only Pepe (Pepe) and the official Trump (Trump) witnessed a major change in the order of the book’s depth. Even BTC and ETH, assets stolen during the attack, saw the lowest spreads, recording negligible changes after the incident. However, the depth of Bitcoin and Ethereum order books recovered quickly within a week. This is a development caused by Bybit’s RPI orders.

RPI orders are intended to increase liquidity exclusively for retailers. This feature is a unique subset of orders placed by market makers or institution participants that are open only to retailers who interact manually with Bybit’s user interface.

Bybit introduced RPI orders on February 17th, a few days before the hack. So the market tried to recover from the incident, but retailers on Bibit had order depth, deep liquidity pools and closer bid spreads.

Binance Free $600 (For cryptopotato only): Use this link to register a new account and receive an exclusive $600 welcome offer with Binance (detail).

Exclusive offer for Bybit’s Cryptopotato Leader: Use this link to sign up and open a free $500 position on your coin!