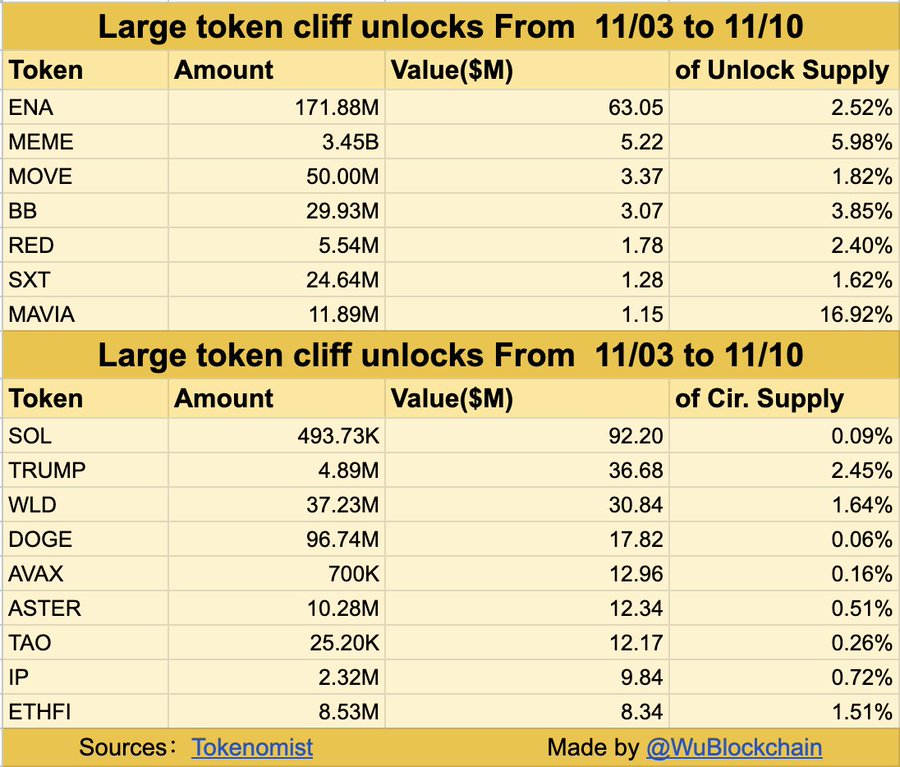

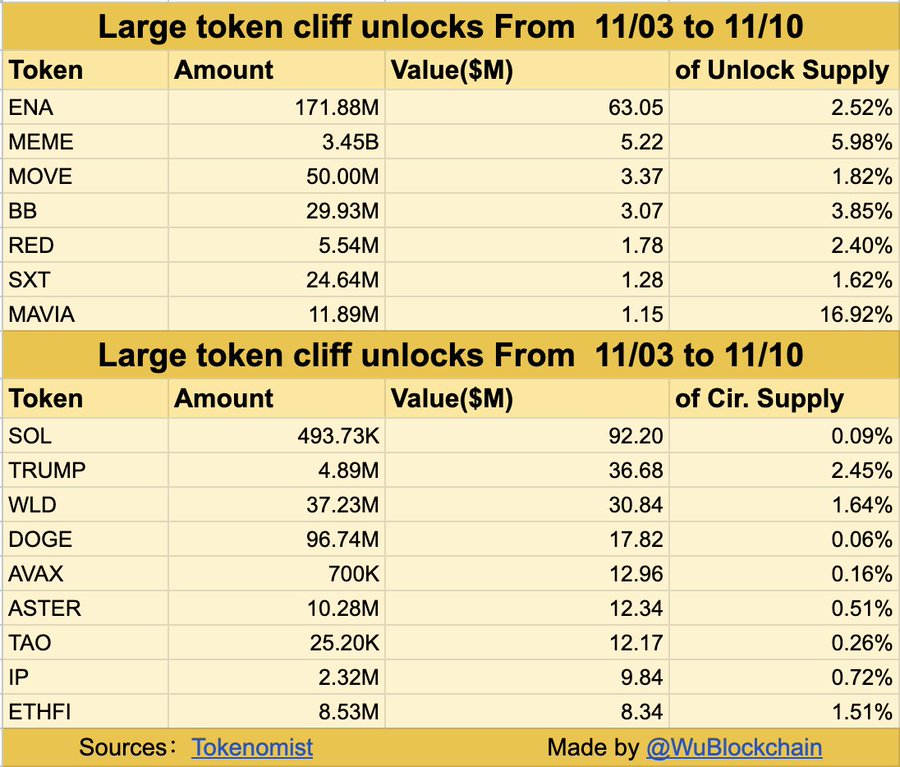

The cryptocurrency market is bracing for a massive wave of token unlocks totaling over $312 million between November 3 and November 10, according to Tokenomist data. These planned releases may cause short-term volatility in some altcoins as previously locked tokens are put into circulation.

Massive one-time unlock of over $5 million

This week there will be a significant one-time unlock with several tokens valued at over $5 million. These include:

- ENA: $63.05 million worth of tokens (2.52% of supply)

- MEME: $5.22 million (5.98%)

- Transfer: $3.37 million (1.82%)

- BB: $3.07 million (3.85%)

- Red: $1.78 million (2.40%)

- SXT: $1.28 million (1.62%)

- Mavia: $1.15 million (16.92%)

The largest of these is Ethena (ENA), which has over $63 million worth of tokens scheduled to be unlocked and could potentially attract the attention of traders due to its relatively small circulating supply ratio.

Featured large-scale linear unlocking

Another set of tokens will see linear unlocks of over $1 million per day, with new supply gradually spread over a week. These include major names such as Solana (SOL) and Dogecoin (DOGE).

- SOL: $92.2 million (0.09% of supply)

- Trump: $36.68 million (2.45%)

- WLD (World Coin): $30.84 million (1.64%)

- Doge: $17.82 million (0.06%)

- AVAX: $12.96 million (0.16%)

- ASTER: $12.34 million (0.51%)

- TAO: $12.17 million (0.26%)

- Intellectual property: $9.84 million (0.72%)

- ETHFI: $8.34 million (1.51%)

Solana’s $92 million unlock is the week’s largest by value, but represents only 0.09% of circulating supply, suggesting limited impact on prices.

market outlook

Token unlocking often causes short-term selling pressure, especially when the release size is large compared to the circulating supply. However, the overall impact will vary depending on market sentiment and liquidity.

With more than $312 million of tokens flowing into the market in one week, the market could see increased volatility in the affected assets, especially ENA, MEME, and WLD, which have a small liquidity base.

If institutional and retail demand remains stable, much of this new supply could be absorbed without major disruption.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.